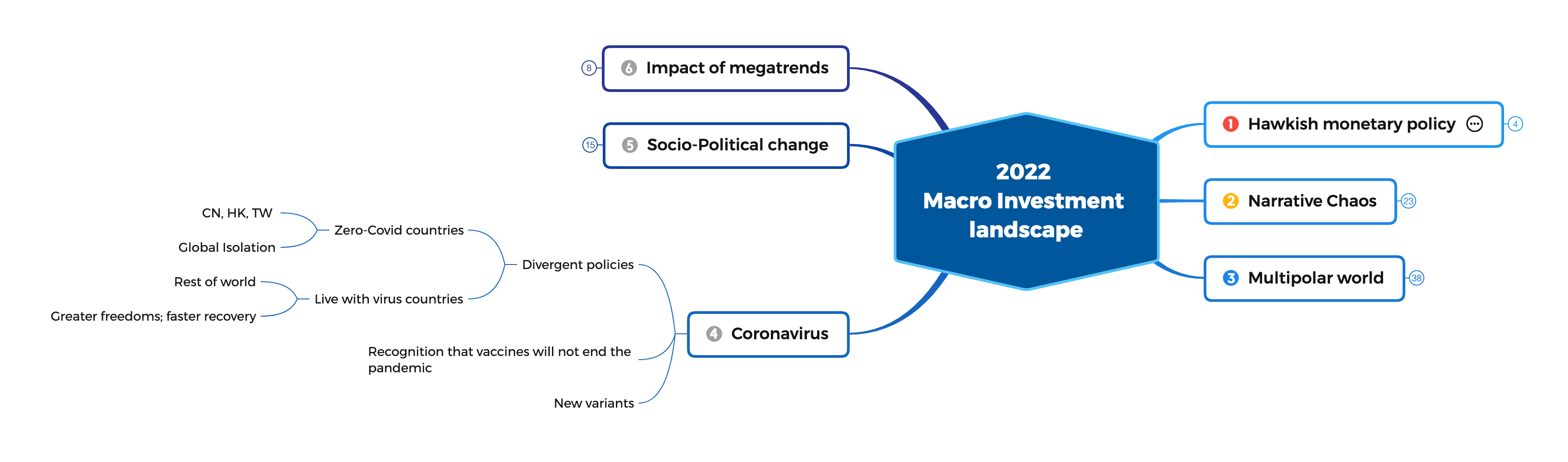

Since the onset of Coronavirus, I’ve made a habit each of mapping out how I see the macro investment climate every 6 months.

The six themes that are top of mind going into 2022, are:

- Monetary policy

- Narrative chaos

- Multipolar world

- Coronavirus

- Socio-political change

- Megatrends

1. Monetary policy

Inflation

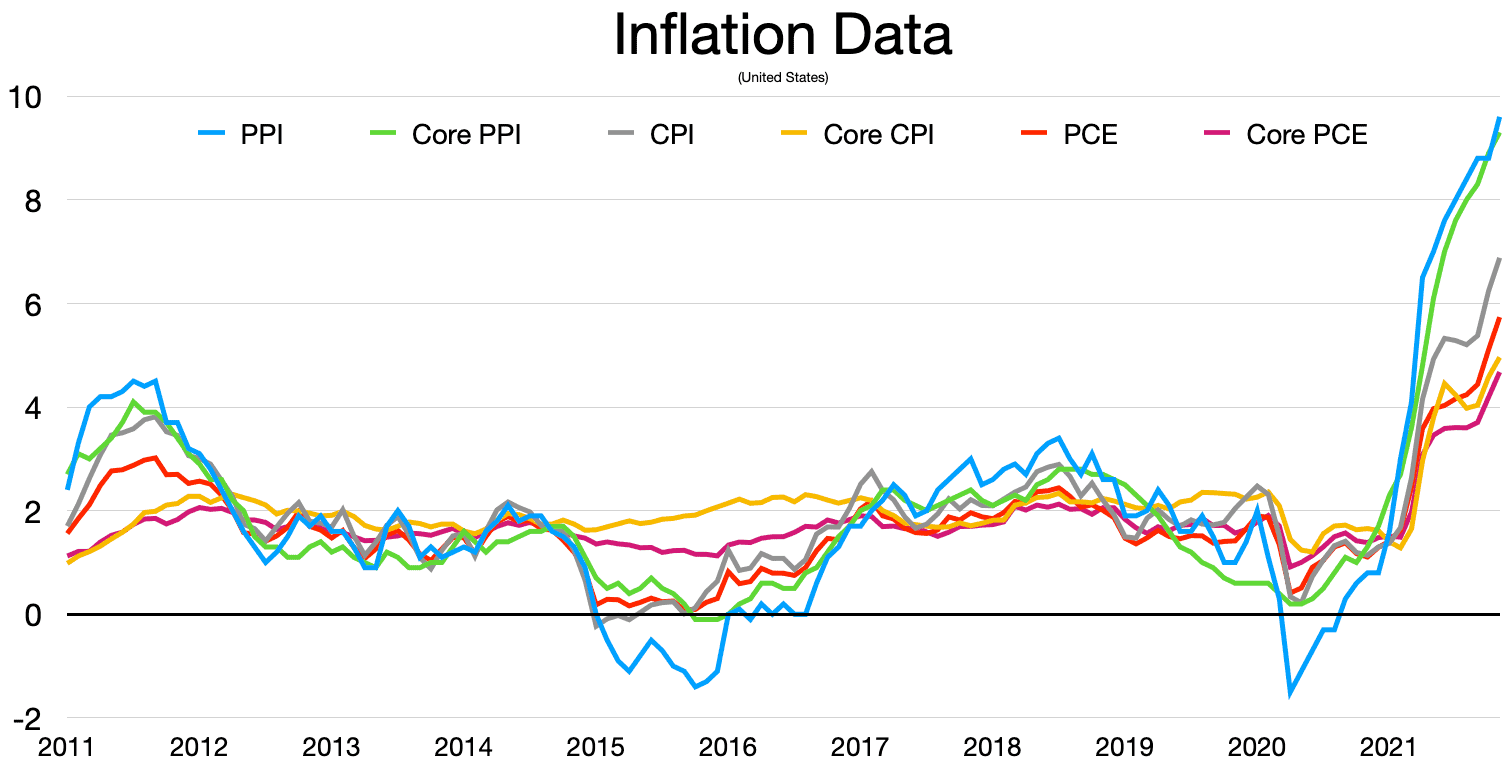

For the first time in decades inflation, and government’s response to inflation (i.e. hawkish monetary policy) is the primary investment concern for money managers across all asset classes.

