Reader note:

This is unedited post of an unpublished write-up from December 2022. I didn’t publish at the time as there was more I wanted to say.

Things have obviously moved on – some companies recovered (e.g. Uber, Amazon, Air BNB, Carvana), some failed (e.g. Farfetch) and some are still trading at depressed values or entering new lows (e.g. Meituan, Alibaba, Fiverr, etc). However, I think there is a lot of useful concepts in this essay as it stands. I am presently (April 2024) still contemplating many of these learnings and the closing questions in the conclusion.

The concept of 2-sided Marketplaces

2-sided marketplaces gained huge prominence in the last cycle, but the model is now in major doubt. Marketplaces fundamentally seek to match buyers with sellers, bringing value to all participants, which grows as the network expands – ‘network effects’.

There is a central difference between the old and new economies: the old industrial economy was driven by economies of scale; the new information economy is driven by economics of networks.

Carl Shapiro and Hal R. Varian, Information Rules 1

2-sided marketplaces have been some of the most impactful New Economy businesses. The model is used across multiple sectors/product, as I set out below, but the fundamental economics / strategies are essentially mostly the same:

- The initial phase involves ‘burning’ capital to acquire customers. The burn is either on Brand Advertising or Customer Incentives (promotions, discounts, free shipping, etc).

- As a platform captures a % of the growing buyer and seller transactions through the marketplace, network effects push down the cost of acquisition, as more traffic is organic.

- At a certain stage, (the hope is) unit economics become positive

- Eventually economies of scale lead to bottom line profits.

The model exists across multiple product categories, which all share this same common DNA.

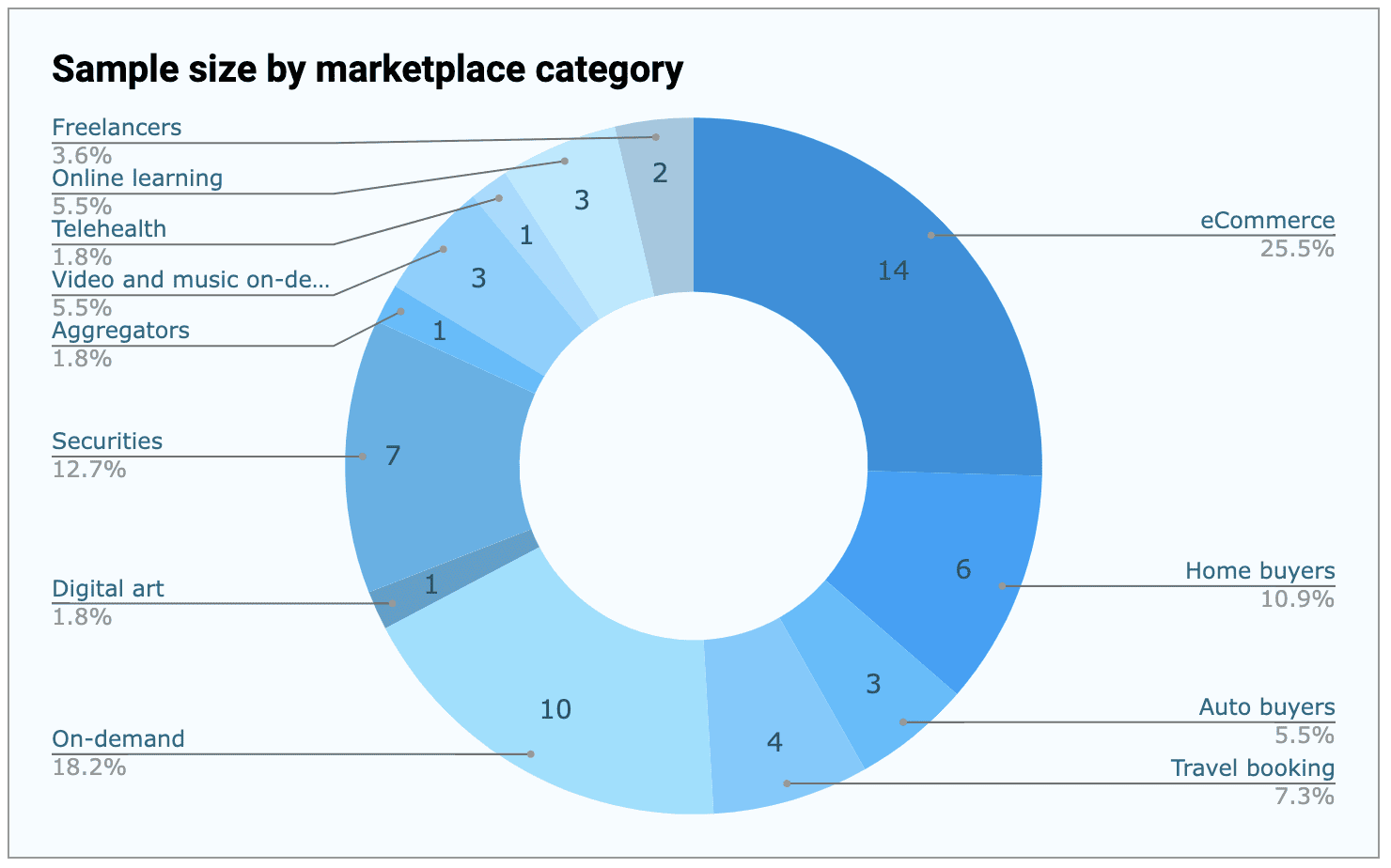

Marketplaces sample and categories

I looked at 55 of the largest listed marketplaces across 12 categories.

