“Know what you own, and know why you own it” | Peter Lynch

Intro

I advise clients on private market investments for a living, but was very passive in managing my own money until my late 30s.

By and large, this has been a positive process, but i’ve made a number of mistakes. These include:

- Macro: ignoring macro warning signs and not reading the market direction

- Due diligence: ‘apeing’ into investments without doing my due diligence. Early sins include not contemplating in crypto the tokenomics (level of dilution and timing/impact of unlocks), and in Equities the level of share based compensation (quarterly dilution which feeds into EPS).

- Technical analysis: being impatient around entry points – i.e. placing market orders, or fomo buying after a big run-up

- Monitoring: clinging on to narratives which are out of favour.

- Selling: not selling when I know the market is likely to fall further, due to ideological desire for the asset to perform

This is an article documenting how I plan to add structure to my investing process.

The process I use assumes you have the time and know-how to pick assets which can outperform the market and a high risk appetite. If this isn’t you, you would be better off forming a view on steps 1 and 2 and buying trackers (for Crypto, this would equate to 50:50 Bitcoin / Ethereum portfolio). Most active asset managers underperformed S&P 500 trackers in 2021.

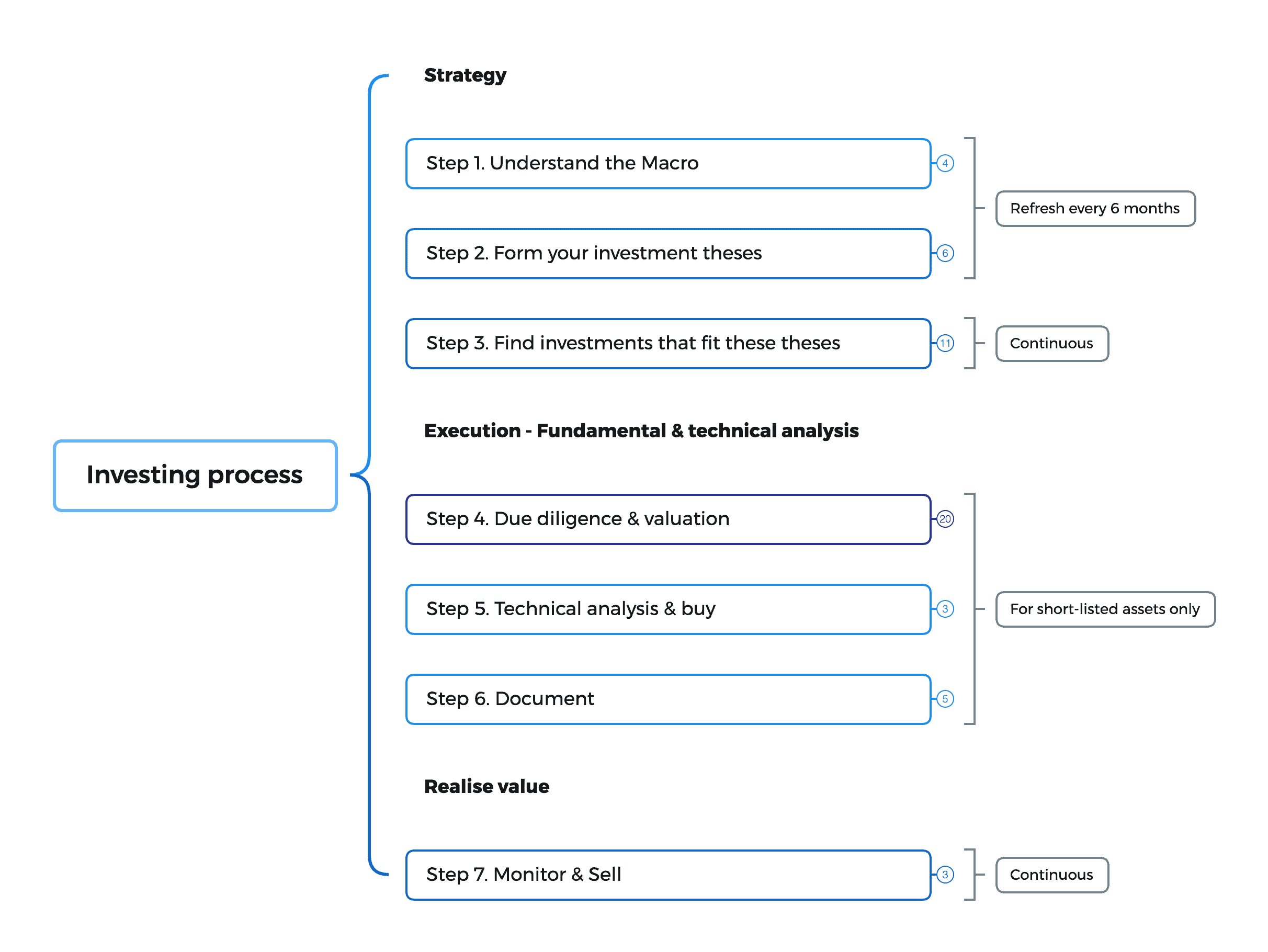

The process

These are the steps I follow.

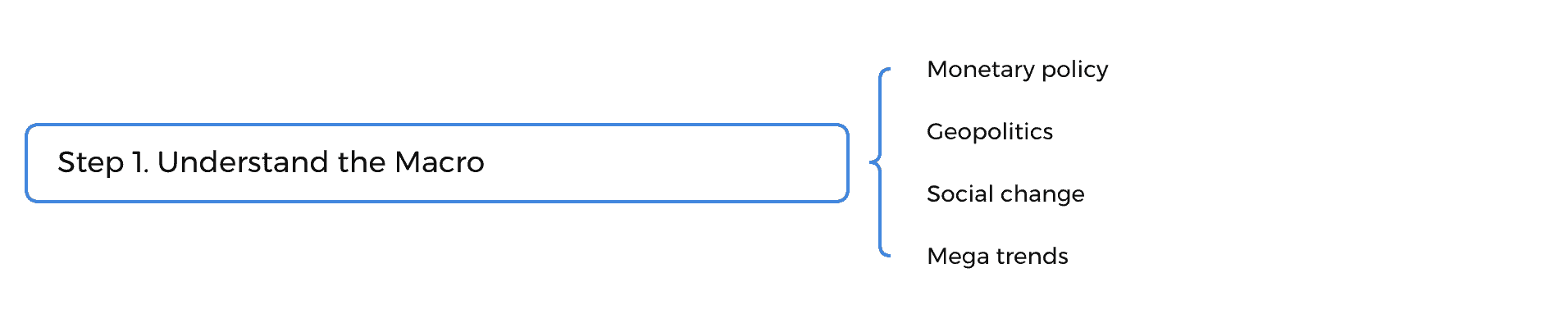

Step 1. Understand the Macro

Forming a view of the macro landscape is crucial, as this drives both short term and longer term valuations of publicly traded assets. It is impossible to generate positive returns going long high risk assets if the market is “risk-off” – you need to understand the overall market direction, which is a function of the macro.

Understanding the macro also takes a huge amount of time. If you want you can shortcut this process read the predictions of others:

- The Financial Times: https://www.ft.com/

- The economist: https://www.economist.com/

- Investment letters and reports from asset managers. This reddit forum is great for this content: https://www.reddit.com/r/SecurityAnalysis/

I use mind-maps to collect thoughts (across each of these investment steps). Xmind is my favourite tool for this: https://www.xmind.net/

My Macro take for 2022 is here: https://www.barnabyrobson.org/2022/01/05/2022-investment-predictions/