Reasons for high inflation, include:

- Loose monetary policy – central banks have been buying $26bn in assets every trading day since covid began

- Supply chain squeeze

- Wage pressure – partly due to a change in social norms post Covid – e.g. the great resignation

- Net-zero policies – which are resulting in energy price inflation

Fed policy change

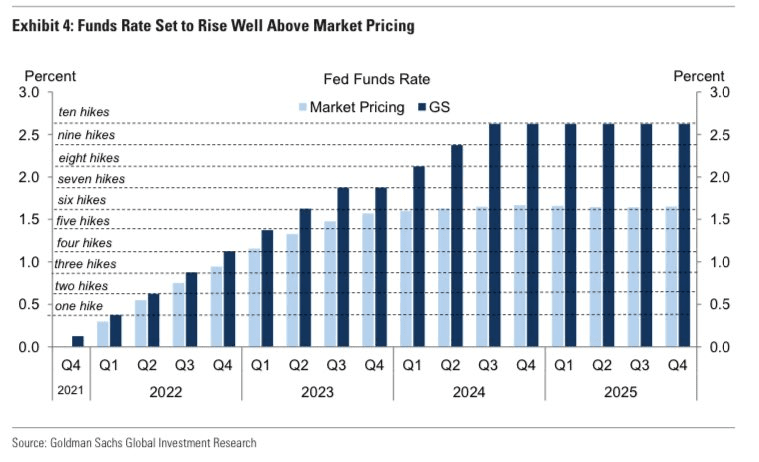

The Fed initially stated inflation was transitory. The Chronology of their announcements was:

- June 2021 – no rate hikes for 2022

- September 2021 – half a rate hike for 2022, and QE tapering soon

- November 2021 – plan to slower tapering; Jerome Powell (Chair of the Fed) stated for the first time that “inflation no longer transitory”

- December 2021 – three hikes plus accelerating tapering, PLUS balance sheet normalisation (reversing asset purchases under QE, AKA quantitative tightening) for 2022.

As of January 2022, the market expects four rate hikes in 2022 (up from one), three more rate hikes in 2023 and two in 2024. This would push interest rates from current negligible levels to 2.5%.

Market Reaction

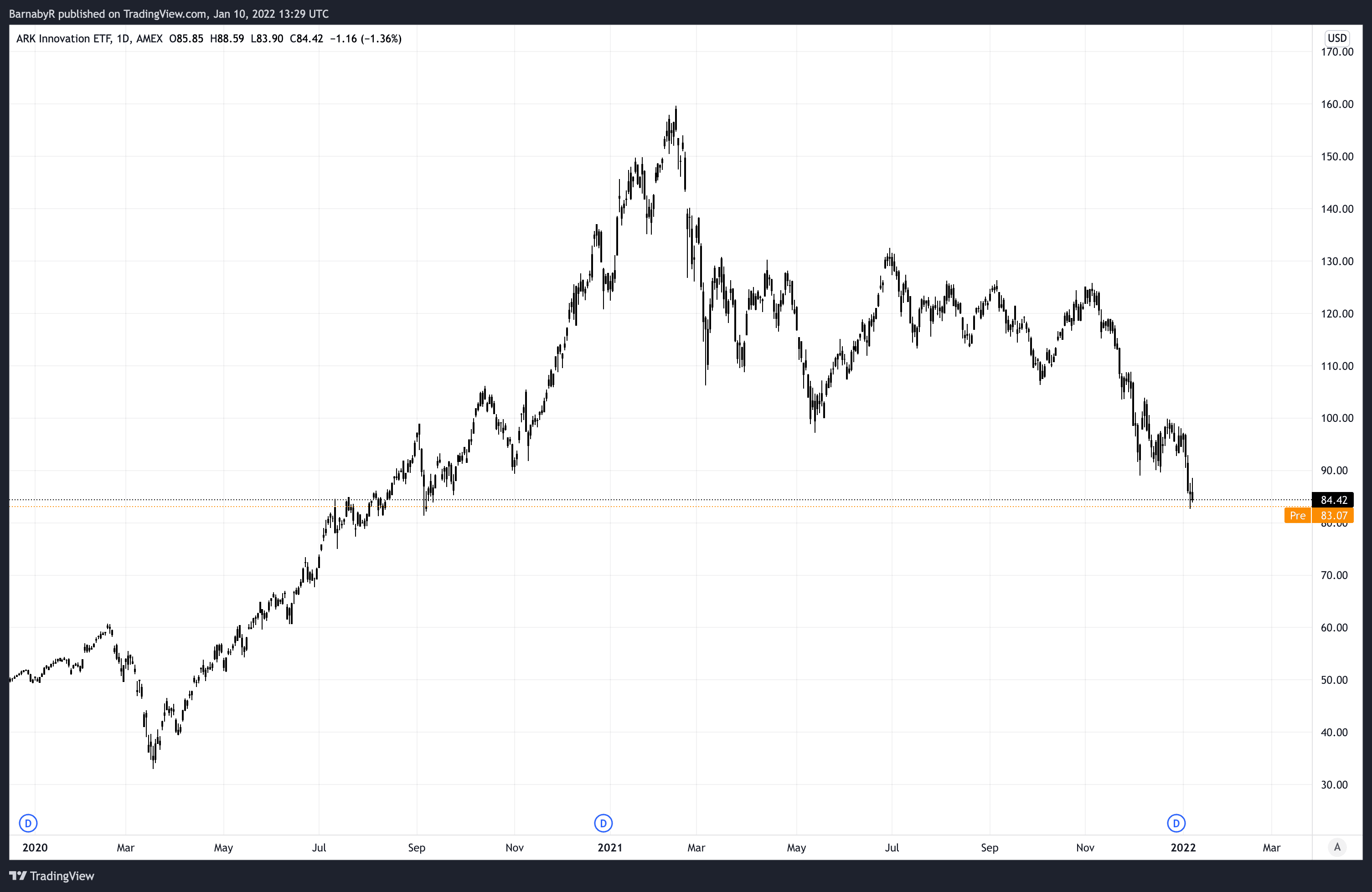

The speed of the fed turnaround on monetary policy / economic outlook, led to the markets to ‘spit the dummy out’ on speculative assets in December 2021. Crypto and many high growth tech stocks fell 70% + between mid November 2021 and January 2022.

