“I think of that Ian Dury song, reasons to be cheerful. And I keep thinking I must make my own list. You know because I spend so much time telling friends about the world falling apart, that we do need a reasons to be cheerful list. A portmanteau, a little list. We need to concentrate on those.”

Ian McEwan (on the Adam Buxton podcast).

Every major new technological development has a constant wall of doubt. Crypto’s wall of doubt sometimes feels as epic as the Great Wall of China. Mainstream media reports with glee any price declines (ponzi!), with scepticism price appreciation (ponzi!) and to stable prices with accusations of drabness (boring ponzi!).

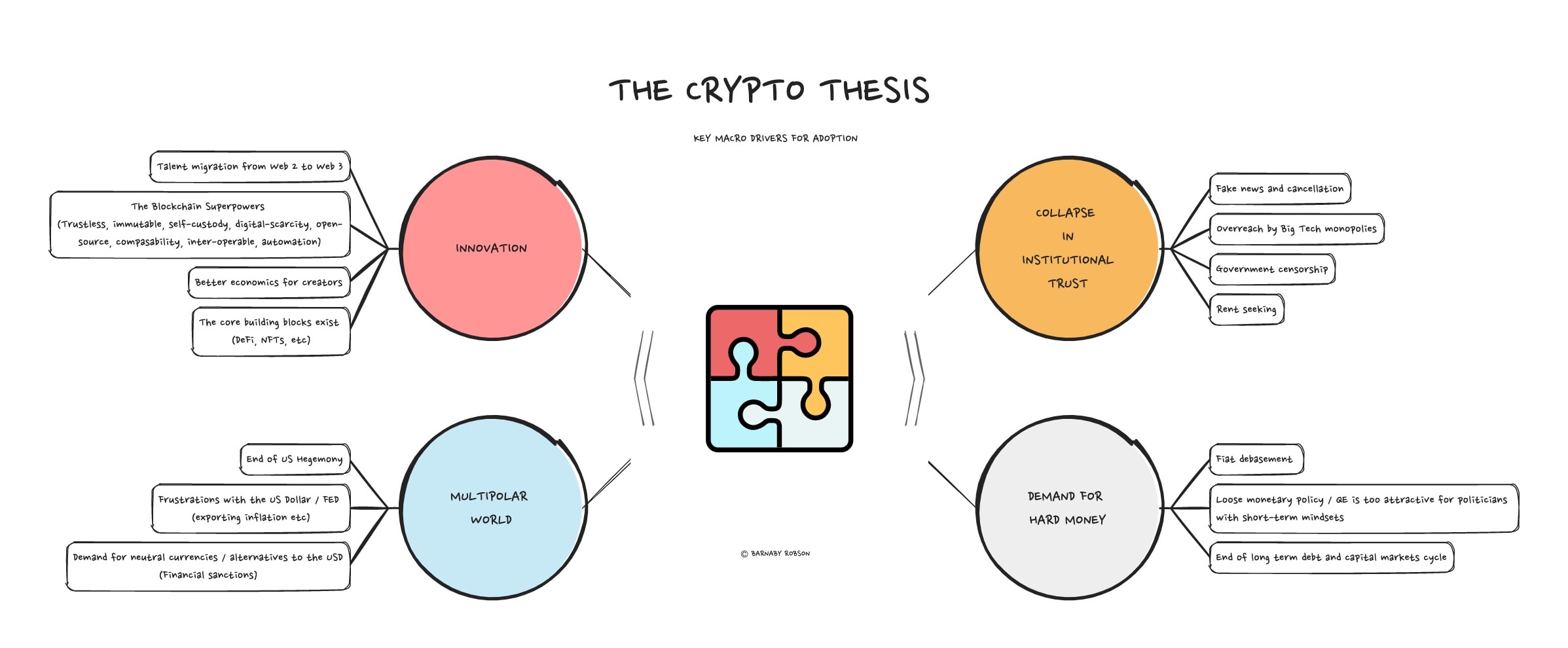

Status of the crypto thesis

While a number of bullish theories around crypto were debunked in this latest cycle (bitcoin as an inflation hedge…), my conviction remains strong as the underlying macro drivers are arguably more real today than ever:

This conviction can be understood through the following mental models for major crypto:

- Bitcoin: US dollar liquidity hedge (reaction against QE) plus sanction-proof technology (decentralised network which allows value to be transferred free of state interference).

