“What are the factors that gave rise to investors’ success over the last 40 years? We saw major contributions from (a) the economic growth and preeminence of the U.S.; (b) the incredible performance of our greatest companies; (c) gains in technology, productivity and management techniques; and (d) the benefits of globalization. However, I’d be surprised if 40 years of declining interest rates didn’t play the greatest role of all.”

Howard Marks – Sea Change – December 2022

Prediction:

The dominant driver of markets in 2022 was the large and rapid rise in interest rates. For 2023, the major story will be the impact of higher rates on business fundamentals and the economy, as the tightening flows through to consumption, corporate investment and the job market.

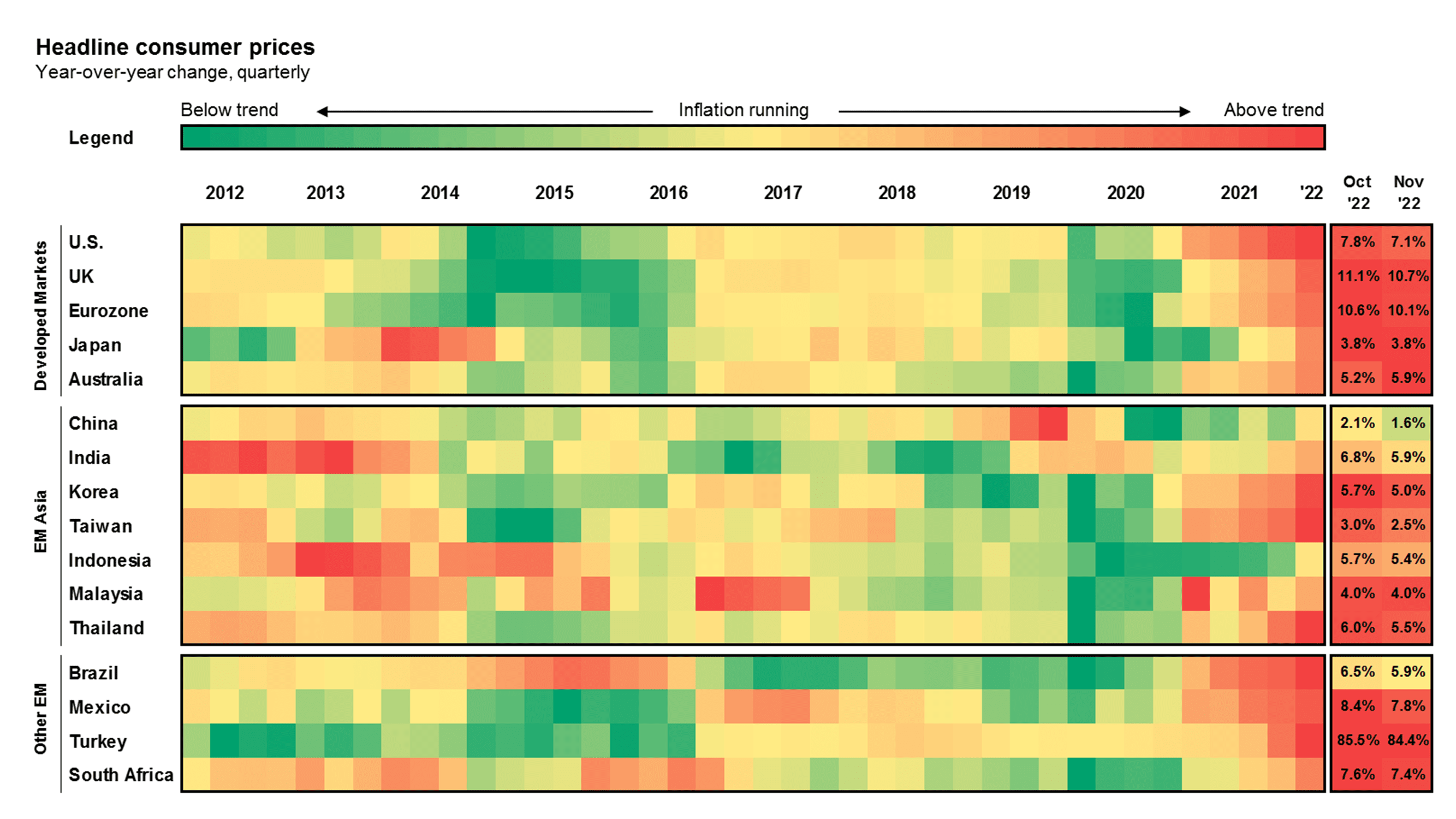

Global inflation

Current monetary policy decisions are driven by inflation expectations.