I believer this abrupt shift in sentiment is at risk of causing a recession in the US. Many retail investors will be feeling significantly less well off which will have implications for consumption.

Interestingly in January 2021 China announced interest rate cuts. The EU also seems settled on waiting until 2024 before raising interest rates.

TL;DR

Having a firm grasp on reported Consumer Price Inflation will be key, as this will drive Fed policy decisions. The Fed has indicated they are willing to prick the bubble / turn very hawkish, if inflation surprises on the upside.

2. Narrative chaos

2022 is shaping up to be another turbulent year for all asset classes. Narratives are in a state of flux as investors try to interpret the impact of multiple potentially contradictory factors. These include:

Direction and impact of monetary policy. Hawkish monetary policy particularly impacts assets higher up the risk curve – i.e. growth stocks / speculative assets, whose valuations are highly sensitive to movements in discount rates. The US appears to be moving hawkish while China and Europe are heading Dovish.

A strengthening dollar, rising interest rates and growing debt may cause emerging market currency crisis. We SAW 40%+ draw downs in the Turkish Lira and Argentinian Peso in 2021. I think we’re set up to see more currency volatility in 2022 – including potential emerging market currency crises. This may drive capital from ‘emerging’ too ‘developed’ markets.

Development of the coronavirus pandemic and its impact decisions on monetary and fiscal policy. With respect to Covid-19 “bad news is good news” has been true for for speculative assets – as further lock-downs invite more stimulus. I believe we are out of the woods, with Omicron seemingly relatively benign.

A confluence of disruptive technologies is transforming lives and industries at an accelerated rate. Companies investing aggressively in R&D today, will continue to disrupt incumbents slower to harness the power of the major innovation platforms (blockchain, AI, robotics, AR/VR, quantum computing). Do investors really want to be allocating to companies which are in the midst of being disrupted? The fundamentals of most tech companies still look good. It’s their valuation multiples which are in question.

A number of potential ‘Black Swan’ events. These include:

- Kinetic war – Potential flash-points include: Ukraine, Taiwan, The Indian-China border, and the South China Sea

- Debt crisis. Money printing has been out of control since the Global Financial Crisis. Markets are now very leveraged and it’s unclear how interest rate moves could impact the financial plumbing.

- Real estate collapse in China, as the Government seeks to burst the property bubble before it’s too late, and reorientate the economy towards pure sciences.

TL;DR

Investment narratives will change rapidly through the year. Investors looking for outperformance in 2022 are going to have to constantly recalibrate. This may be the year where holding cash is the winning investment strategy.

3. Multipolar world

The unravelling of American power has been rapid. Rivalry between the US and China is set to shape the 2020s. Broadly I see the world being divided into three camps:

- US block. Key members are Japan, India, Australia and the UK

- Sino-Russian. Key allies include: North Korea, Iran, Cambodia, Myanmar, Pakistan, Afghanistan, Venezuela and a number of countries along the former Silk Route.

- Neutral countries. Perhaps controversially, I believe the neutral bucket includes the EU, where France and Germany are unwilling to confront Russia (and China) due to trade dependencies. Many other blocks: ASEAN, Africa, LATAM and the middle east are likely to see advantages from neutrality.

America was very late to realise China would not be sub-servant in a US led world order. Action against China is one of the few policies which gets bipartisan support in the US. Meanwhile Russia is upping the anti, with 100k troops positioned on the border in Ukraine. Conflict in Asia or Europe seems very likely. This may be fought in proxy, but the temperature gauge on international relations is smoking hot.

Action by China or Russia could easily lead to Japan and Germany, respectively, turning away from their post WWII pacifist stances – which ironically is the last thing China or Russia wants. Japan has sharply increased military spending and also removed long-standing restrictions of its ‘self-defence forces’. Germany is being called our for not meeting NATO defence spending targets.

How close is China to the US?

The four factors I think are relevant to assessing a nation’s strength are:

- Economic might

- Cultural impact

- Technological prowess, and

- Military power

Economic might

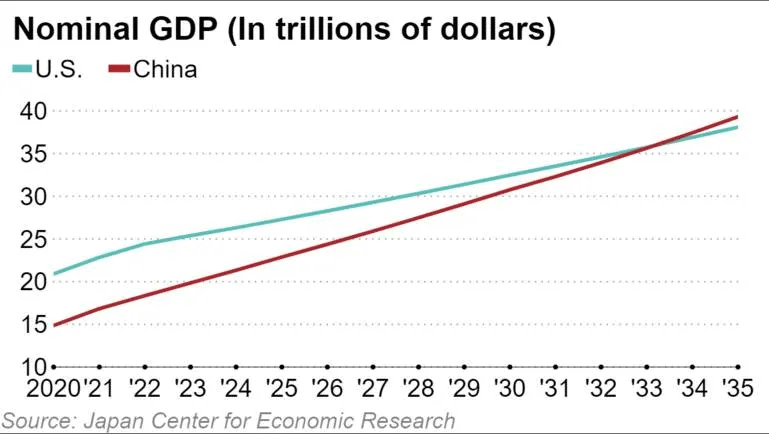

China is set to surpass the US on a Nominal GDP basis in 2033, having already surpassed the US on a purchasing power parity (PPP) basis.

The US needs a plaza-accord moment, or a domestic set-back to China’s economy. The former seems unlikely, while the latter is possible. Triggers could include: crack-down on private enterprise (in particular, consumer internet and real estate), leading to recession. In addition, I believe we will see a reversal of the FDI which led to China’s historic rise, as international manufacturers look to reshore or diversify supply chains.