All these marketplaces have a Third Party seller ‘3P’ business which earn a ‘take rate’ from gross transactions on their marketplace – depending on the category referred to as GMV / GTV / Gross Booking / Gross Services Value etc.

Marketplaces in Numbers

I’ve looked at how marketplace valuations changed between their highs and 31 December 2022 and their latest quarterly performance.

Highlights include:

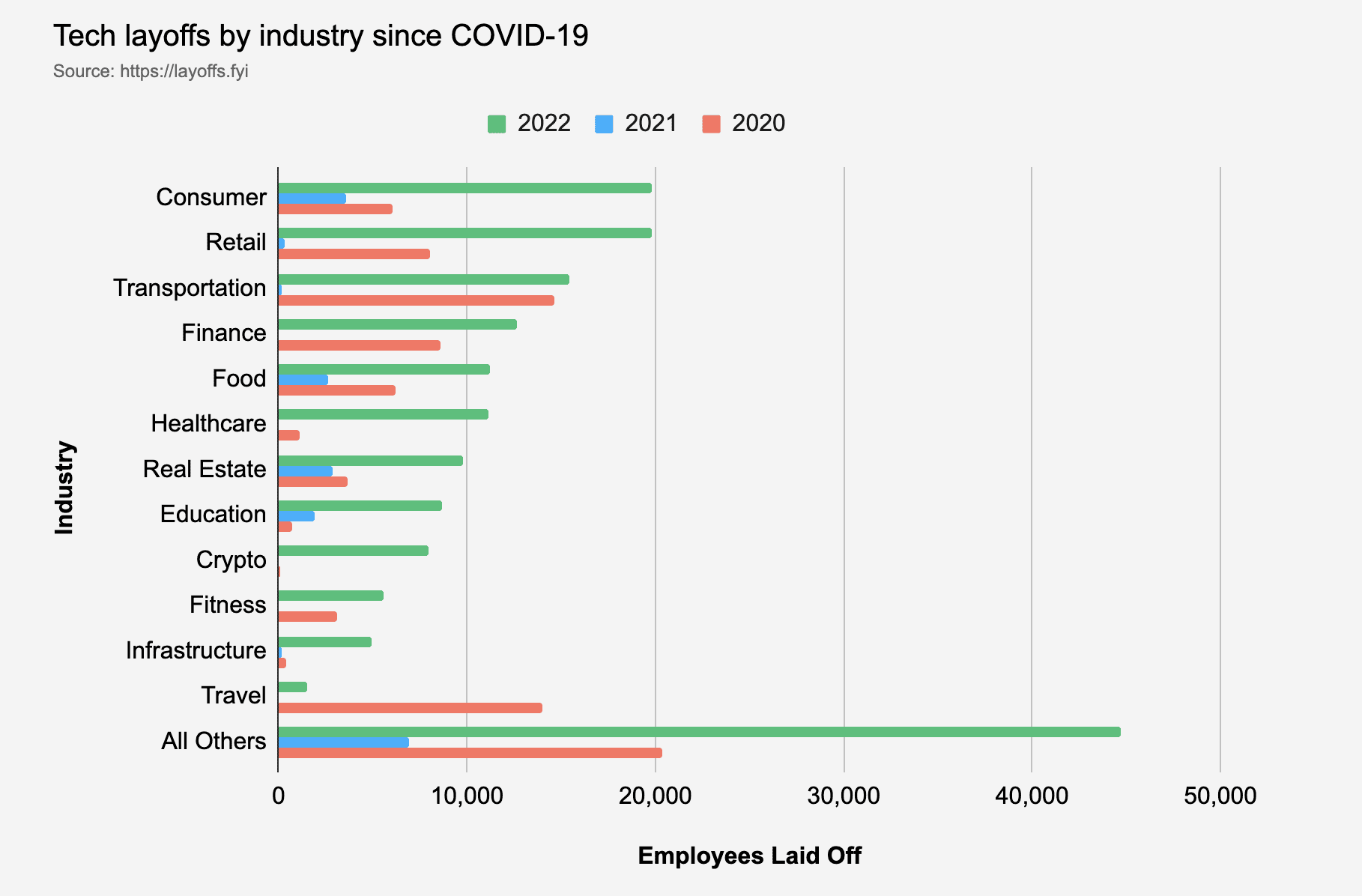

- All categories underperformed the Nasdaq

- 62% of marketplaces are loss making. This despite an average of 18 years operations, and being of sufficient scale to be listed.

- For the sample, approaching USD 4 trillion in market cap has been lost from the highs. The median decline in share price is 79% – this is more than bitcoin

- Some categories are fairing much worse than others – e.g. Homebuyers and Freelancers – with many individual names down 90+%. We are approaching dot-com-bust levels of deterioration.

