Summary

- #1 NFT platform by far

- Metaverse and gaming investment play

- Disruptive business model “play to earn” AKA P2E

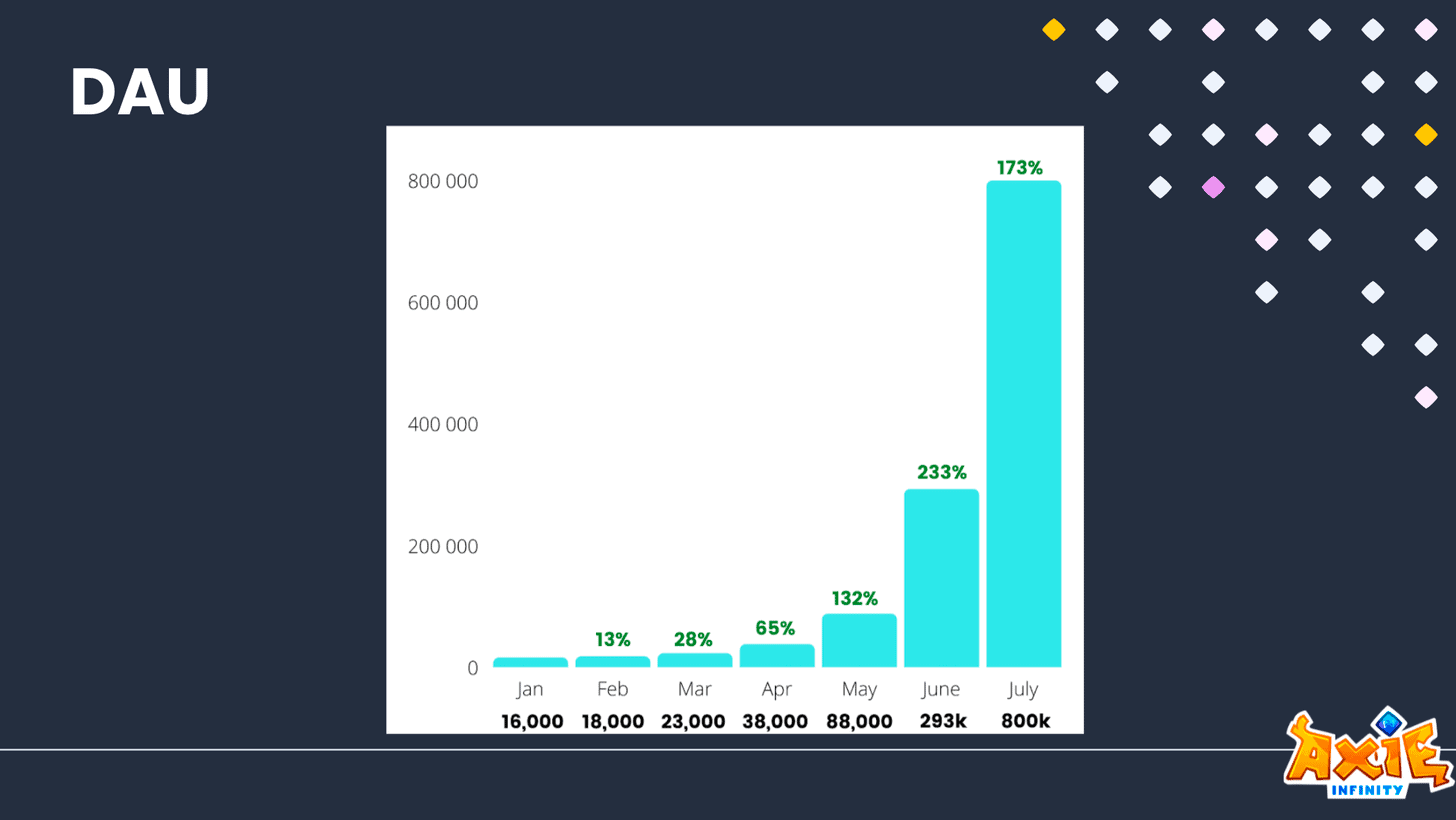

- Viral. User growth > 100% a month, with >800k players as of July

- Accelerating protocol revenue (>USD 200m monthly)