- Ethereum: decentralised computer, which will allow through decentralised applications (dApps), for people to own the financial services, media platforms etc that they use

The start of a new cycle

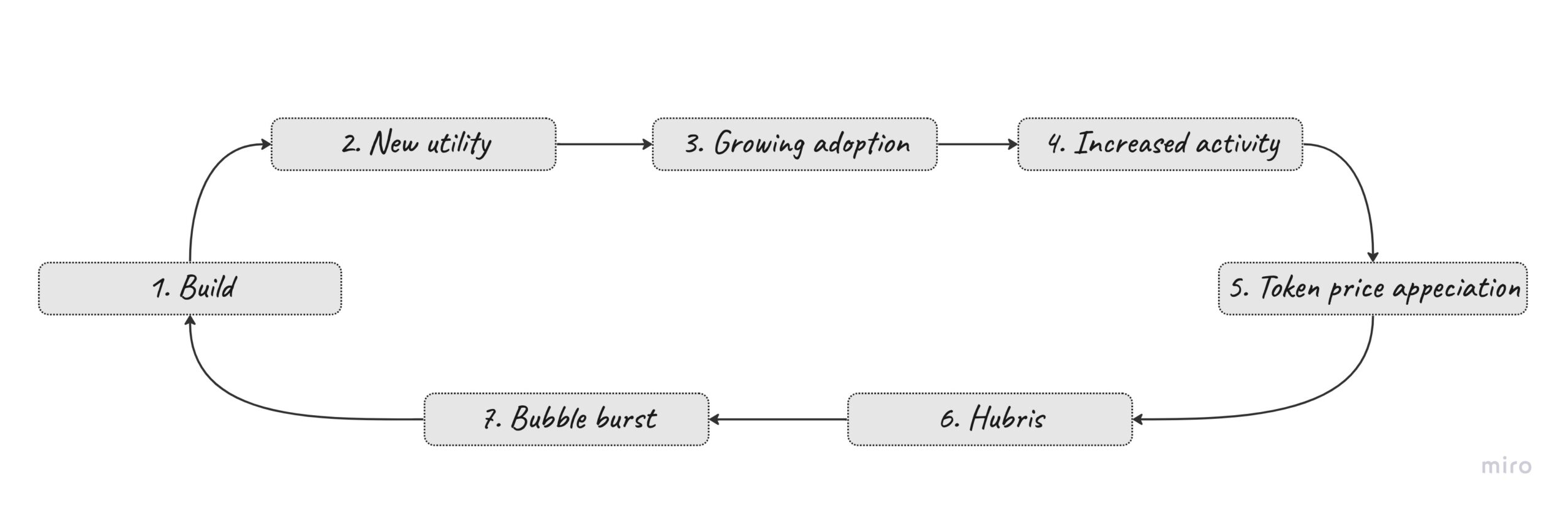

We have learnt that crypto evolves in cycles. I.e.:

(a) Build > (b) New utility > (c) Growing adoption > (e) Increased activity > (f) token price appreciation > (g) Hubris > (h) Bubble burst. And repeat.

I think in terms of price-action Bitcoin and Ethereum are now chopping around the bottom, and Crypto is therefore entering its 5th cycle.

This means a lot of crypto fans are probably feeling a little poor right now… but equally, this is where the next wave of innovation starts.

Reasons to be cheerful

As the dust settles and I look around, this is my Portmanteau of reasons to be cheerful for crypto:

1. Open Social steps into the limelight

A rapidly emerging sector in crypto is Social and this is where some of the most exciting innovation is happening. Open Social or Decentralised Social (DeSo) is the crypto-native approach to traditional social media (TradSo). The DeSo architecture stack is nascent and arguably more challenging than Decentralised Finance (DeFi), due to the heavier load on decentralised infrastructure (need to store videos, images, etc) and the need for lower cost and latency.