In 2022, I was surprised at the vigour with which the Federal Reserve raised rates in their campaign to quash inflation – and also on the knock on impacts for all asset classes.

My assumption going into the year was Fed would not raise rates so fast due to (a) impact on Treasury note payments and (b) impact on wealth / recessionary effect.

I was also of the view that inflation was being driven by supply side factors which would unwind.

I was wrong in my assessment of Jerome Powell / the Fed’s stance.

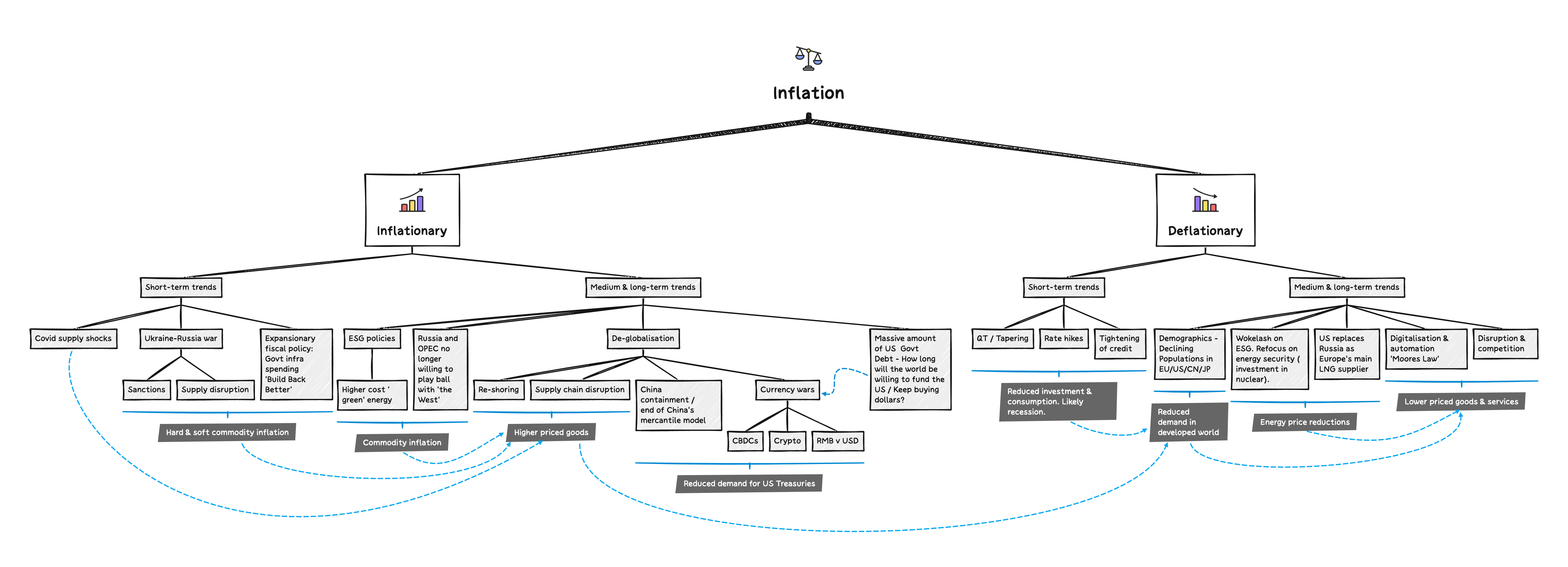

What are the drivers of inflation?

“Conditions in China and the East are far different from what now exists in the West. In response to the pandemic, China, Japan, and other Asian economies opted for social measures rather than aggressive monetary and fiscal stimulation. As a result, nominal spending growth is now much lower and near normal and inflation rates are at or below targets.

Take note that this much divergence of inflation conditions across major economies is unusual in this day and age and is a very strong indication that the root cause of inflation in the West is the monetary/fiscal stimulation that was applied there but not in the East. This is also a clue as to the degree of tightening that will be required in economies that are experiencing a monetary-induced inflation.”

Bridgewater Capital, January 2023

I set out in the mind map below what I feel are the key factors driving inflation – both demand and supply side.

In summary, there are a number of conflicting factors, and the net impact of all of these is very hard to predict.