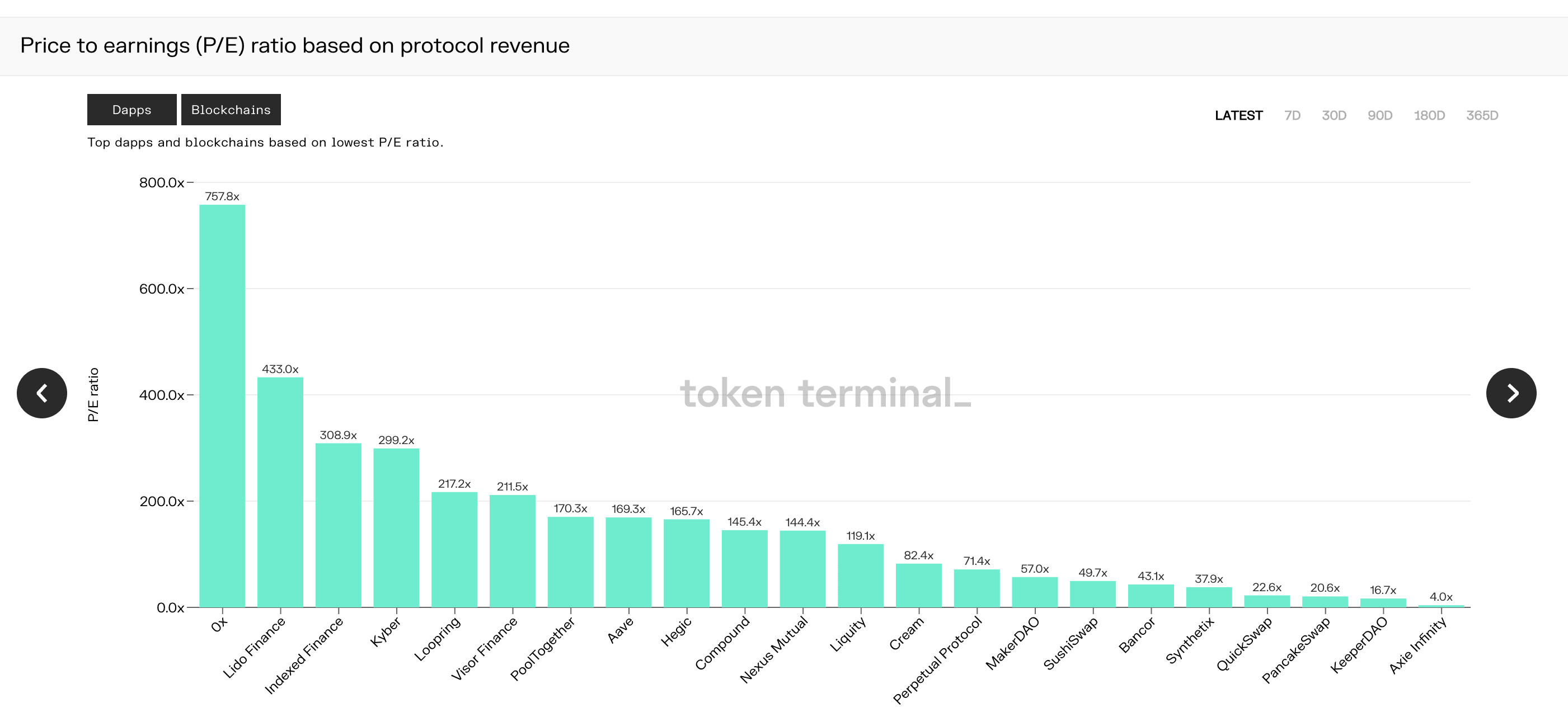

- Low p/s and low p/e

Background

Axie Infinity is a Pokémon-inspired strategy game running on blockchain. Players earn tokens through gameplay. Players can battle, collect, raise, and build a land-based kingdom for their pets.

Axie uses the Blockchain to reward players for their contributions to the ecosystem (P2E). P2E has resulted in Axie becoming a source of income for many people in developing countries, through ‘scholarships’, whereby ‘sponsors’ buy Axies and the Scholars play and take a share of earnings for their time.

Axies

Each Axie belongs to one of three classes, and has 6 body parts.