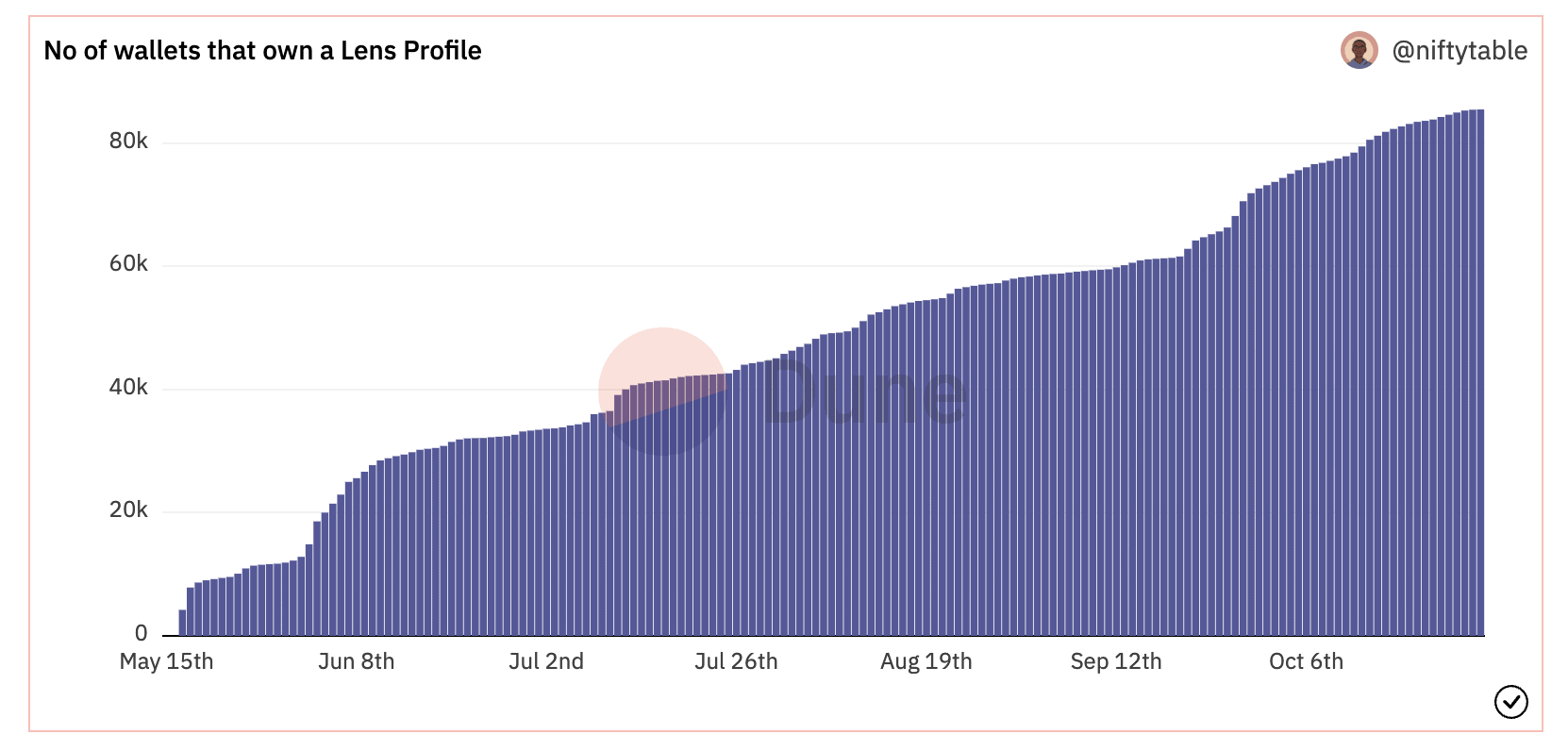

A key innovation of DeSo is the building of open-source social graphs (which store a users interactions – posts, comments, followers, likes, etc). The leading player is Lens. Lens Protocol is user-owned, and enables decentralised social apps (front-ends) of a user’s choosing to tap into their social graph. This enables the virtues of Metcalfe’s law to apply (i.e. positive network effects) but at the social graph layer, without the user losing control of their data. Profiles on Lens Protocol have grown to 100k since May, with 400k+ posts stored in their social graphs.