- 100%, or 10 of 10 on-demand transport and services businesses were loss making

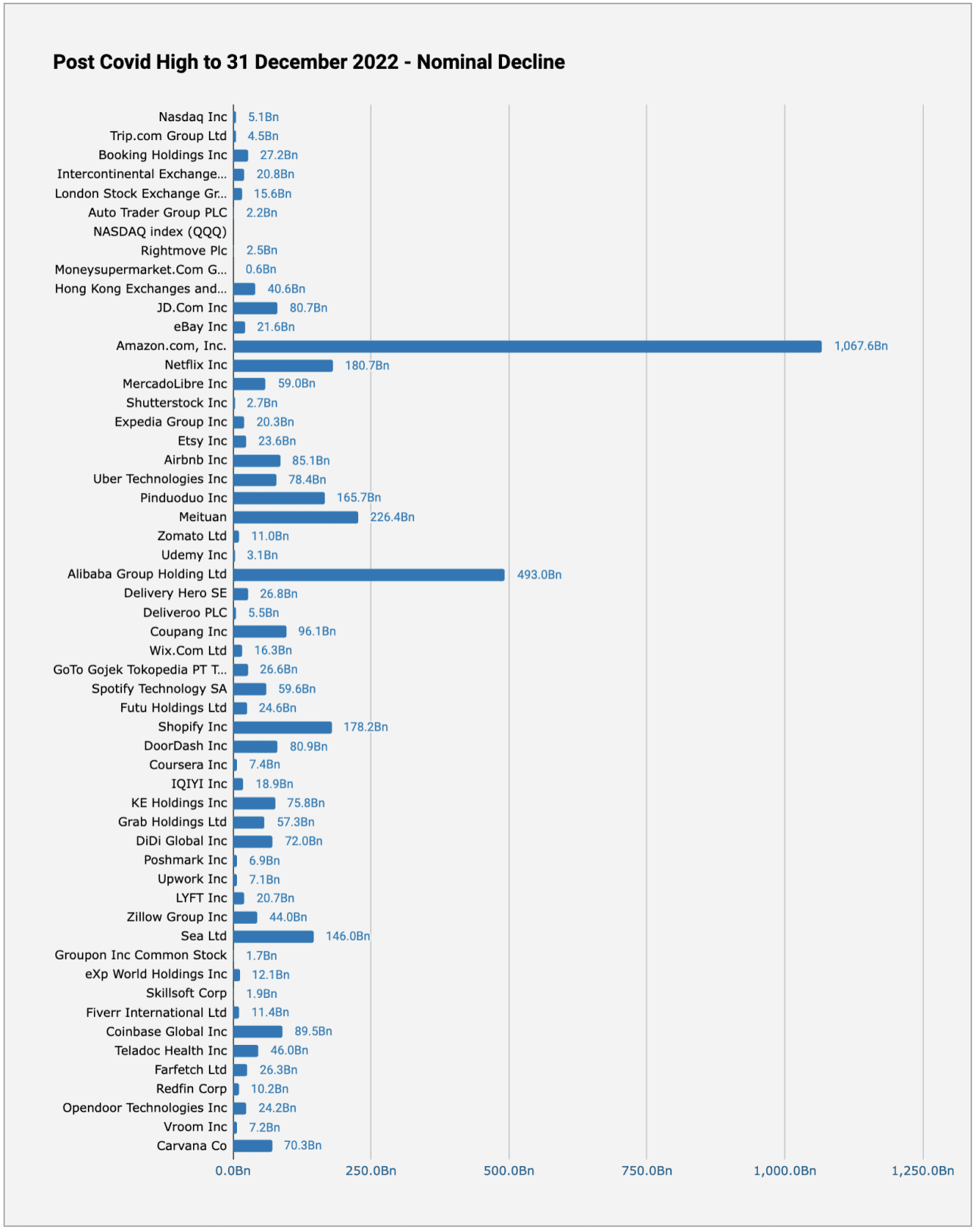

Declines in market cap – PERCENTAGE decline from Covid high to December 2022

The worst performers from Covid High to 31 December 2022 were two auto marketplaces, down 98% and 99%.

The median decline in share price is 79% – this is more than the decline in bitcoin.

Meanwhile, the delta on the Nasdaq composite was 35%.

Declines in market cap – NOMINAL decline from Covid high to December 2022

On a nominal basis, the biggest post covid loser was Amazon, which lost a whopping USD 1 trillion.