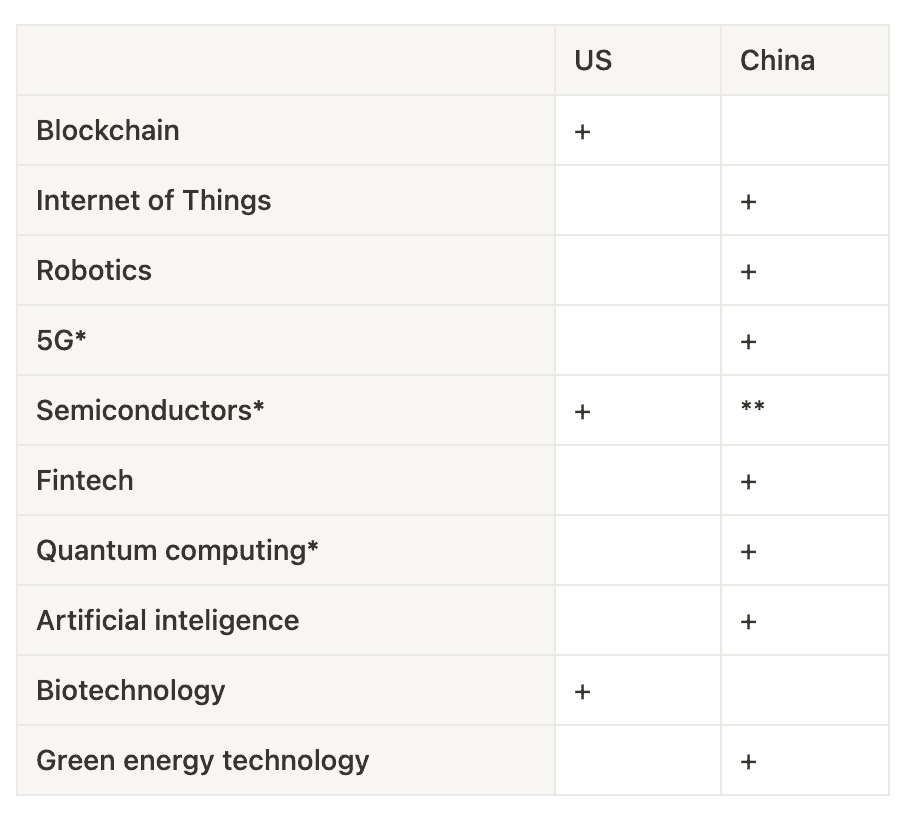

Technological prowess

The table sets out my views on where the US and China stand on foundational technology competition. The problem for the US is that while America has generated much of the original IP for these technologies, the manufacturing capabilities sit in China (Robotics, 5G, Green Energy). China leads in AI and Fintech.

Notes:

* interpreted from a December 2021 Harvard Kennedy School paper on China and the US’ tech rivalry. Read here

** In China’s favour if Taiwan considered part of mainland China.

Military might

The era of perceived US military dominance is over. The embarrassment of the Afghanistan withdrawal (defeat?) has seriously diminished the reputation of the US military. This leads to heightened risk that China and/or Russia unilaterally seek to change the status quo in locations of interest. Russia and China have clearly demonstrated that they now feel confident to more assertively project power along their borders (Crimea, Ukraine, China-India border, South China Sea Islands) than would have been thinkable five years ago.

In relation to Taiwan, the belfer center reported US war games over Taiwan, simulate China winning 18-0*.

Cultural impact

The US has a huge cultural lead. China’s soft power is very weak.

Even within Asia, Japan and Korea have stronger cultural power. China doesn’t really feature culturally outside of Cambodia, Myanmar and Laos.

TL;DR

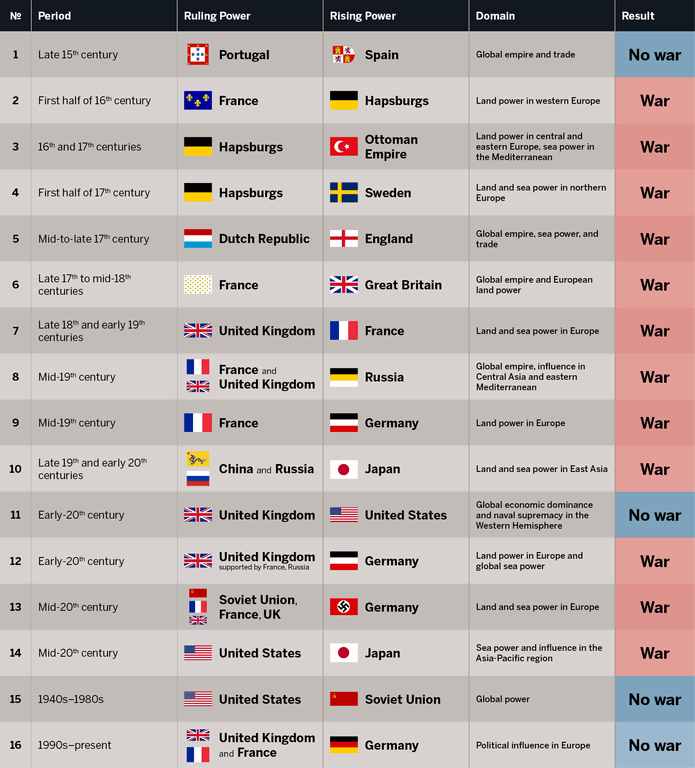

Can America and China escape the Thucydides trap?

I’m not confident they can. The relationship between the superpowers is bad, and seems likely to get worse. As the graphic shows, most times a new power rises there is conflict.

Assessing each of the national strength factors in the round, China is much closer to the US than many in ‘the West’ imagine.

4. Coronavirus

Omicron almost feels like a market irrelevance at this juncture. It appears to be benign – my family and friends who have had it have mostly expressed uncertainty as to whether it was a cold – That said:

- Markets with ‘zero-covid policies’ are currently looking very out of touch. Unfortunately, this includes mainland China and Hong Kong, which are currently facing a wave of lock-downs in Q1 and Q2 2022, which will likely hit manufacturers, supply chains and growth.

- The second-order long term impacts of the pandemic (e.g. changes in the way we work) will be profound and long-lasting.