The 2 big surprises for me in 2022 were:

(a) How quickly the EU replaced Russian Natural Gas with supplies from Norway and the US

(b) The speed at which Fed monetary policy reduced wealth, thereby driving people back into the workforce, offsetting ‘the great resignation’ which now feels like a distant memory. People are no worried about the cost of living and job security.

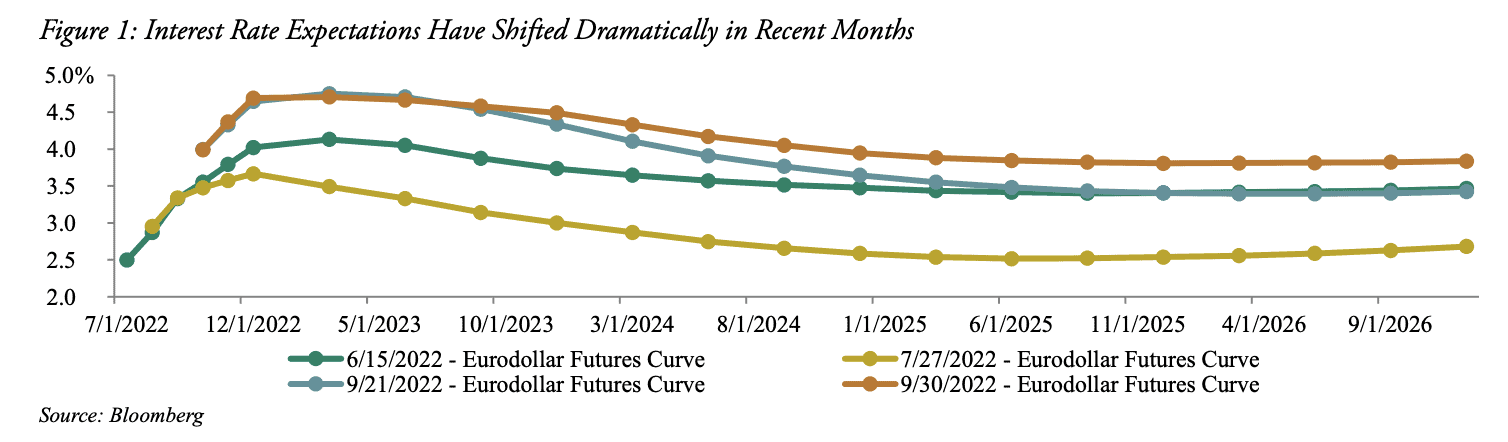

Interest rate trajectory

The fed funds rate went from 0.25% in January 2022 to 4.75% in January 2023. This doesn’t sound big but it had a monumental impact on asset prices, and the economy. For example, the monthly interest on a floating rate USD 200k mortgage went from c. $400 to $1,000 in the last 12 months – causing a substantial cut in disposable income and therefore consumption. We will feel the lagged impact of this in the months to come as fixed rate loans hit renewal.

The key question looking into 2023 and beyond is when then the Fed will be forced to pivot (i.e. start cutting rates) and at what level interest rates will stabilise.

The market view is in a state of flux as illustrated by significant fluctuations in the the Eurodollar Futures Curve (which shows expectations for interest rates on three-month dollar deposits for specific dates in the future).

My thesis is:

- Rates go to 5.20% by summer 2023

- Fed pivot in 4Q23

- Future rates land at around 3% – significantly above the 0.25% rates people were accustomed to.

The main reason I think rates stay higher for longer is geopolitics will push down demand for the US Dollar – specifically China, The Middle East and Russia will significantly curtail T-note purchases. As such, US rates will need to remain elevated to attract other buyers.

Other reasons include:

- the wage increases during the 2009 – 2022 period will be extremely hard to unwind.

- globalization is reversing. This is going to be significantly inflationary.

- the Fed has to maintain credibility. They will be very concious of the policy errors from the 1970s

The historical record cautions strongly against prematurely loosening policy. We will stay the course until the job is done.

Jerome Powell, February 2023

What this means

The implications are multifold and include:

- high chance of severe recession. We are already seeing job cuts across most major companies, ranging from 10% – 30%.

- cash is king and fundamentals matter again.

- earnings/DCF based valuations are back in; GMV/Revenue/Gross Profit based valuations are out.

- tech and crypto valuations are not coming back to 2021 levels any time soon.

- investors can now potentially get solid returns from credit instruments.

- investments higher up the risk curve are going to be out of vogue for quite some time.