Each Axie has different traits which determine their role in battle. There a huge number of permutations with certain types of Axies impacting abilities in battle.

An Axie possesses 3 genes. A dominant (D), recessive (R1), and minor recessive gene (R2) for each body part, which impacts breeding potential.

NFTs & Tokens

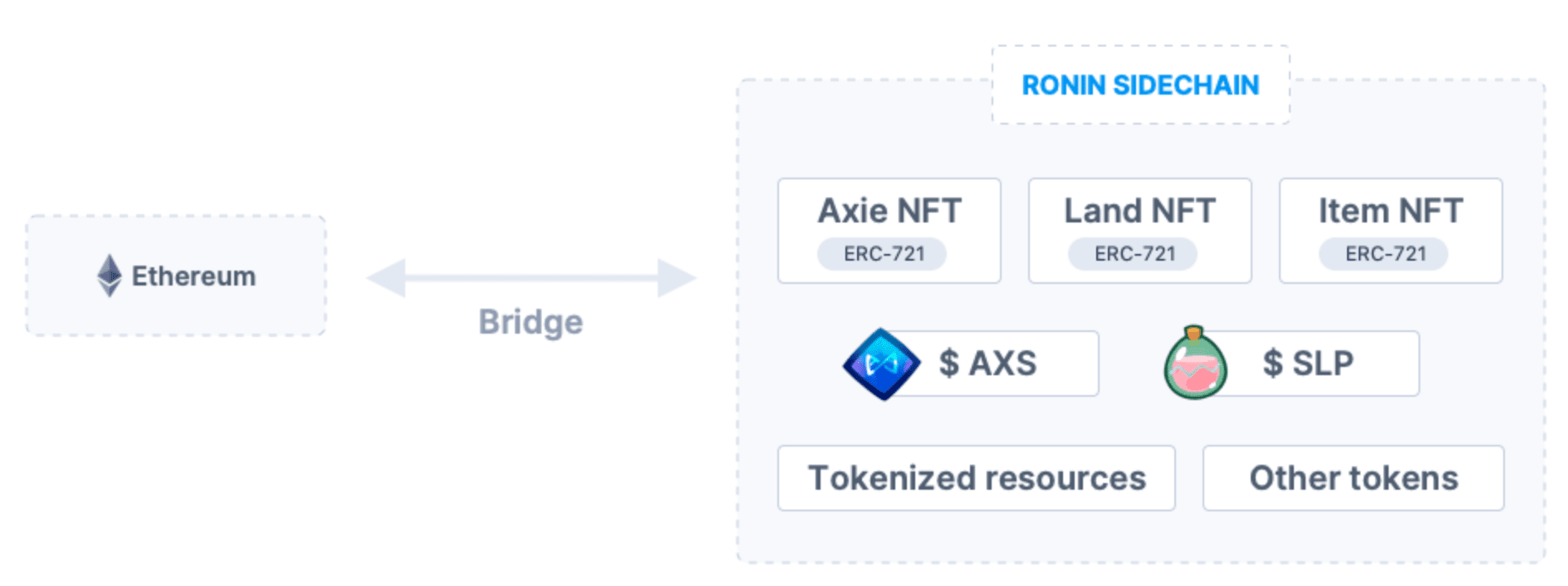

Axie runs on the Ethereum network.

- The Axies, Land, and in game items are all NFTs which can be traded in the Axie marketplace.The game has two key tokens, $SLP and $AXS which can be traded on exchanges.

- $SLP or Smooth Love Potion tokens, are earned as rewards by players through battle or adventure mode.

