Intro

In 2023 I read for 52 weeks straight and in particular loved Richard Koch’s ‘The 80/20 Principle’. It helped bring clarity to what’s important. When I finished I quickly picked up another of his books: ‘The Star Principle’. It explains the concept which took his net worth from $2m to $200m.

My initial take was the book was a 3/5. It didn’t immediately grab me, but the ideas slowly built up in the unconscious, and I’ve noticed its now having a significant impact on how I think and behave (“Is this a Star Company?”) – leading to a change in my asset allocation and today’s article!

For those not familiar – What is the Star Principle?

The concept of a Star Company comes from BCG’s Growth / Share Matrix – a mental model which dissects companies into four types:

- Stars: leaders in high-growth markets;

- Question marks: followers in high-growth markets;

- Cash cows: leaders in low-growth markets; and

- Dogs: followers in low-growth markets.

A Star has the following attributes – it is:

- in a market niche which is growing fast, at least 10% a year. The:

- 10%+ growth trajectory should be expected for at least the next 5 years, and preferably for decades

- niche must be profitable

- the leader in its market niche

- this leadership is measured by sales relative to the next biggest rival in the niche

This seems relatively simple, why does this matter?

Richard’s fundamental point is about positioning – i.e. if you invest in, or work for a company which is in a fast growing segment and is the market leader in that segment, your chances of success are significantly higher than they would otherwise be. You are setting the odds in your favour.

I’ve previously written on navigating inaccurate data & misleading narratives when investing (HERE) – The Signal v Noise issue is real and growing – and any mental model which gives an ability to evaluate businesses using simple frameworks that produces more reliable results is very welcome.

My investment decision tree is now something like this:

This cuts out 99% of potential investment opportunities because Star Companies are rare. Goodbye Analysis Paralysis!

Understanding Niches

One factor I overlooked when first studying the growth / share matrix c. 22 years ago, is a Star Company does not need to be a global Titan. It just needs to be the leader in a niche.

For a niche to be a separate market, it must have different customers, different products or services and a different way of doing business from the main market or other market niches.

Richard Koch

There are lots of niches: different customer segments, different geographical markets and so on. In fact, the most reliable way to build a Star business is to copy a successful Star in one market, and take its business model to new market. This is something you see time and again, when analyzing Stars in emerging markets – their blueprint often comes from the US or China.

Finding Star companies

Recall what a Star Business is. It is the largest company in its niche. That niche must also be growing fast, at least 10 per cent, and ideally more, for the foreseeable period. Both conditions must apply, or it isn’t a star.

The process to find a Star is therefore relatively simple:

- Figure out which niches are profitable and that you expect to grow 10% + over the next decade

- Figure out who the leaders are in the niche (and sub-niches)

Step 1: Identify niches

The below are my opinions on sectors most likely to grow 10%+ per annum, that are also profitable:

- Artificial Intelligence & Quantum Computing – key to future productivity and operating efficiency.

- Cloud computing platforms – AI is creating explosive demand for data

- Semiconductors – the picks & shovels for AI, cloud computing and much of tech

- Crypto – Continuous improvements in blockchain technology and the development of more sophisticated and user-friendly platforms will drive adoption.

- Genomics & biotech – advancements in genetic engineering, personalized medicine, and the treatment of complex diseases.

- Cybersecurity – As digital transformation accelerates, the need for robust cybersecurity solutions becomes more critical, driving demand .

- Electric Vehicles and Battery tech – The transition to electric vehicles is accelerating, fueled by environmental concerns and government incentives. Advances in battery technology, increasing consumer acceptance, and the phasing out of internal combustion engines support robust growth.

(Side-note: this is a very tech heavy list. There are plenty of Star niches outside of tech. For example, health foods and drinks companies have been phenomenally successful).

Step 1b: Eliminate niches outside your circle of competence

The areas I understand the best from the above list are AI, Crypto and Semiconductors, so it makes sense for me to focus on these. I ignore areas like Genomics which are way outside my knowledge and experience.

Step 2: Identify the leaders

To do this you need to understand the value chain in a niche, and the leaders of each sub segment in that niche.

