“At no point in our lifetimes have interest rates been so low or negative on so much debt.”

Ray Dalio, November 2021

Prediction

The West

The Fed may be close to finishing rate increases but the next period is when we should expect to see increasing stresses in credit markets, as higher interest rates flow through to government, corporate and individual balance sheets.

Investment and business models predicated on cheap money are no longer economically viable and this will lead to significant restructuring across a number of technology sectors.

The East

The picture is very different in ‘the East’ as in response to the pandemic, China and certain other Asian economies opted for social measures rather than aggressive monetary and fiscal stimulation.

As a result, nominal spending growth is now much lower and near normal and inflation rates are at or below targets. While the US, Europe, and the UK must tighten aggressively to bring inflation down, China is in a position to stimulate / cut rates.

The global debt landscape

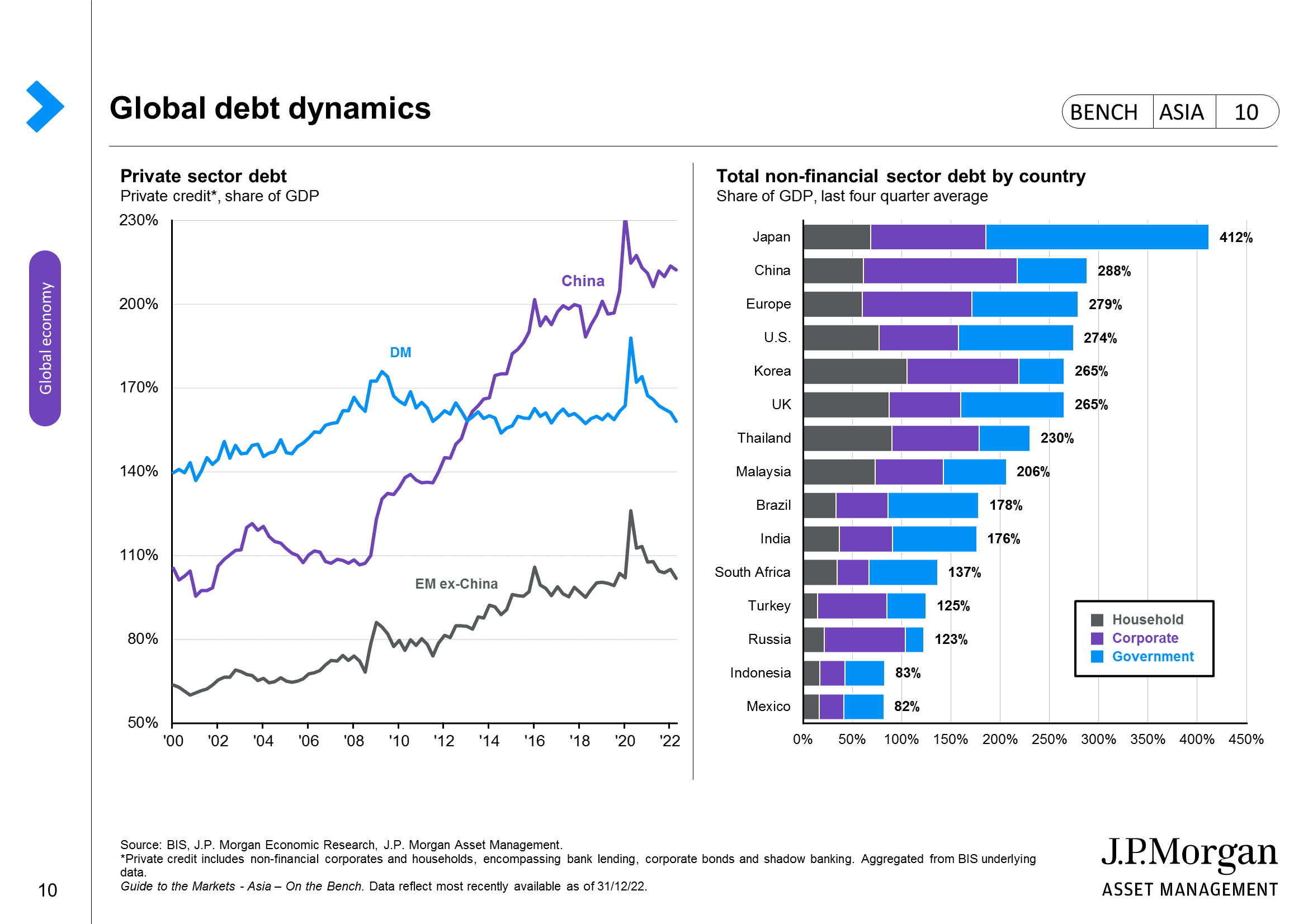

Global debt is around $235 trillion across governments, businesses and households.