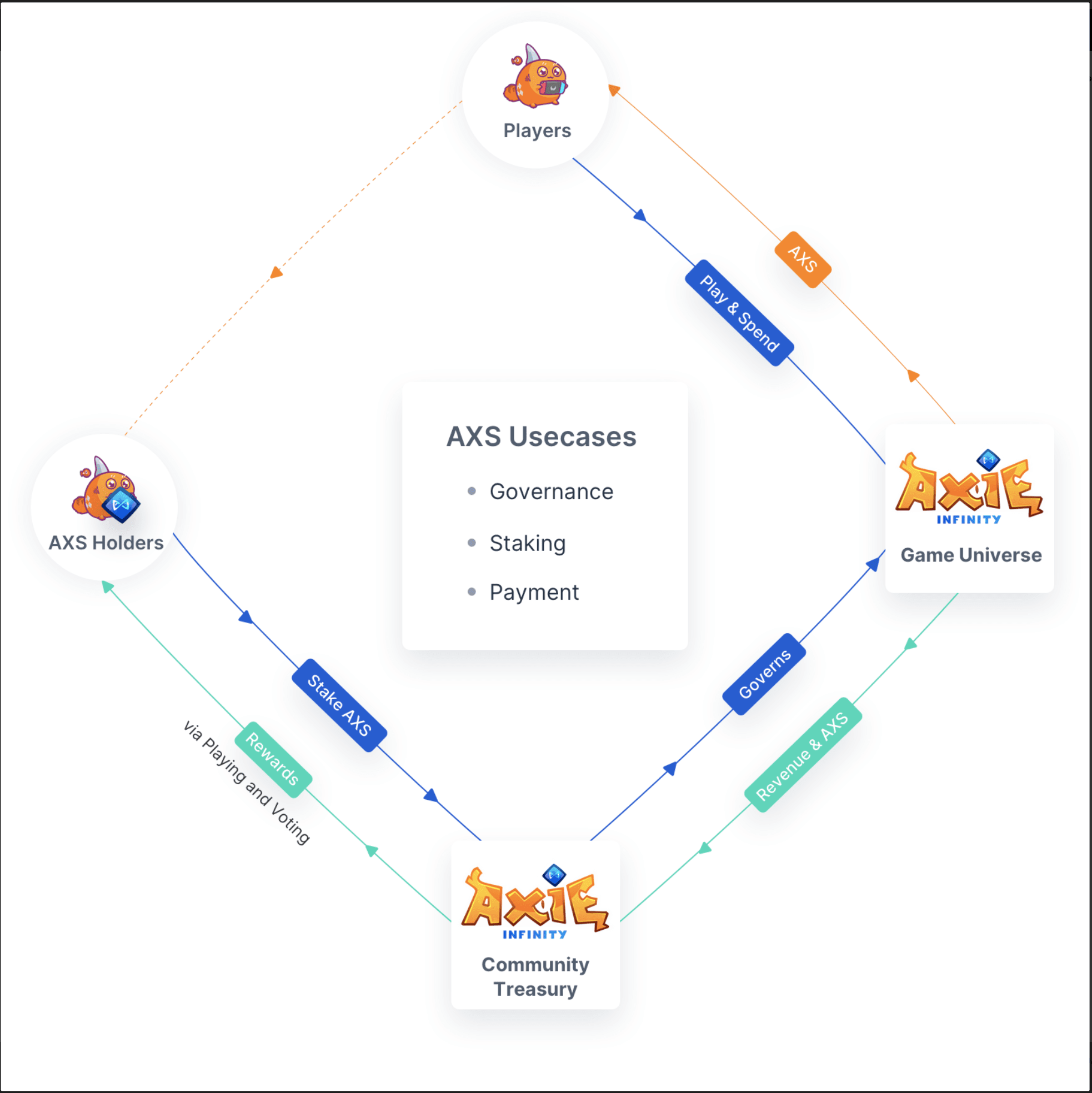

- $AXS or Axie Infinity Shards, are the governance token which receive revenues from the community treasury.