Source: Dune Analytics; Made by Kofi.

2. The emergence of Physical-Backed Digital Tokens (PBDAs)

For many years people have believed the holy grail for crypto is Real Estate. It’s the largest asset class (roughly 3x that of equities) and suffers from a lack of liquidity and accessibility. On-chain fractionalisation of real estate is therefore the biggest opportunity for crypto.

Physical Backed Real Estate NFTs are launching. Platforms such as Roofstock are creating LLCs to take ownership properties. They tokenise the property and mint an NFT which represents ownership (property deed). The NFTs can then be browsed and purchased on a marketplace with one-click. Roofstock made their first PBSA sale in October 2022.

Meanwhile, Azuki, currently the 3rd most valuable NFT collection, just auctioned 8 unique Gold Plated Skateboards (”Proof of Skate”) where ownership is verified through an NFT. All skateboards sold for at least 200ETH (c. USD 300k).

I believe another fertile ground for PBDAs is: antiques, physical art and other and unique and valuable physical artifacts. The Bazaar is targeting this opportunity but i imagine only a matter of time before the major auction houses – Sotheby’s, Christies, etc – cotton on to the potential.

3. Web3 gaming has a long way to run

Web3 gaming has arguably brought more new users to crypto than any other use-case. Web 3 gaming active wallets are currently at c. 900k – down from 1.4m in November 2021, but still double the current c. 400k users currently interacting with DeFi. But this is just a drop in the ocean compared to 31m users of the Epic Games Store and 69 million users on Steam.

As we discovered in the last cycle Web3 gaming suffers from reflexivity – i.e. players were more drawn to the price appreciation of the underlying NFTs/Tokens than the fun of playing, which ultimately is not sustainable. See charts of Axie inifinity trading volumes for evidence of this.

The focus for Web3 gaming needs to be on (a) developing quality games which are genuinely fun / engaging, and (b) on removing friction for users and developers – creating easier on-ramps, mobile apps, app store access:

- Regarding engagement, despite a number of calamities Axie Infinity feels best positioned to deliver a breakthrough given the experience, financial backing and scale of Sky Mavis (The Axie development studio). Meanwhile there are a large number of games under development scheduled for release in 4Q22 / 1Q23, which have been bootstrapped through NFT sales and could deliver a break-out. I’m keeping my eyes on Civitas – i.e. Civilization for Web3, and keeping fingers crossed that WilderWorld finally deliver on their Web3 racing game

- Regarding friction reduction, we’re seeing the emergence of new platforms such as Zebedee, Pepper and Ultra looking to provide Epic Games Store / Steam type interfaces for Web3 gaming. Several of these platforms have all accumulated 100k+ downloads

4. Large Tech embraces crypto

This is just a small sample of news from big tech:

- Twitter has announced a partnership with four marketplaces to enable the purchase, sale, and showcase NFTs through tweets. Binance was a significant backer of Elon Musk’s takeover of crypto and I would expect more crypto friendly developments in the next 12 months. Twitter is currently rumoured to be working on a “Wallet Prototype” that supports crypto deposits and withdrawals

- Apple has recently approved the sale/trading of NFTs within apps on its App Store. With over c. 1Bn iPhone users this could have significant ramifications for NFR and Web3 adoption, and crypto more broadly.