The basic maths are that as the Fed raises rates from 0.25% to c. 5% this results in c.$10 trillion increase in global interest payments from c. $5 trillion to $15 trillion – i.e. meaning c 18% of Global GDP will be spent on debt service alone.

This additional c. $10 trillion in debt services costs will result in massive demand destruction, until… governments/central banks kick the can down the road and start printing money again.

Government debt

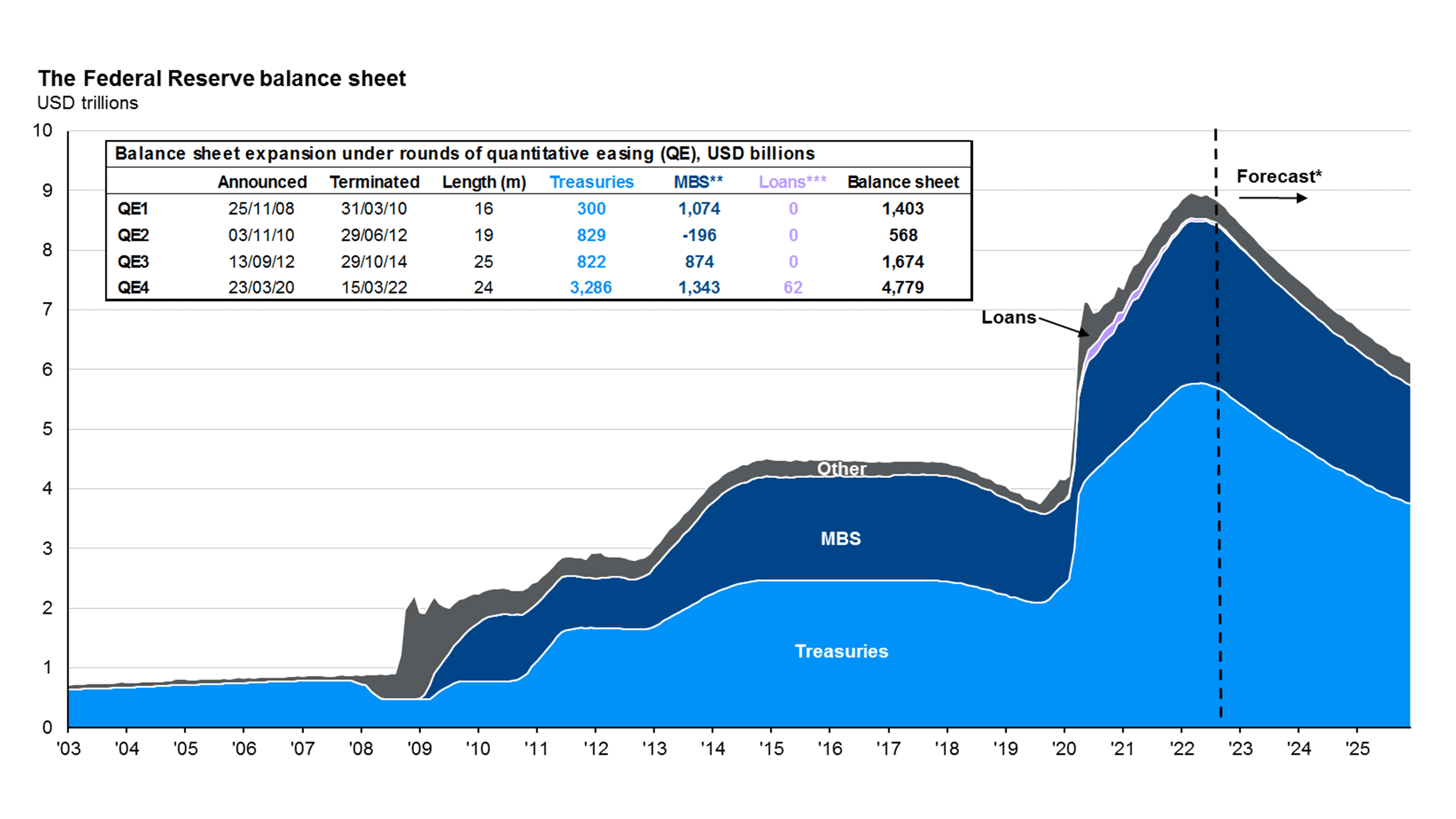

“What I have a problem with is the Fed is expected to do $2.5 trillion of quantitative easing after vaccine confirmation—and after retail sales reached their [past] trend and are now above trend.”

Stanley Drunkenmiller

In the US, the implications of higher rates look dire for the government due to the massive debt load. At present, the US is able to make the world bear the brunt of this due to the dollar’s reserve currency status.