The Amazon Story in numbers

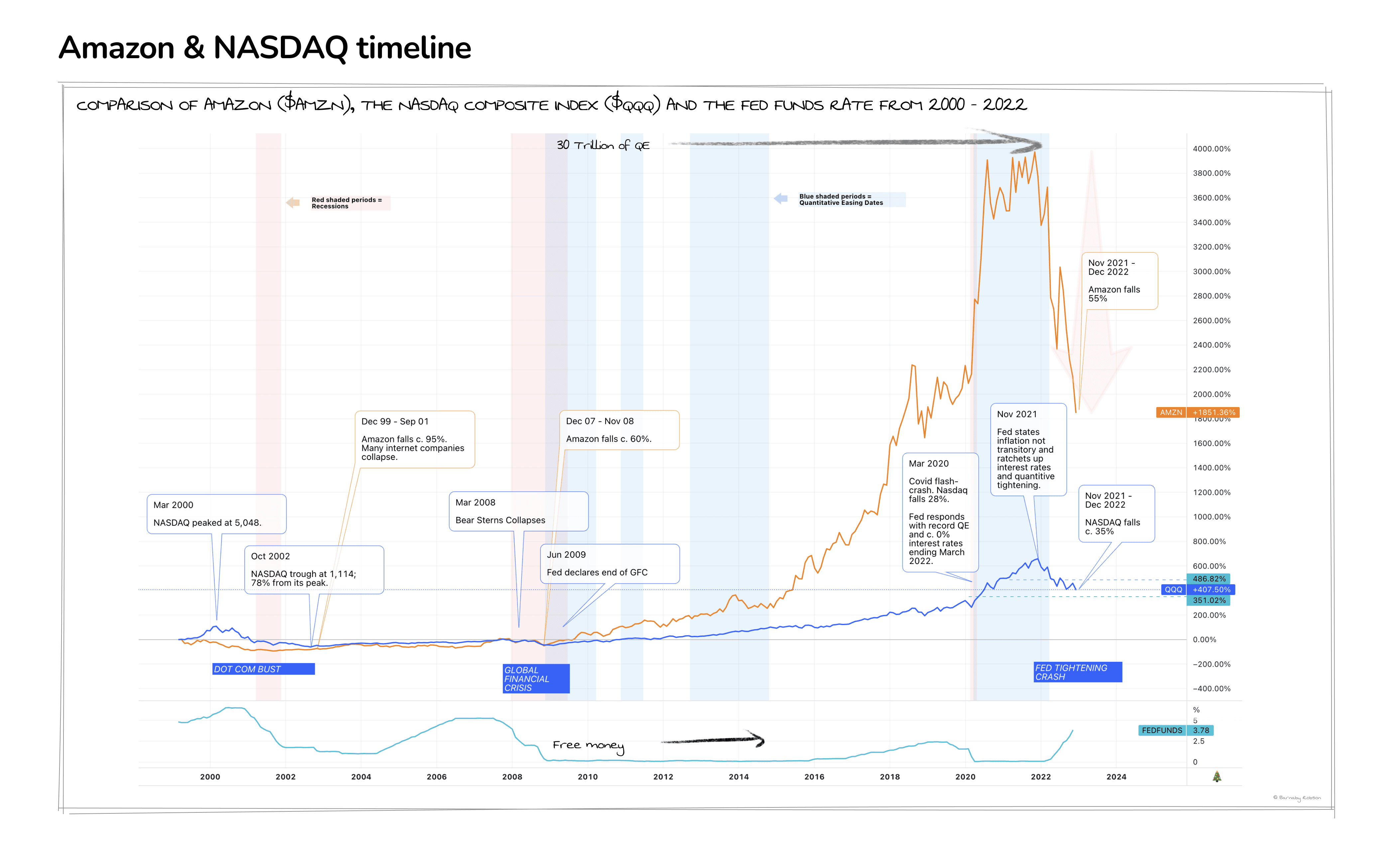

Amazon is the poster-child for two sided marketplaces. However, this cycle is not the first time Amazon has seen big declines. I’ve annotated other declines in the chart below.

But this time Amazon has gone from being a cash cow to losses on a free cash flow basis, which is concerning. I believe they are suffering from ‘Factor 4’ in the list of marketplace decline drivers below.

Why have all marketplaces gone out of favour?

So what is happening? Why have 2-sided marketplaces seen such a steep decline relative to the Nasdaq?

Fundamentally, i think there are five key factors:

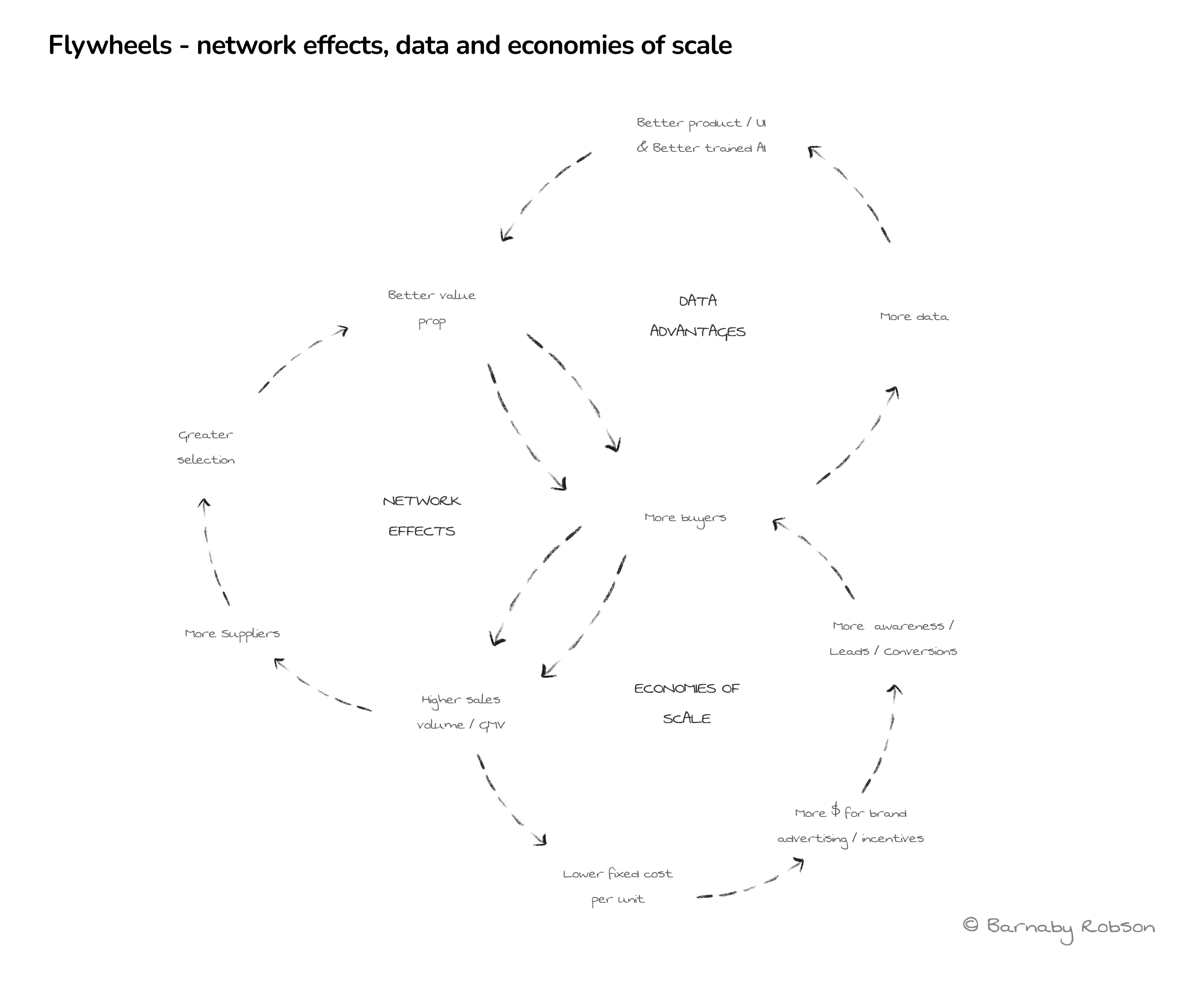

FACTOR 1. The marketplace model is predicated on ‘network effects’. But some categories don’t seem to have the same degree of network effects as others.

Many well know marketplaces are struggling to organically aggregate demand and gave been relying on incentives to do so. My belief is companies with super heavy marketing spend which haven’t yet tipped to organic, don’t have a network effect.

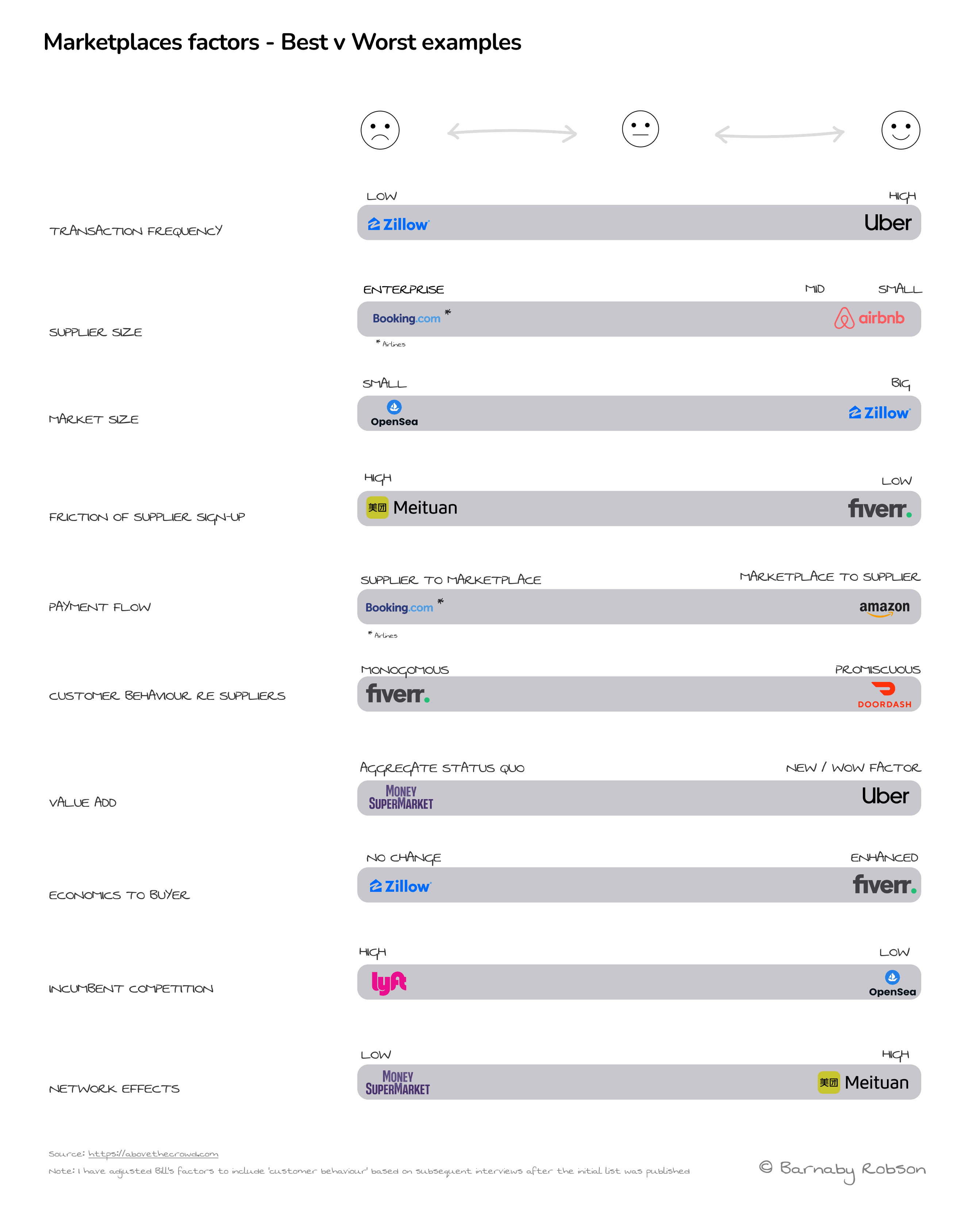

FACTOR 2. Not all marketplaces are created equal

Bill Gurley set out 10 factors to consider when evaluating marketplaces in “All Marketplaces are not Created Equal” in 2012.