- Google announced they will start accepting crypto payments in 2023

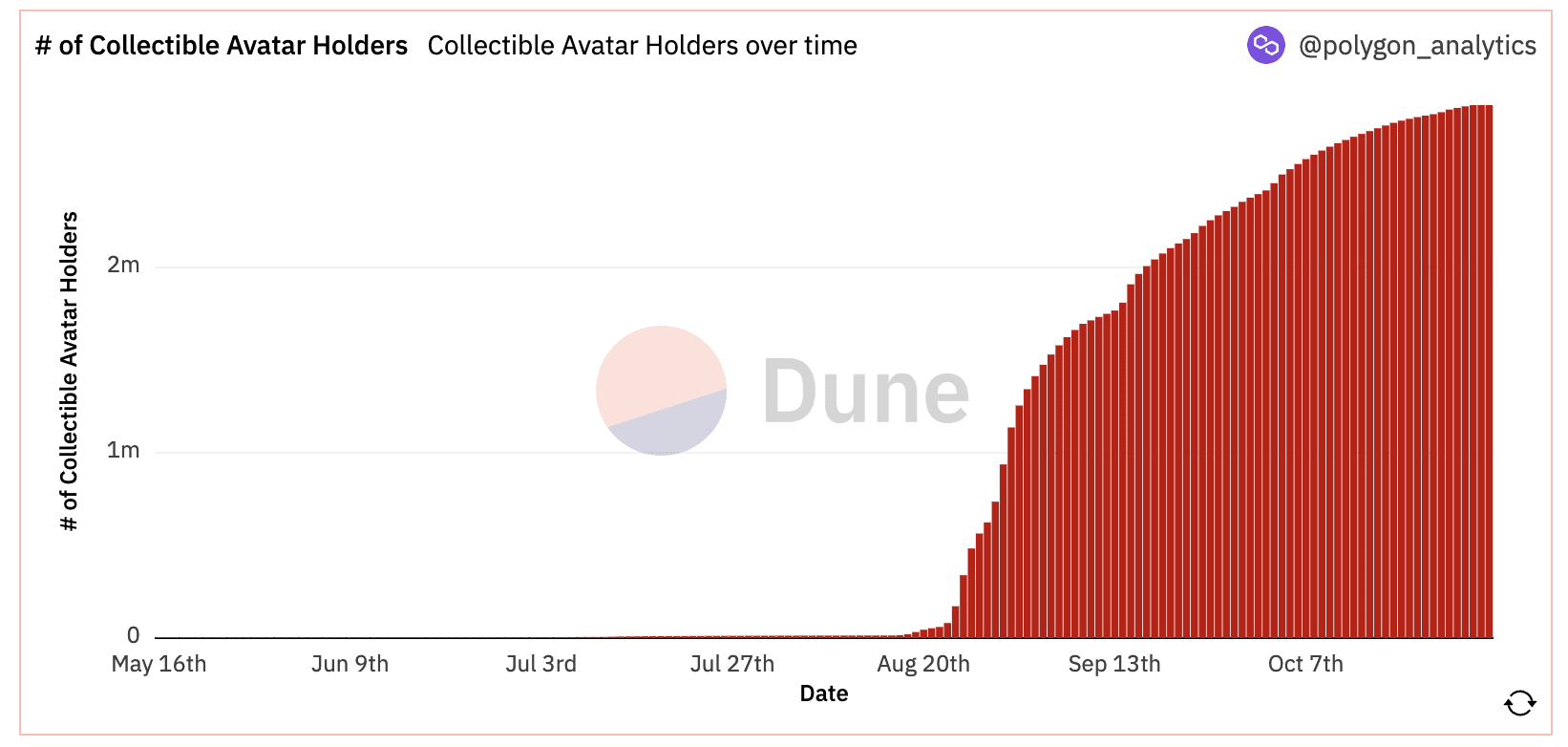

- In summer 2022 Reddit onboarded c 3 million users to crypto via NFT avatars on the Polygon Blockchain – many unwittingly interacting with crypto for the first time.

Source: Dune Analytics; Made by Peter the Rock

5. Retail, HNWI and institutional interest is growing

Recent surveys show growing interest:

- A Charles Schwab survey found that approx 46 percent of Gen Z and 45 percent of Millennial participants wanted to add crypto to their retirement portfolio

- A KPMG & Aspen Digital survey (which I may have contributed to) recently found that “60 percent of family offices and high-net-worth individuals interviewed are presently allocating less than 5 percent of their portfolios to digital assets, while 54 percent say they want to allocate between 5 and 30 percent”