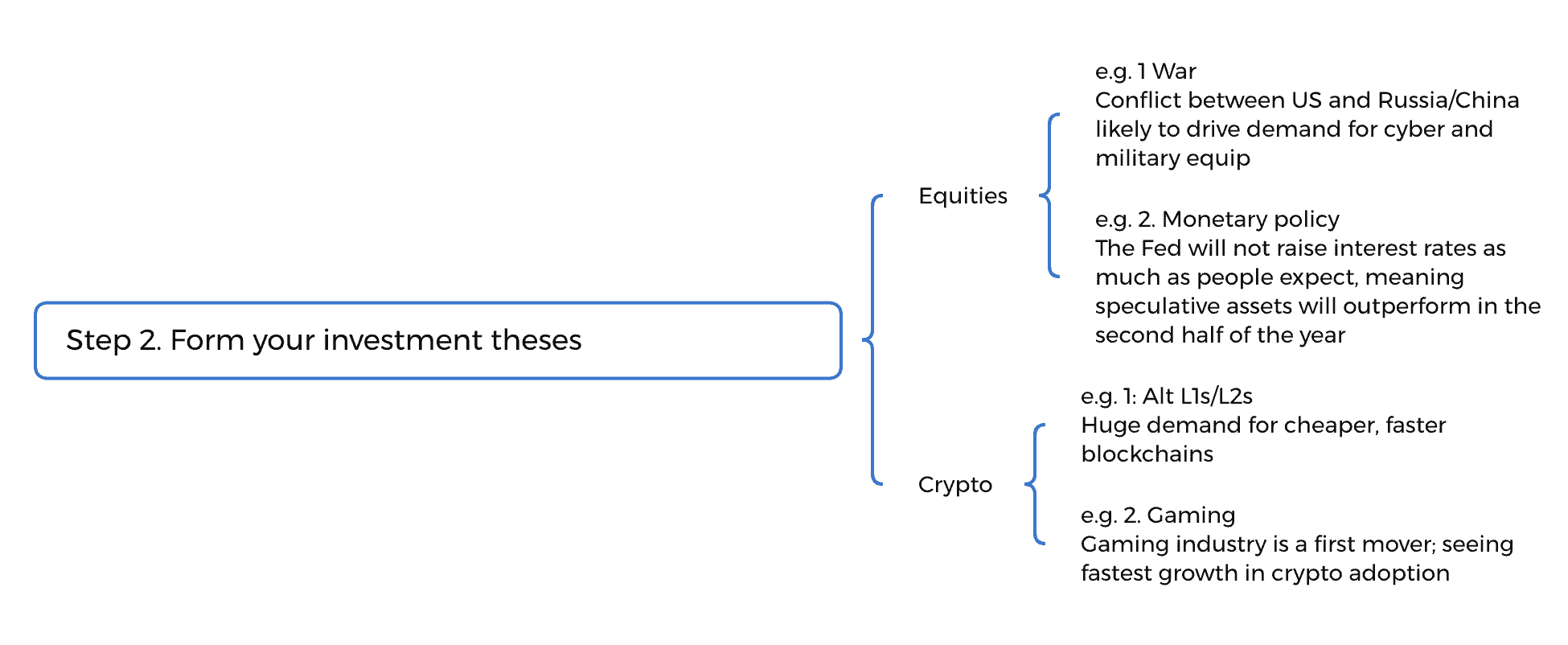

Step 2: Form your investment theses

Once I have clear view on how the macro will evolve, I build out investment theses which complement.

Typically there will be an overarching thesis, and a series of sub theses.

Sub-theses are important as there a literally thousands of assets, and with limited time you need to narrow down a short list of assets for more in depth analysis (Step 3), and also seek to becoming something of an “expert” in specifics fields so you can pick the relative winners.