In the short term, while the US maintains hegemony the Fed monetary policies have to be followed in most of the world. Emerging markets, with high government debt to GDP are going to be especially vulnerable to currency collapse and capital outflows. It is likely the IMF will be extremely busy seeking to manage this in 2023.

Corporate debt

The first asset class within Corporate debt to be affected by rising rates is junk debt. This is because variable rate loans, which were at 5-6%, are now at 11-14%.

Companies will have trouble meeting their debt obligations and will have to restructure. Insolvency petitions in the UK for 2022 reached levels not seen since 2009.

The Banking sector

The flow through to the global banking sector is hard to map out.

Banks with high CASA (Current Account / Saving Account) funding are benefiting from rising rates through higher net interest margins. At the same time, the rising risk of corporate and household debt defaults and bankruptcies, will flow through to loan loss rates. For this reason, banks are currently being cautious in loan origination which potentially will cause liquidity challenges.

At the end of 2022 we saw runs on certain banks in Vietnam, and I expect we’ll see more of this in other markets in 2023.

Household debt

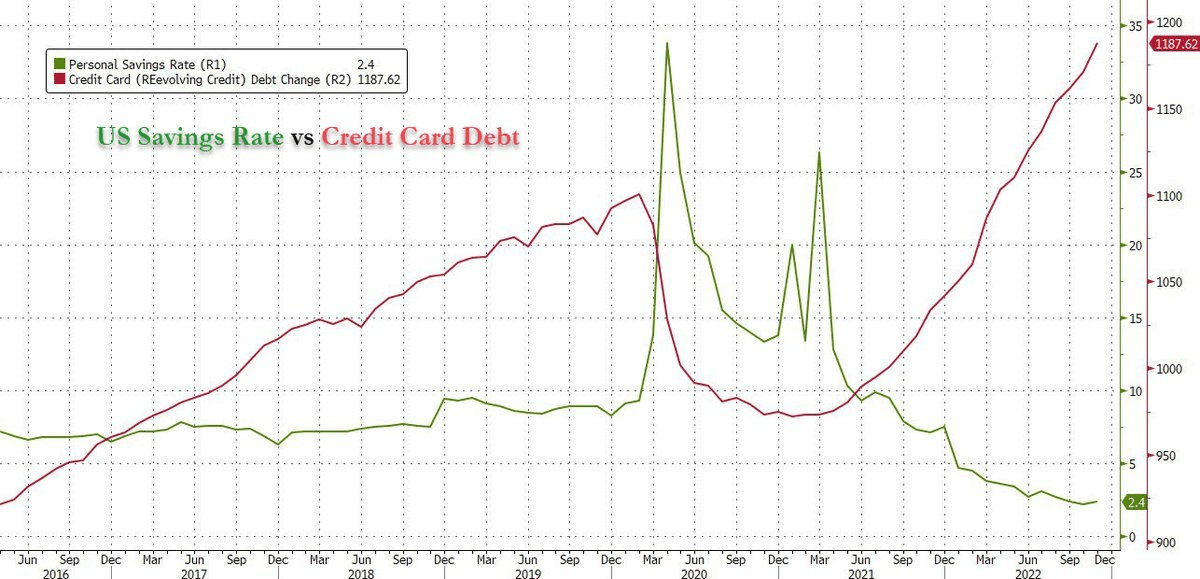

To date, consumers have not responded to the economic downturn by cutting consumption. Instead, they have run down savings and ramped up credit-card debt.

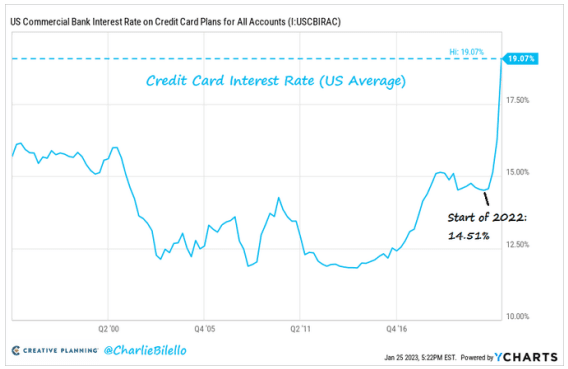

Credit card debt in the US is at an all-time high, with the average rate hitting c. 20%. I don’t see how this doesn’t become a big problem in 2023, with stock portfolios also down and layoffs rising.

Similarly mortgage rates are also rising (albeit at a slower pace on a weighted average basis until fixed rate mortgages hit renewal dates). The longer rates stay higher, the bigger a concern this becomes for the real estate asset values and the banking industry.