Many recent marketplace categories score badly against his criterion and perhaps should not have been pursued.

In the graphic, I’ve adjusted Bill’s factors a little, and set out examples of good versus bad for each factor.

FACTOR 3. Valuation fundamentals were forgotten

During a decade of free money, investors began to value tech growth above all else. Valuation metrics for marketplaces moved up the income statement from Price / Earnings to Price / Revenue, or even Price / GMV. The assumption was as marketplaces scaled they would achieve network effects and flywheels, and become profitable / free cash flow generative – in a similar vein to Amazon.

However, 62% of marketplaces in my sample are still loss making. This despite an average of 18 years operations in the sample.

FACTOR 4. Free money made companies careless

With a hurricane of 30tn QE at their backs, and encouragement from notable VCs, tech companies threw money at scaling up and growth, with little regard for unit economics.

Because there was so much free capital available to do things like finance receivables etc a lot of marketplaces were doing this. But by funding low margin businesses, they became low margin themselves.

We’re now seeing wholesale cost-cutting and product/geographic rationalise across tech, with Elon Musk’s actions at twitter demonstrating how much ‘fat’ there was in the system

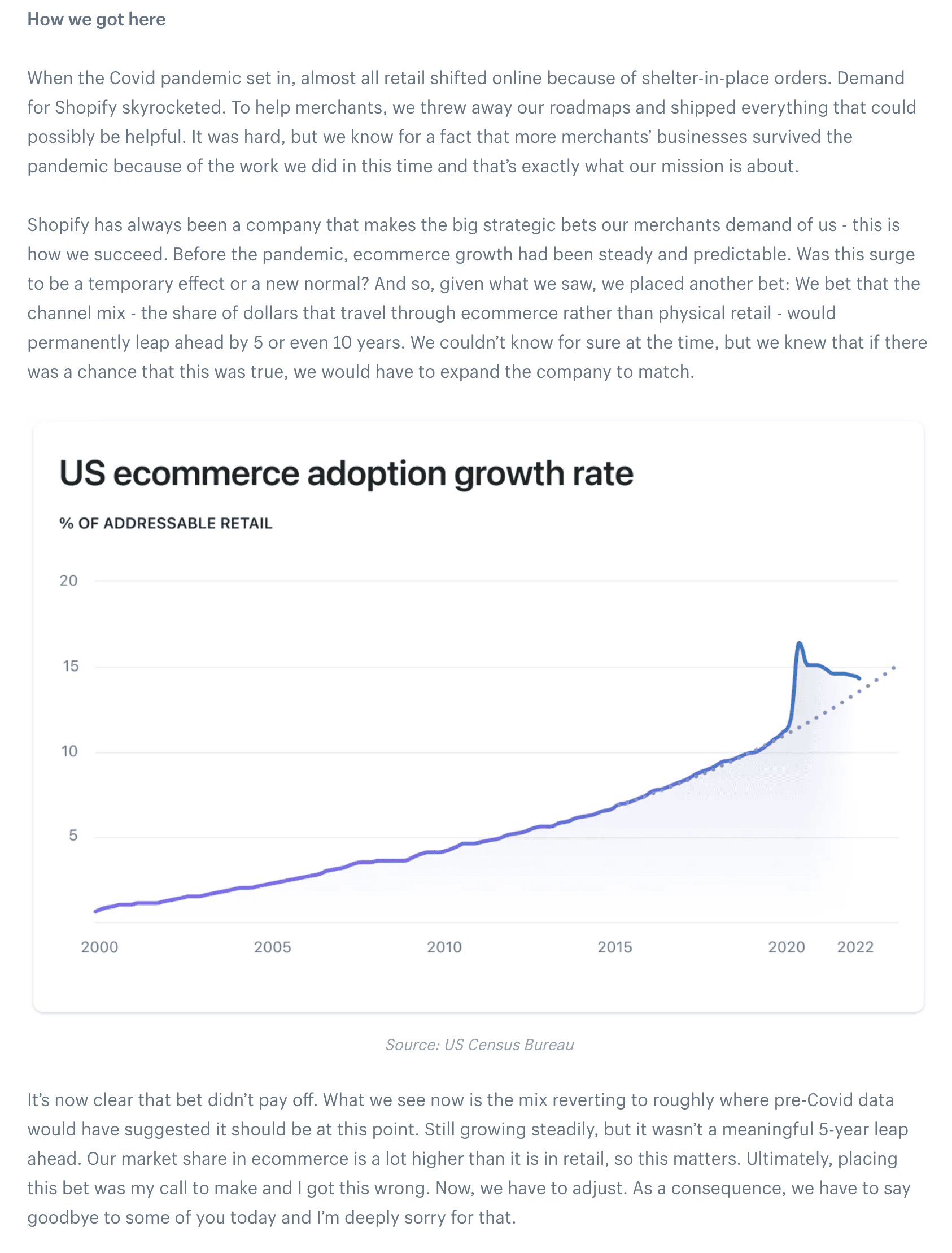

FACTOR 5. Over investment during 2021, as marketplaces assumed the Covid Bump would continue

In reality we’re going back to trend. The aberration was 2020 and 2021. As such, platforms such as Amazon and Shopify are seeing reduced profitability.