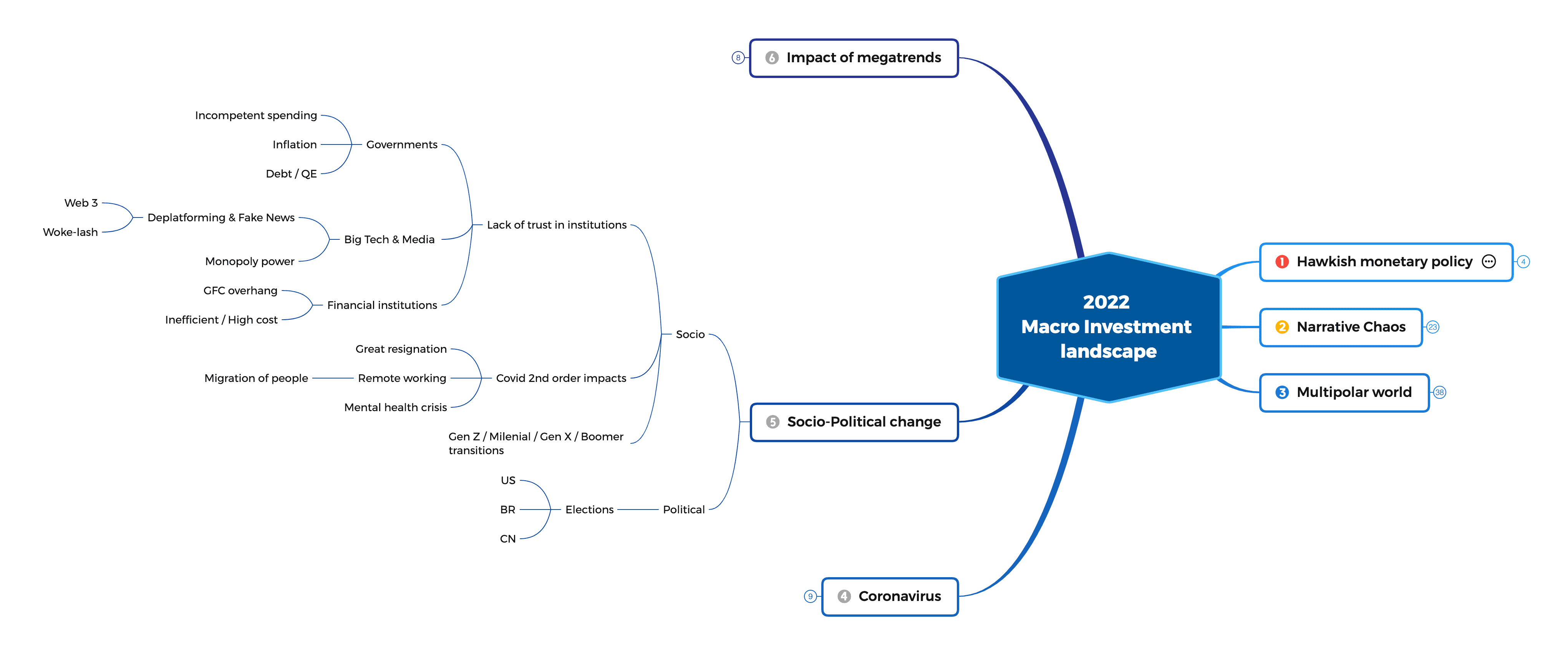

5. Socio-political change

Lack of trust in institutions

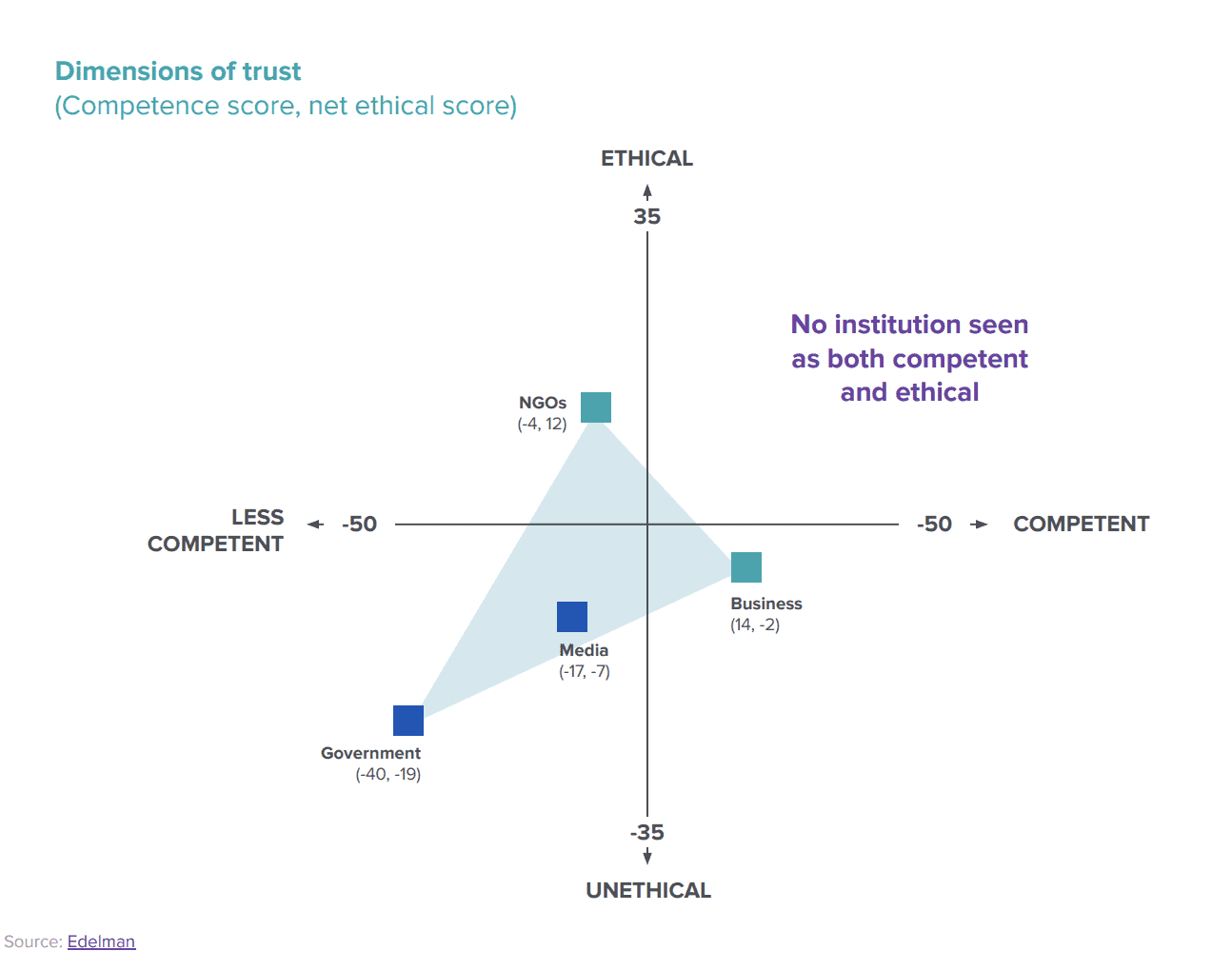

Many have lost trust in Governments, Media and Big Tech. Reasons include: the WMD debacle, ‘Fake News’, labelling the ‘lab-leak theory’ as a conspiracy, poor advice from governments and the media regarding handling of Covid, de-platforming, cancel-culture, and so much more…

A survey from Edelman shows no major institution is seen as both competent and ethical.

We are way more polarised and divided than we’ve been since the 1960s. In part algos on social media are to blame as they drive people to the most extreme content, and hide alternative views.

Woke-lash?

For a long time there has been zero-tolerance to debate on critical / ‘sensitive’ issues. However, individualism is finally on the rise, with:

- more people speaking their minds, and saying what the silent majority is thinking.

- distrust in the media and big tech leading to the growth of independent media – substack, podcasts, mirror.xyz, etc

- the rise of decentralised applications controlled and owned by users and creators (i.e. Web 3).

For too long companies and governments have emphasised equality of outcome, rather than equality of opportunity. People are starting to see this as misguided and discriminatory.