For example, for semiconductors the value chain looks something like this:

As you can see, there are many niches, and sub niches, and sub-sub-niches. Examples of clear star companies in sub-niches include:

- Design > Logic > Discrete GPUs: Nvidia (c.80% share)

- Design > Memory > DRAM: Samsung (c. 46% share)

- Front-end Manufacture > Specialist Foundries: TSMC (c. 52% share)

- Front-end Manufacture > Lithography Machines > Extreme Ultraviolet: ASML (c. 100% share)

- And so on

But where’s the Alpha in this?

The best Star companies compound over decades. Even ones which have hit the public markets, and appear highly valued can grow significantly in value. So even if you are not early, if you find a star which is fairly priced and hold for decades (assuming it stays as a star) you will likely do very well.

As an example of compounding, this is what the revenue and profit trajectory looked like for ASML over the last decade.

Even if you had bought ASML in 2013, when they were a well established Star with revenues of USD 5bn, you would still be up 700% by now, consistent with the c. 7x increase in ASML’s profits over this period.

Why you should only focus on Stars (and avoid Question Marks)

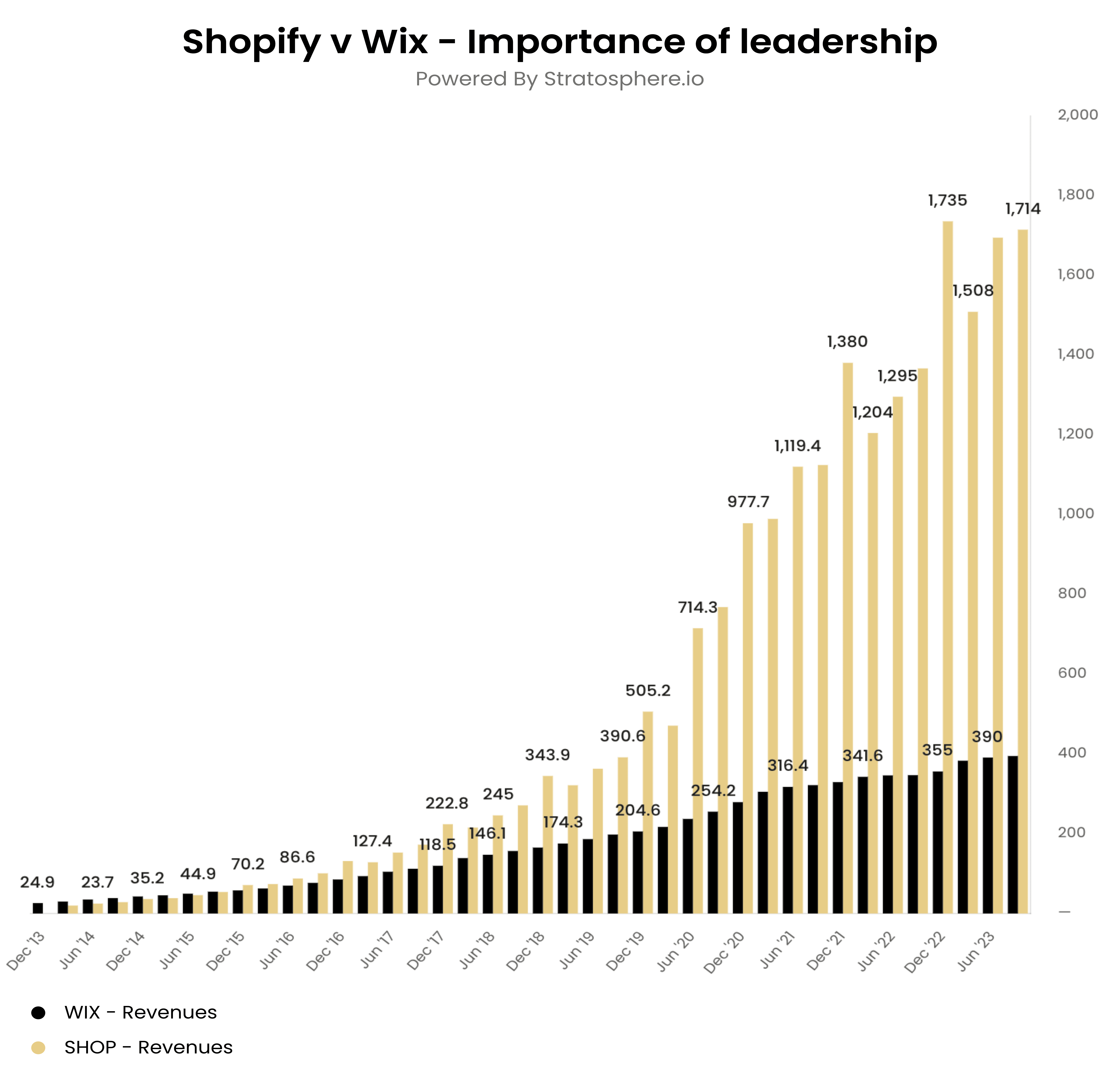

This chart sets out the revenue growth of Shopify and Wix – both compete in eCommerce enablement. While Wix had higher revenue in 2013/2014, Shopify took market leadership in 2015 and never looked back.

If you had switched an investment in Wix into Shopify in 2016, when Shopify became the clear niche leader, you would have been up c. 3,000% by now instead of c. 500% – i.e. a 2,500 percentage point better return. I believe Shopify’s greater scale (with network effects) will contribute to continued outperformance.

Most Alpha – Hidden Stars and New Stars

While it’s safest to invest in established Stars, supernormal returns come from investing in companies on the verge of becoming Stars, or Stars that people have not cottoned on to.