I have pasted below an extract from a public note from Spotify explaining how they misread the cycle / demand pull-forward effect.

What comes next?

This is what I believe will happen:

- Revenue declines in 2023, due to recession and reduced sales incentives.

- Absolute focus on path to profitability – customer incentive cuts, job cuts, exits of unprofitable markets (geography or products), price rises, etc.

- Ultimately, customers will determine if marketplaces have a viable business (profitable revenue). Some will fail.

- I also expect large mergers to drive scale and fundamentally improve unit economics through reduced competition.

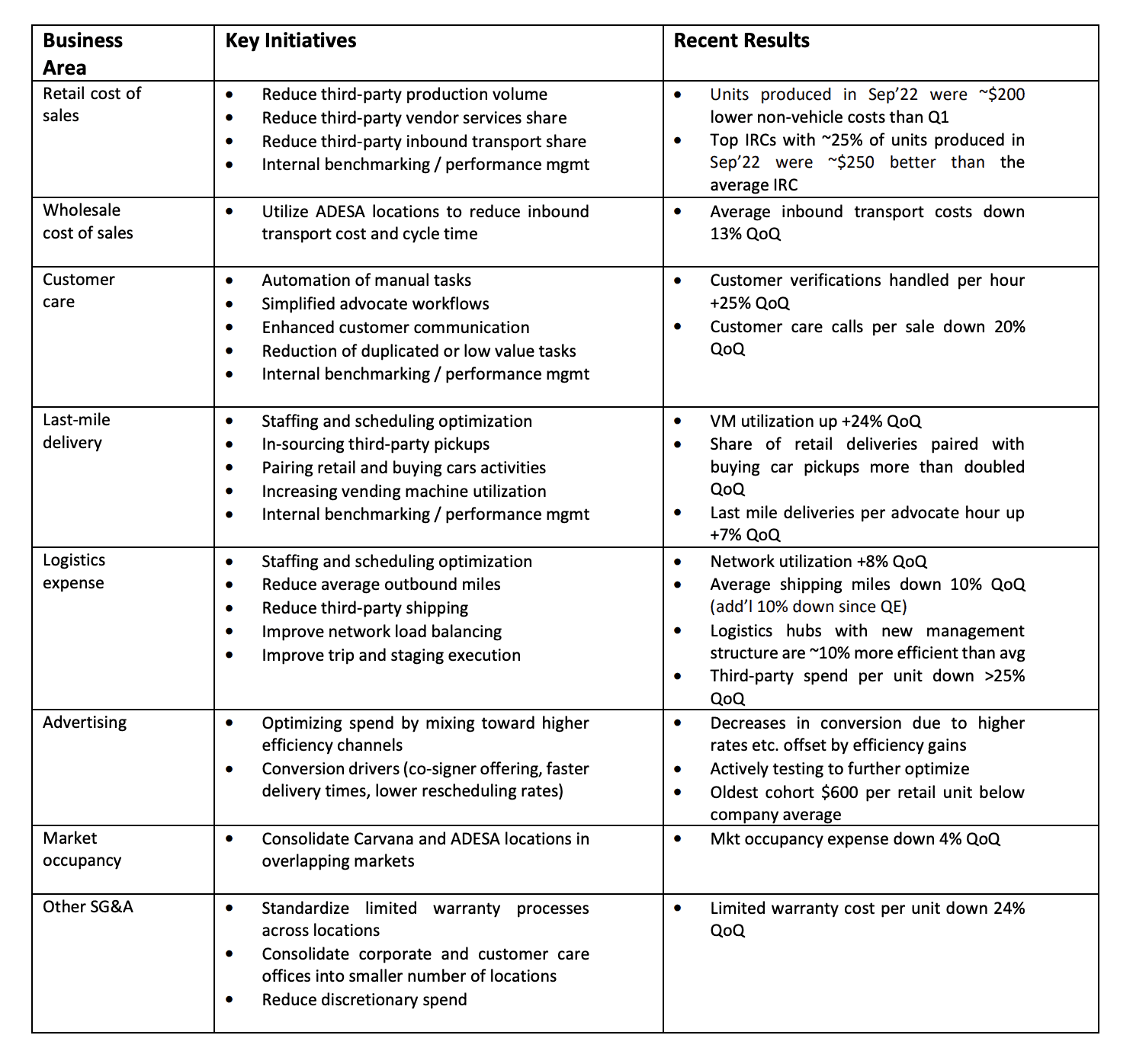

The below is an extract on Carvana’s turnaround plan – key cost optimisation initiatives etc.

Conclusion

As an investor, i’ll be considering the 10 Bill Gurley factors at such a point in time as I allocate to marketplaces in the future.