Purchasing and breeding Axies

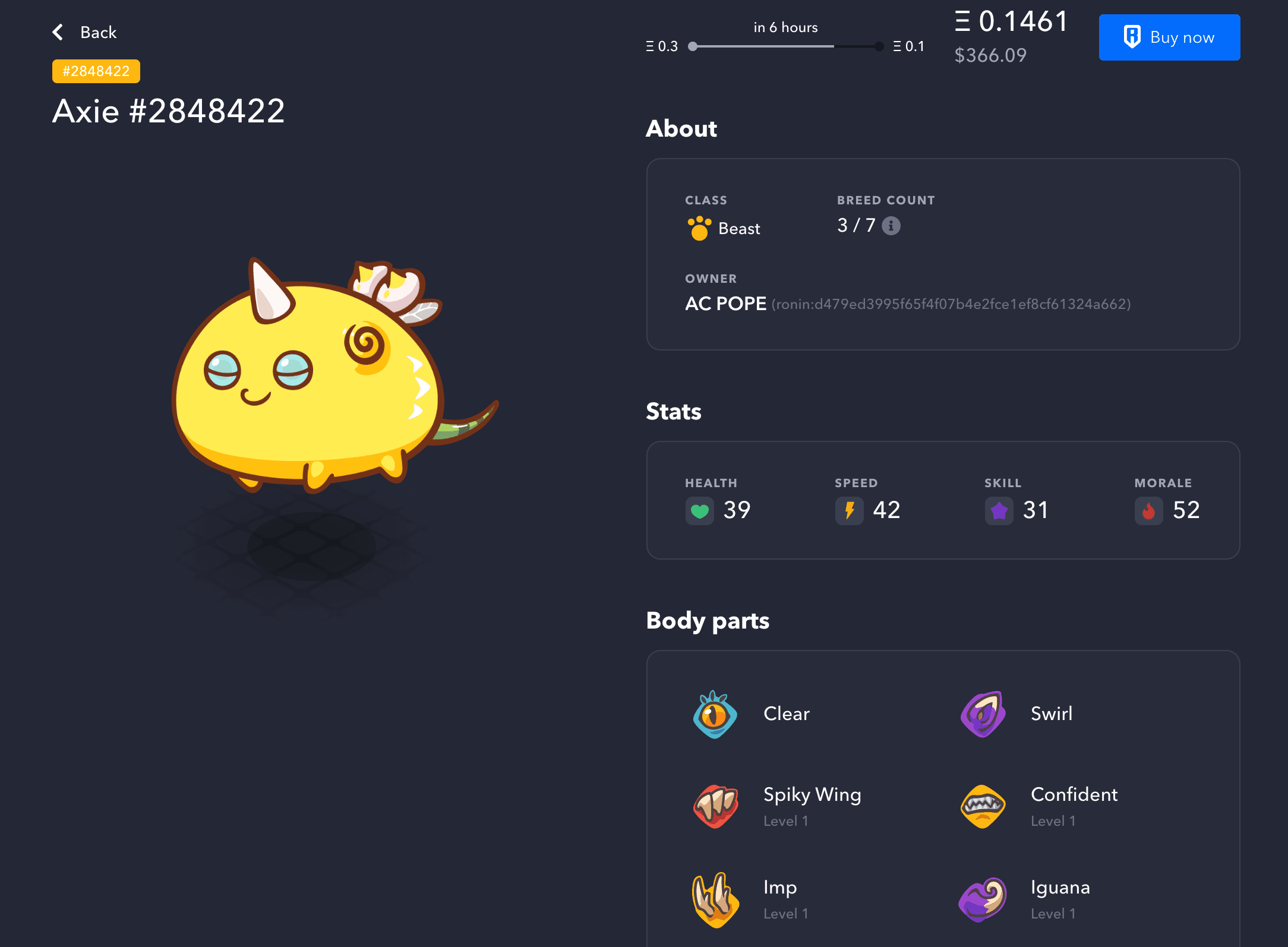

Axies can be purchased on the Axie Infinity marketplace, with payment via Wrapped Ether. Three Axies are needed to play.

The cheapest Axie at the present time costs c. USD 330, making the upfront cost to build a team c. USD 1,000!