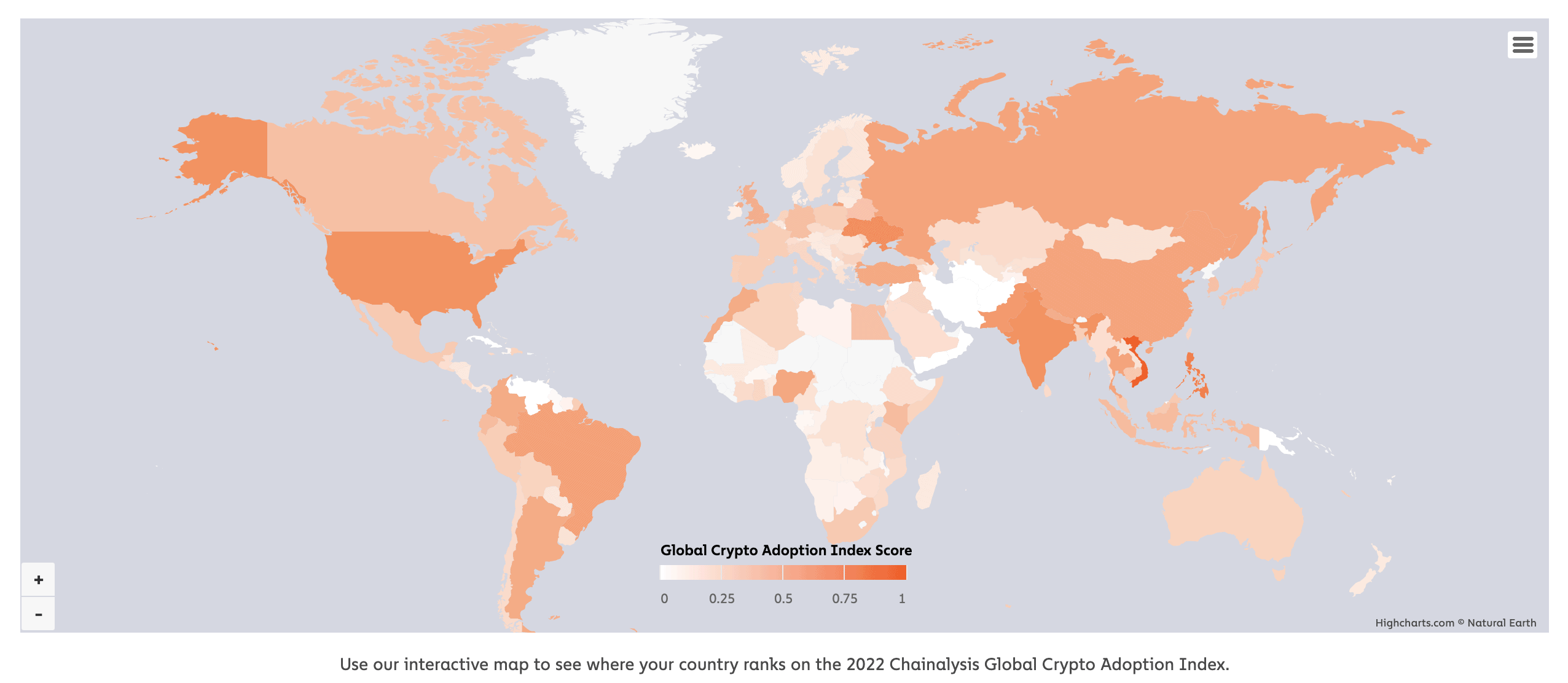

- Chainalysis 2022 crypto adoption index shows that while overall adoption has slowed, it remains a pre-bull market levels. I.e. people stuck around. Also notable is that emerging markets dominate, with the only two developed markets in the top 20 being the UK and US.