Covid 2nd order impacts According to LinkedIn’s chief economist, pre-pandemic saw 1 in 67 as Work From Home (WFH). The figure now is 1 in 7. Looking back sending everyone home for two years will be seen as one of the events of the decade – it has changed so much:

- The Great Resignation: Mindsets have changed – people are prioritising health and happiness over wealth. Some of the most watched videos on youtube are now of people camping or building. I’m starting to lose track of the number of friends looking to move from white collar jobs into carpentry!

- Remote working: Flexibility in work location is leading to migration – both within nations (i.e. city to country; high tax state to low tax state), and across borders (digital nomads in search of lower cost of living, lower taxes and better weather!). Property prices should adjust accordingly, benefiting rural real estate / more affordable locations.

- Mental health crisis: Locking children into home schooling for two years, is going to be seen as a big mistake. Not only has a generation suffered from a deterioration in education quality, many have missed key social interactions in formative years.

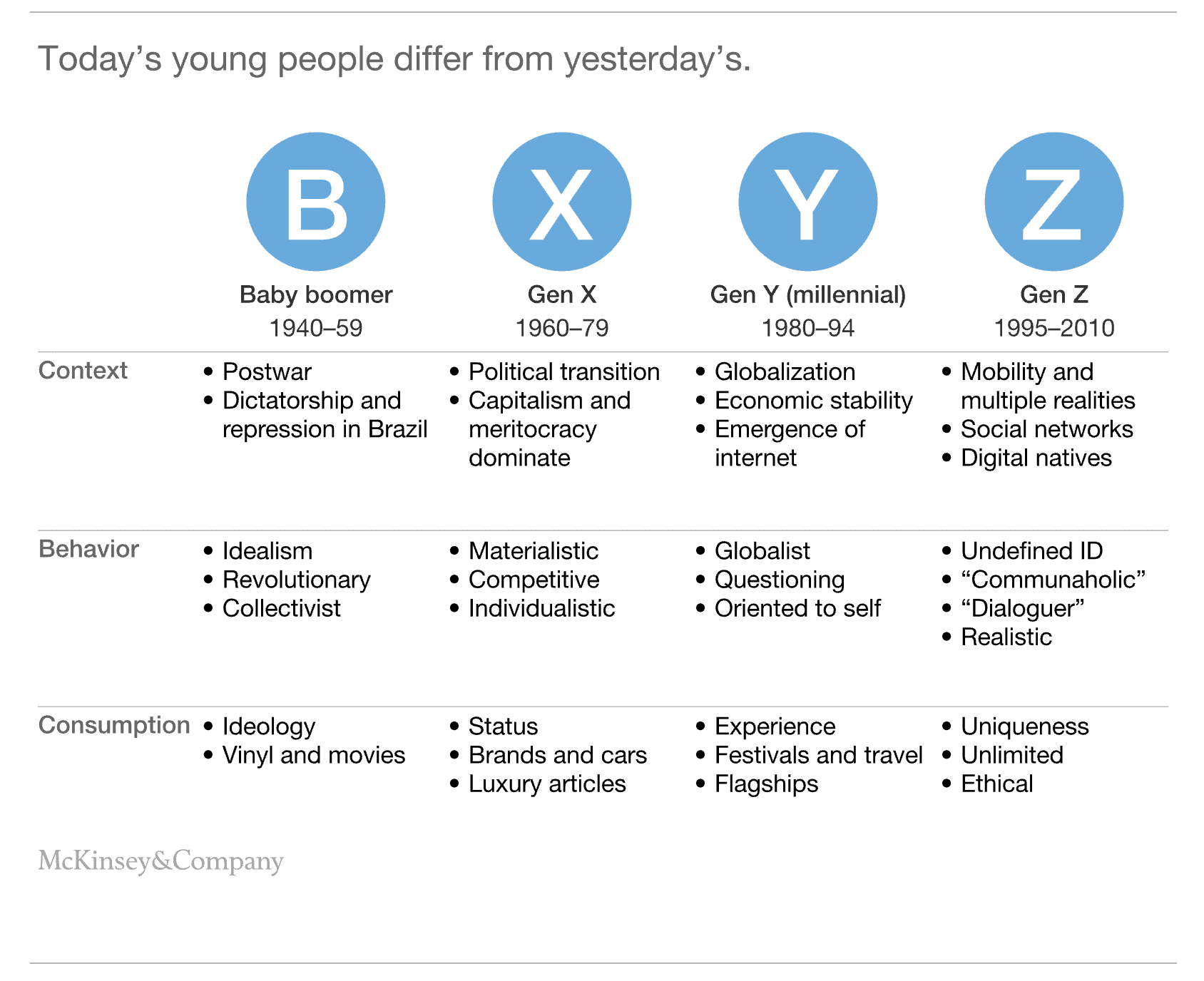

Generational change

We are seeing generational transitions

- Gen X are in the golden ages of their careers.