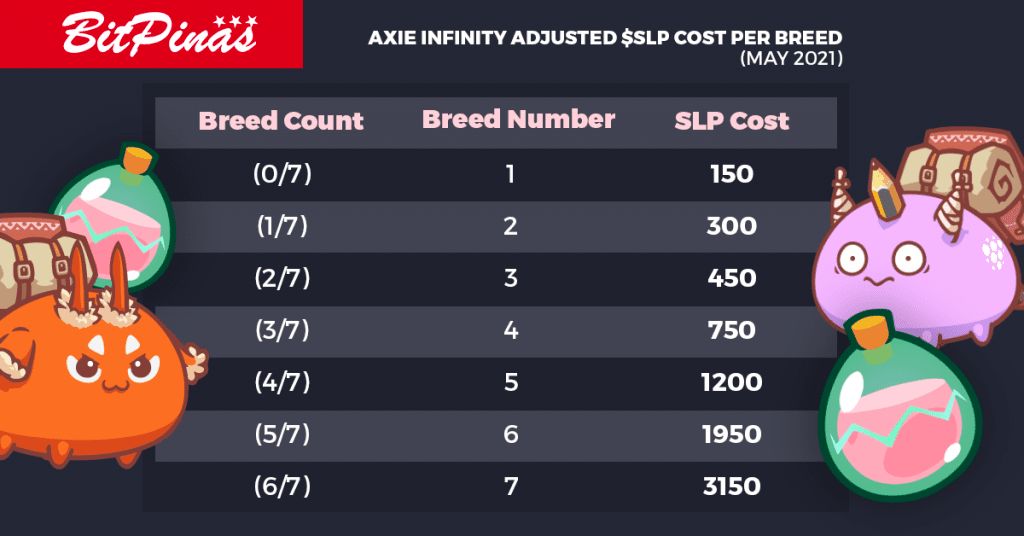

Axies are can also be bred a maximum of 7 times. Breeding makes it possible to recover the investment quickly.

Breeding costs 4 $AXS as well as a number of $SLP based on previous breed count.

In the future $AXS will be a currency for the purchase of NFTs in the game.

Community treasury / Protocol revenue

The Treasury receives inflows from:

- 4.25% of all Axie NFT marketplace transactions.

- The AXS portion of the breeding fee.

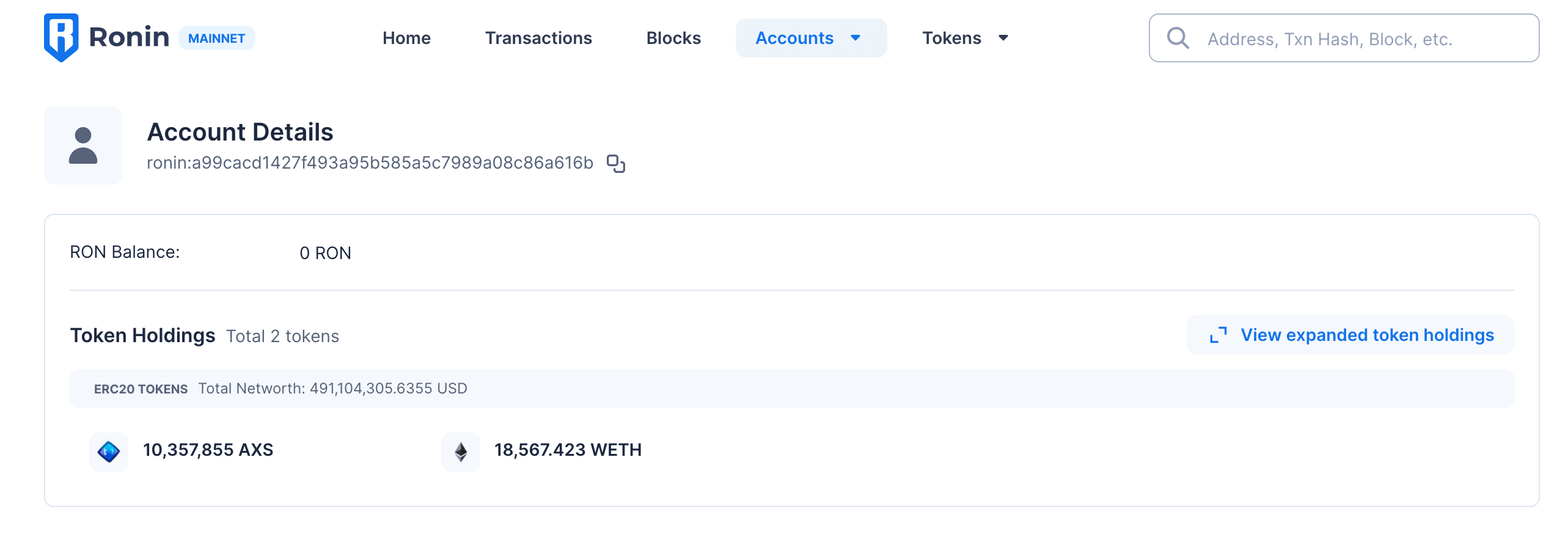

The community treasury held almost USD 500m as of 4 August 2021.