Source: Chainalysis; Geography of Crypto 2022

6. We are only just discovering the potential of NFTs

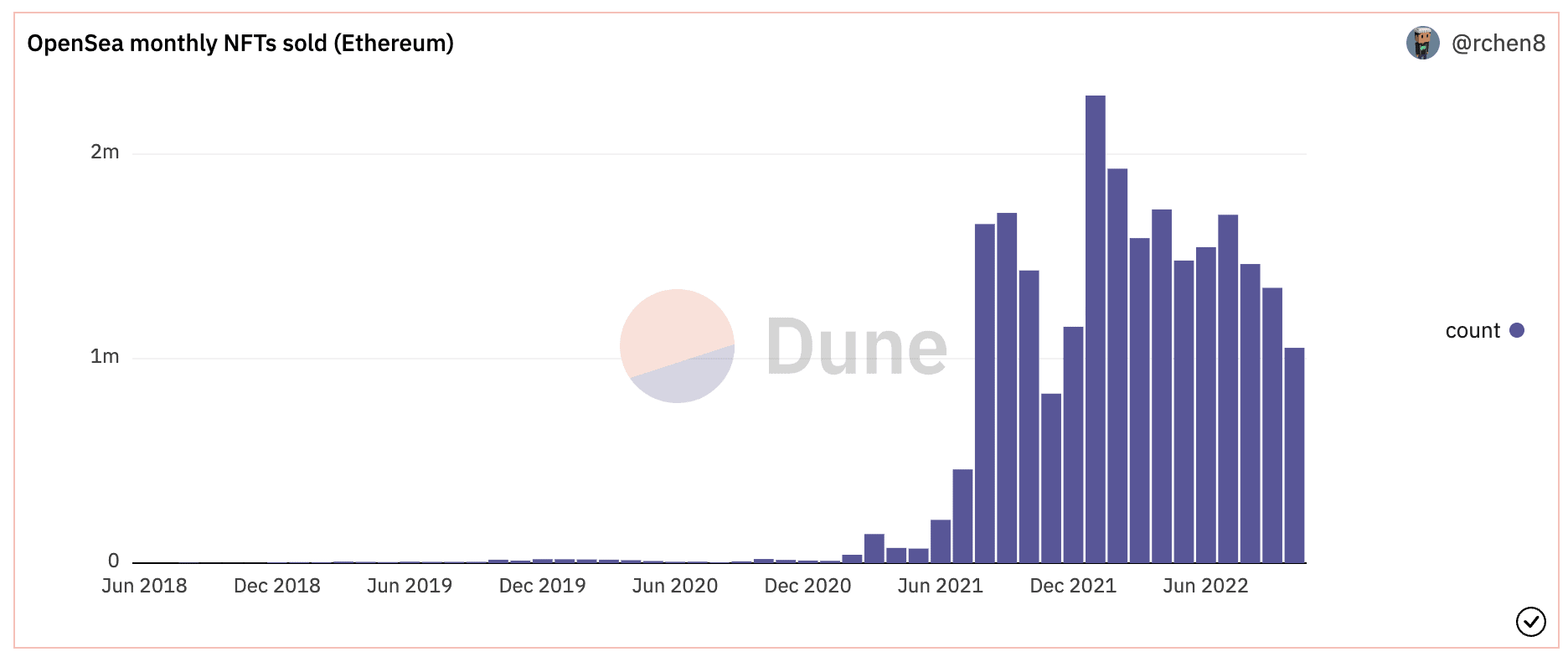

- While the value of NFTs sold has come down significantly from the January 2022 highs, the number of NFTs traded is still at elevated levels

- A recent report from Galaxy Digital found USD 1.8bn has been paid out in NFT royalties. Compare this ti creator monetisation on Web2 and this is at the heart of why the creator economy will move to Web3. As explained above, NFTs are much more than picture profile images, and are in fact powering much of the innovation we are currently seeing in crypto.

Source: **@richardchen39 on dune.com

Conclusion

While it’s fair to say 2022 has been brutal for crypto-fans, this is exactly the point in the cycle where one should be paying attention to new developments and innovation. I see a lot of reasons for optimism and excitement for the future of crypto and Web3. We are starting a new age of build and exploration.

Caveats and disclaimers

Views are my own, and not those of organisations/businesses of which I’m a member/owner.

Not investment advice. Caveat Emptor.

Sources / Credits / HatTips / Acknowledgements

Messari / Dustin Teander – The Open Social Map

Delphi Digital / Joseph Lloyd – A primer for Web3 Distribution

Axie World – Axie infinity marketplace statistics

The Milk Road – NFT house

Ben Usinger & Adam Stuckert – for your sharing and insights on Physical Backed Digital Tokens

Paul McSheaffrey & Yang He – Insights into family office and HNWI digital asset allocation