- Gen Y are the ‘engine room’ and on the cusp of leadership roles.

- Gen Z entering the workforce.

It’s going to be a period of rapid change in organisations. We’re already seeing increased attrition as job for life mentality diminishes.

I think Web 3 and Decentralised Autonomous Organisations (DAOs) will be a big draw for Gen Z, which will result in workforce supply constraints, and ultimately drive greater adoption of automation and tech to compensate – in both traditional white collar and blue collar jobs.

Politics

There will be elections in democratic countries: South Korea, France, Brazil and Australia – these will be a good guage of the public’s view of the handling of coronavirus. There have been mass demonstrations in France, Brazil and Australia around the use of lock-downs and one imagines many incumbent governments will be voted out for overreach.

I’m most focussed on the US mid-terms congressional elections. In November all seats in the House of Representatives and 34 of the 100 seats in the Senate will be contested. The Democrats looks set to loose big; I would anticipate a wave of more considered policies in the coming month to stimulate growth and stave off this outcome.

I’m also slightly intrigued by the situation in China – as also in November 2022 the CCP holds its 20th National Party Congress where Xi Jinping is expected to be re-appointed Chairman. It is expected to be a rubber stamp, but beneath the surface Xi has ruffled many feathers, so there could easily be a surprise.

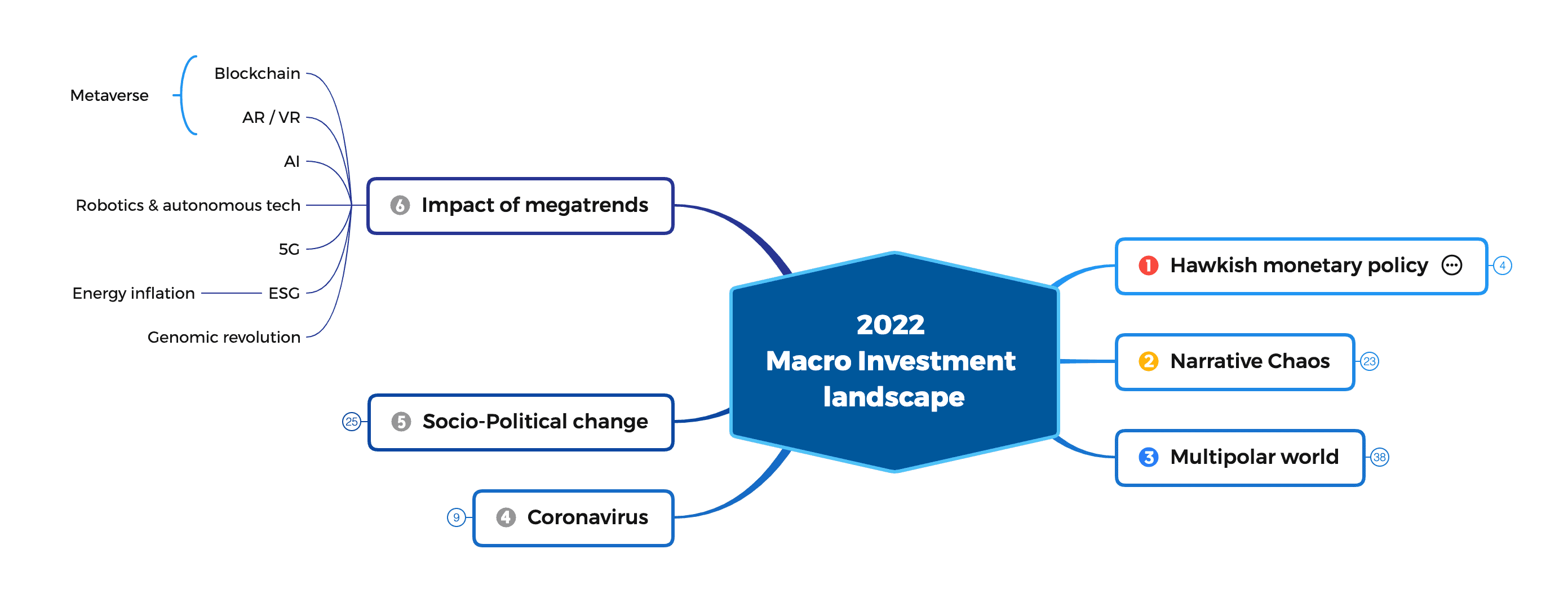

6. Impact of megatrends

The two mega-trends I’m most focussed on for 2022 are Blockchain and AR/VR. The combination of the two is what people refer to as the ‘metaverse’.