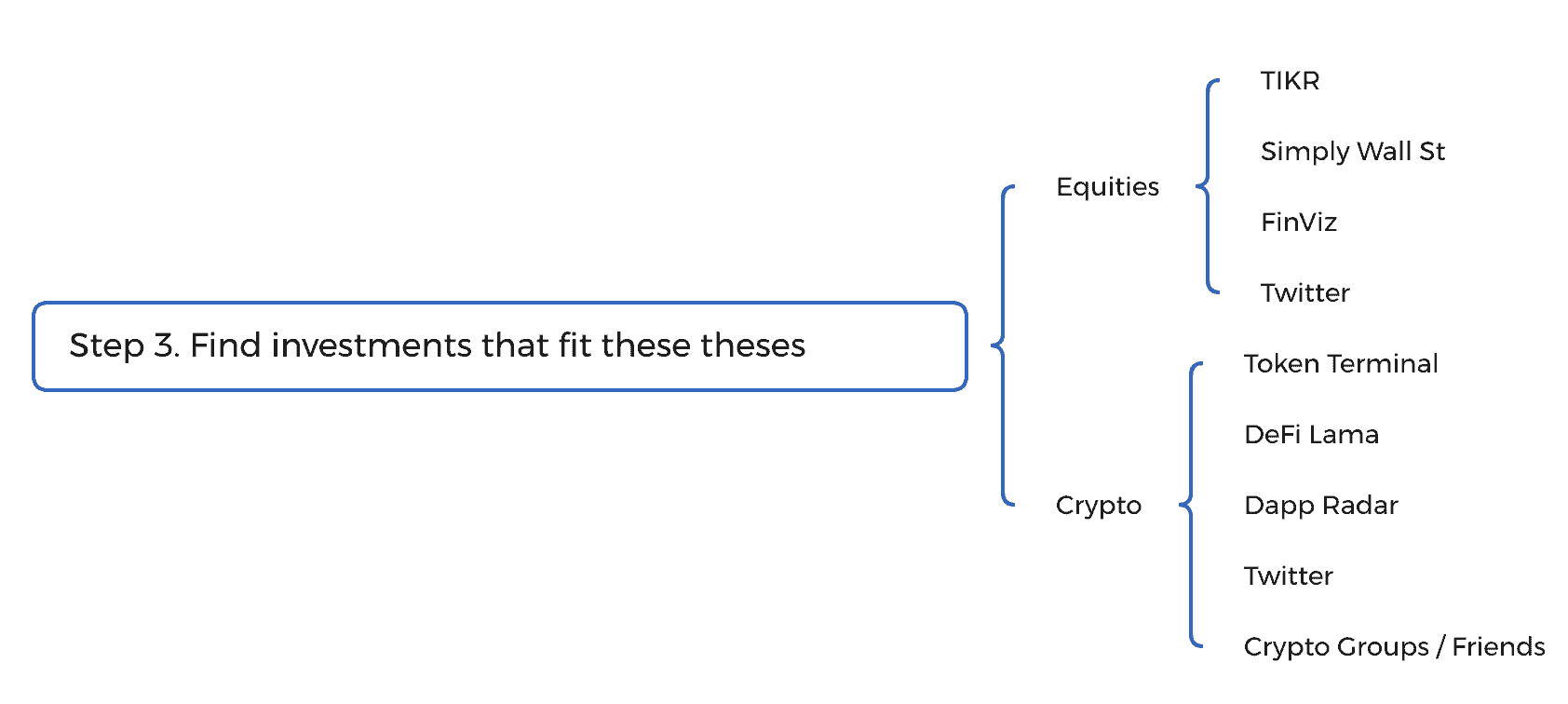

Step 3. Find investments that fit these themes, and form a shortlist for futher analysis

Key tools are use for long lists and shortlists include:

All asset classes

- Twitter Lists, which follow the best investors across specific asset classes. Example for growth stocks.

For equities:

- The Investment Talk Substack has a great list here

For crypto

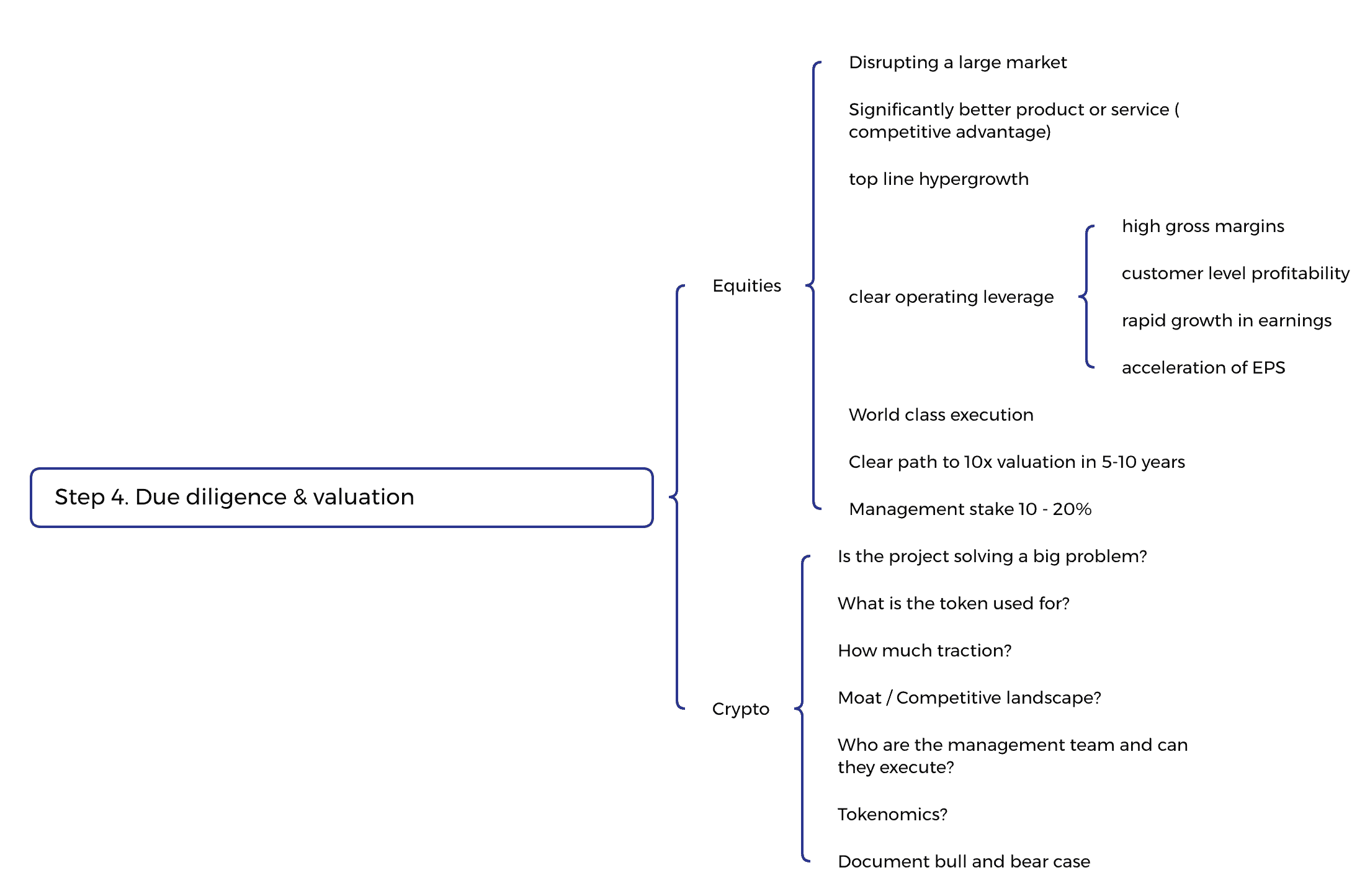

Step 4. Due diligence and valuation

You need to vary your analysis / due diligence depending on the asset category.

Fundamentally

- for equities you are looking for high growth, free cash flow generation and high Return on Invested Capital. Read Michael Mauboussin’s essays for more.

- for crypto, a clear view that Demand > Supply is key. Other considerations are set out below.

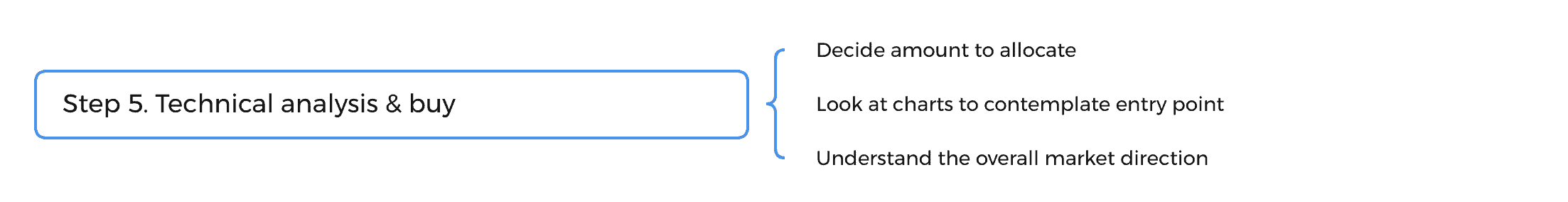

Step 5. Technical analysis

The key tool I use for technical analysis is Trading View.