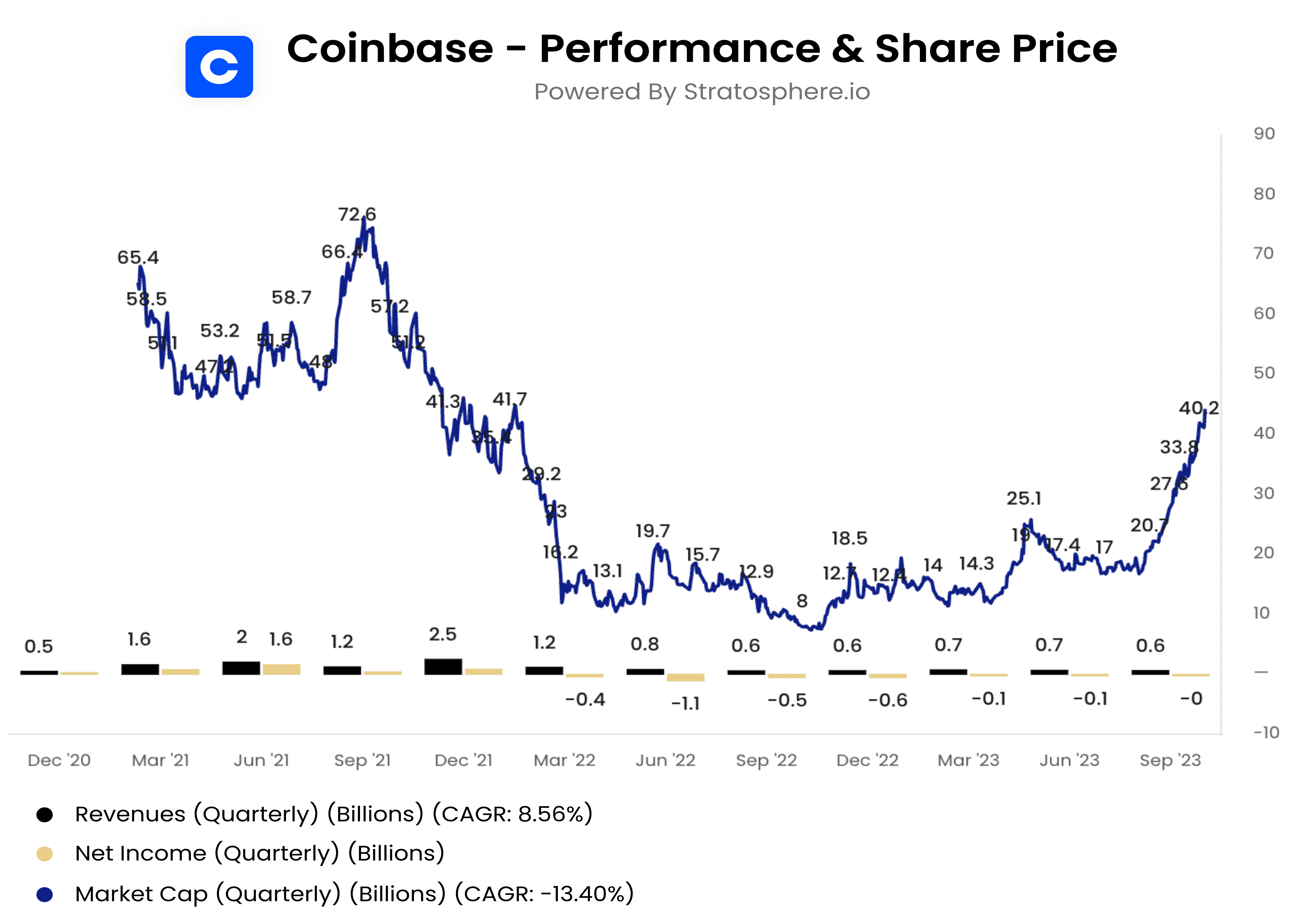

Example, Coinbase – a new Star in the making

Rewind back in time:

- c. 24 months ago, and Coinbase was miles behind competing exchanges FTX and Binance in trading volumes. It was NOT a leader and seemed to be falling ever further behind.

- c. 18 months ago, and the markets were utterly risk-off, FTX had just collapsed and the crypto industry was in crisis. Crypto was NOT seen as an asset class viable for Star nurturing.

- c. 12 months ago Coinbase cut 25% of their staff, in a push to lower operating expenses and drive profitability

- c. 4 months ago, Coinbase launched Perpetual Securities trading, it’s own layer 2 – Base which enhanced their self-hosted wallet, together with a Real World Asset (RWA) platform – all 3 being major sub-niches within crypto.

- c. 2 months ago, the CEO of the biggest exchange (Binance) plead guilty to federal charges – opening the door to Coinbase to vie for leadership in Centralised Crypto exchanges. Simultaneously the markets became risk-on, and the chances of a Bitcoin ETF being approved in early 2024 rising. The large funds – BlackRock, Vanguard, etc are all clambering to offer BTC ETFs.

So very rapidly, Coinbase transitioned from a follower in a declining market, to a likely leader across several niches (custody, institutional trading, US retail trading, RWAs, decentralised wallets, etc) in what now looks like a rapidly growing market again. People who recognised this and bought Coinbase on 1 October 2023, would be up 140% as of 31 December 2023.

Applying the Star Principle in career decisions

Like the 80/20 principle, the Star Principle can be applied to many areas, including one’s vocation. For example, following the Star Principle:

- Geographically, it would be best to position oneself to work in high growth countries.

- In terms of profession, one should pick a niche or a sector which is likely to grow 10% + for decades.

- And in terms of working for others, you are likely to be much better rewarded – in terms of compensation and career progression – if you are working for the Star company in your chosen niche.

Overall thoughts

In life you gain enormous advantage by eliminating the unpromising portions of the chessboard and freeing your time and attention for the most productive ones. While the Star Principle may sound noddy / obvious, I’ve found it a great mental model to simplify, and focus on the few things that matter. I think others will benefit from this too – buy the book!

These are some of the questions I now ask myself all the time, as I seek to seize the lessons:

- are my current investments in Stars?

- if not, who are the Stars in the niches I like? – I should be invested in these…

- what steps should I be taking to better understand new niches which are emerging, that are going to offer future Stars?

- how can I best direct my clients towards profitable niches? Should clients be selling Question Marks or Stars which are clearly fading?

- how can I invest in Stars sooner – before others have realised they are Stars?

- In business if I am not the #1 player how can I redefine the market so I am the #1 player in my chosen niche?

- am I in the right industry, niche, company or profession according to the Star Principle?