Blockchain / Crypto

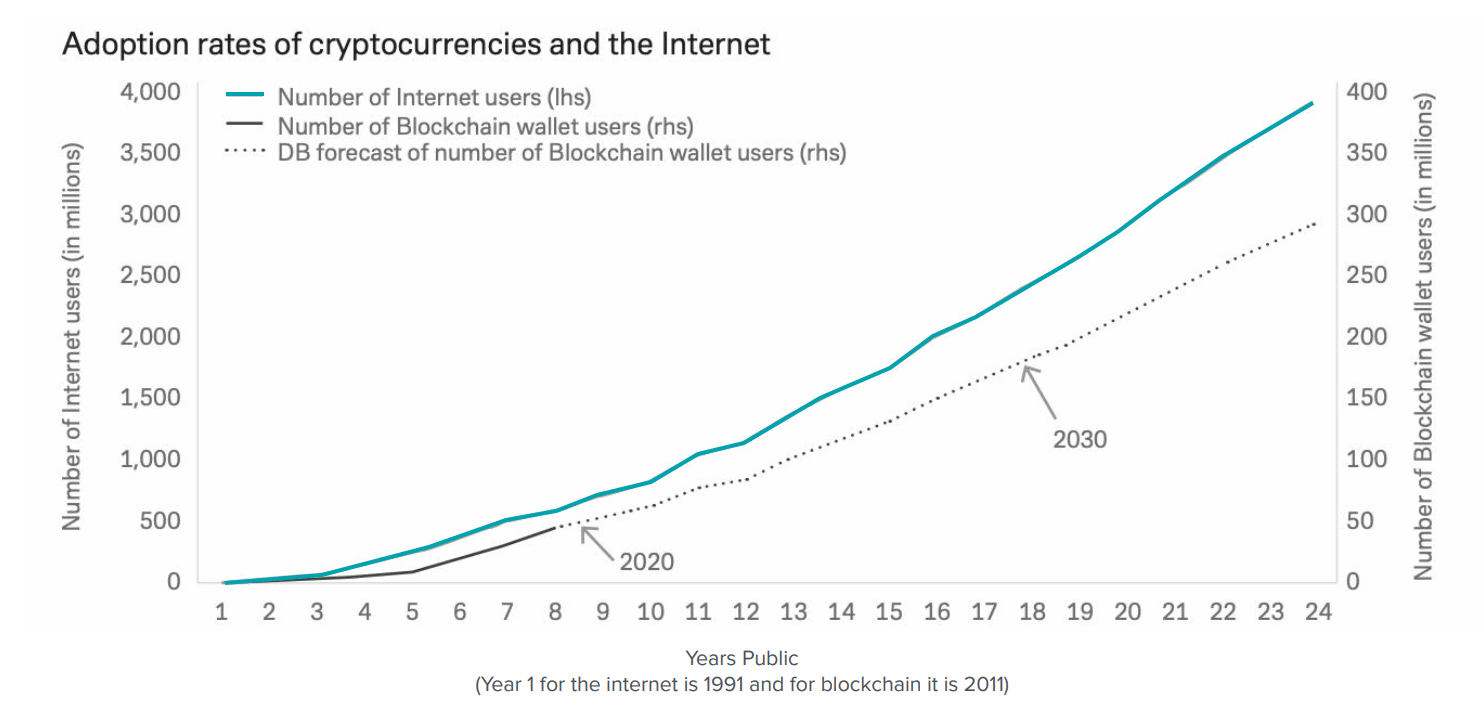

Crypto adoption is broadly tracking internet adoption. When compared to internet adoption, today is 2000 in the internet – i.e. we have 20 years of exponential growth ahead of us.

Drivers of crypto adoption include many of themes discussed above:

- Democratizing access to financial services

- Encourage collective owned open alternatives to tech monopolies

- New innovative products

- Migration of the creator economy to Web 3.

Augmented Reality & Virtual Reality

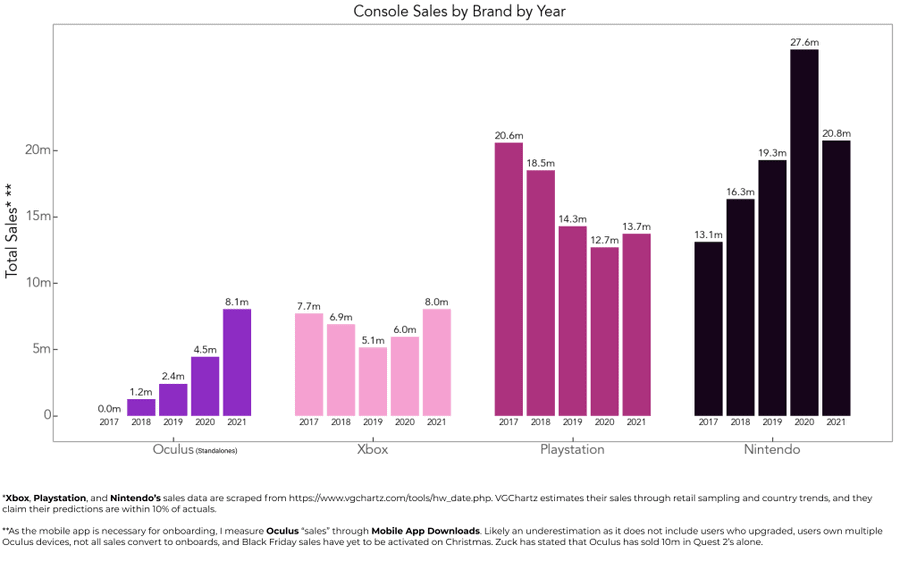

Virtual Reality (VR) is finally, after many years of failed promise, seeing mainstream adoption. Oculus VR sales exceeded Xbox sales in 2021 for the first time.

Augmented Reality (AR) could be even more impactful than VR – Apple is expected to introduce its first AR headset in 2022.

Overall predictions

Monetary policy: Markets have over-cooked inflation fears, and we’ll see two Fed rate rises in 2022. ‘Balance Sheet normalisation’ is my chief concern – If the Fed rigorously adopts quantitate tightening (QT), then ‘Houston, we have a problem’. The timeline for QT is potentially summer, so one would want to be defensively minded going into Q2.

Narrative chaos: We will massive swings of capital between different asset classes. Crypto will reach new all times highs at some point in the year confounding sceptics yet again.

Multipolar world: > 50% chance of some form of conflict in Ukraine. If this happens then a 25% chance of conflict in Taiwan, if Russia is unopposed. Military hardware, cyber software, and Oil / Gas will see upswings.

Coronavirus: Most of the world will move on from lock-downs / zero-covid policies, including at some point China after Omnicron punches through. Coronavirus will no longer be a leading investing narrative by the end of the year

Socio political change: Mainstream media will continue to haemorrhage users, and the influence of leading independent voices that are unafraid to question the establishment will continue to grow – Joe Rogan, Bari Weiss, Matt Taibbi, Glenn Greenwald, the ‘all in podcast’, etc. This should be net positive for society as people return to constructive debate of matters of importance. We will see the rise of the regions with large urban centers and property prices adjusting to reflect shifting demands.

Impact of megatrends: Gen Z will embrace Web 3. We’ll see > 500m people with crypto wallet addresses by the end of 2022. It will be the year that all institutions will need to take note of crypto, and start to adopt their business and operating models for a Web 3 future.