Chris Perruna sets out the ideal buy point for any asset class in this thread here.

I prefer the trading view pro version, as it allows me to set up multiple buy/sell notifications if price triggers are hit, and also Volume Profile analysis which is critical for understanding levels of ‘resistance’ (i.e. defence or capitulation).

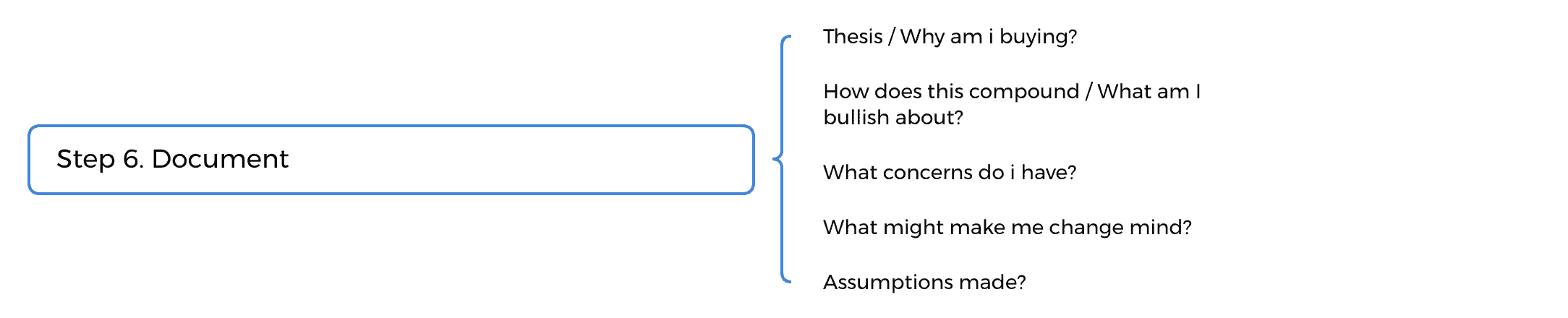

Step 6. Document

Document your rationale to invest, is key to:

- making the right decision to buy

- making the right decision to sell, and

- learning from your mistakes.

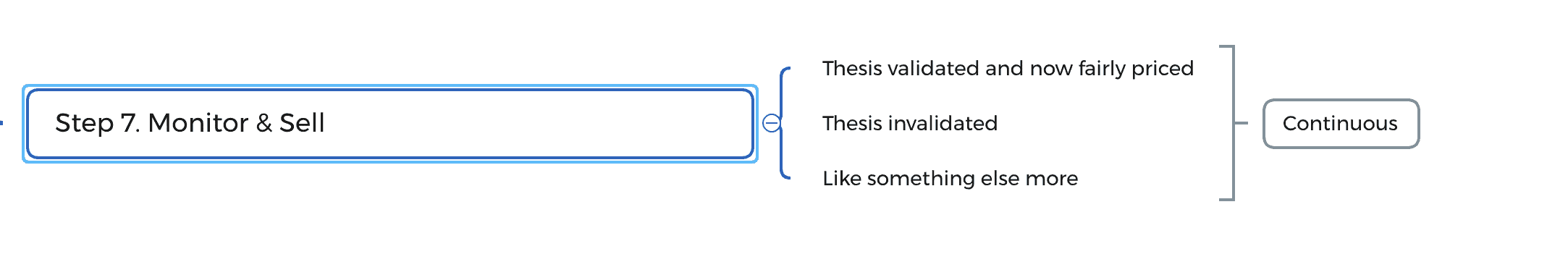

Step 7. Monitor and sell

If your objective is capital accumulation, you cannot be wedded to your investments. You need to sell if:

- market direction is turning negative, in which switch to cash/defensive assets until things improve

- your initial investment thesis is broken

- the asset you invested in is not performing

- you’ve identified another asset with better risk adjusted returns