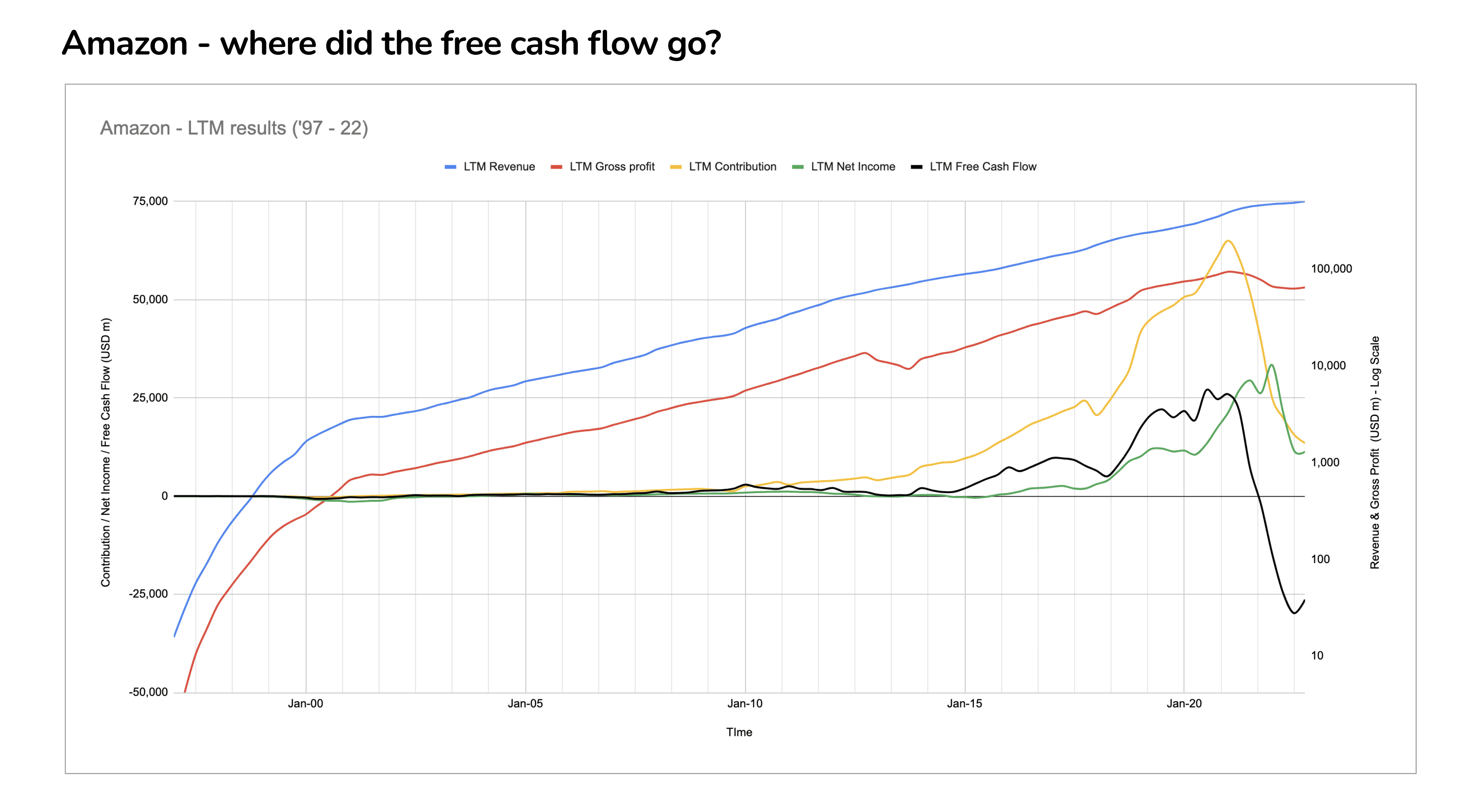

Fundamentally, in valuation what we have to remember is multiples are just a proxy for distributable free cash flow at some point in the future. I.e. what REALLY matters is the free cash flow* – ie the money that one can ultimately take out of the business. Don’t lose sight of this!

As I look forward to 2023 and beyond, these are some of the questions I’m pondering, and I feel investors should be considering:

- Does the marketplace vision – i.e. burn cash to scale up and build network effects and flywheels; then monetise acquired customers by expanding across verticals etc – still work without QE and ‘free money’?

- Why do some categories have more powerful network effects than others? What has history taught us about the factors that make for a successful 2-sided marketplace? Are marketplace models simply not suitable for some sectors?

- The economics of marketplaces – How and why these are so misunderstood by many investors and business people. What are the Northstar metrics and benchmarks we should be contemplating in this new macro environment?

- What happened to marketplaces in 2022? Why did Amazon’s cash cow turn back into a cash burning machine?

- What are the implications of a recession? How will marketplaces respond?

- Why post-pandemic S curves differed across geographies?

- Has the pandemic altered Merchants views of marketplaces – e.g. are marketplaces bringing new customers to merchants or simply charging merchants and what are the implications?

- Which categories are most under threat from direct to consumer / eCommerce enablement,

- Where do we go from here? What is the redemption ark / pathway to default alive? Will we see corporate failures, fundamental restructurings, mergers, etc?

- Will Elon Musk’s drastic cost-cutting at twitter, become a blueprint for Private Equity to take-private marketplaces (and other tech businesses) and do the same?

*My preferred value creation metric is free cash flow per share, or alternatively written: free cash flow LESS share based compensation.