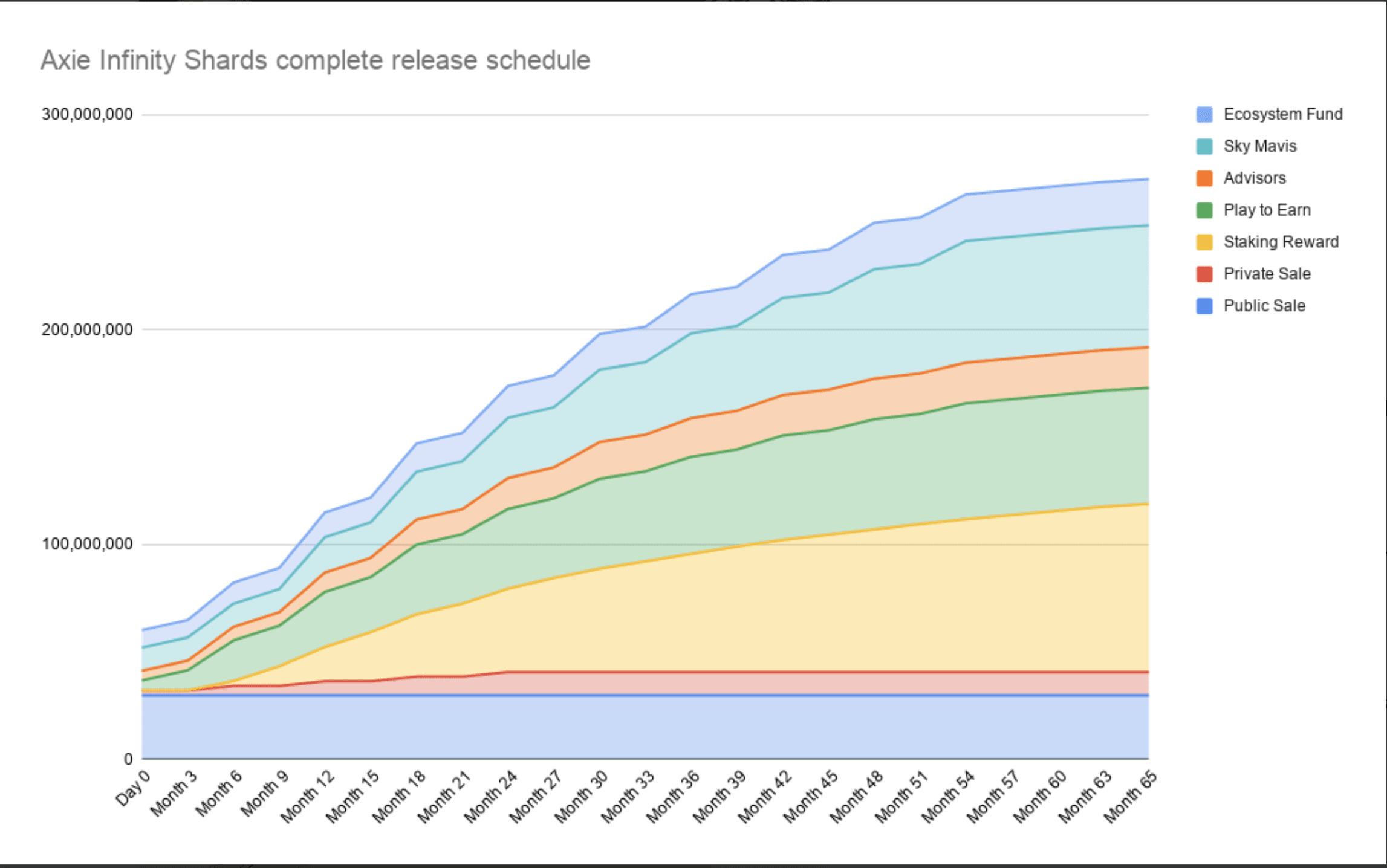

$AXS token supply

Total $AXS supply is capped at 270 million, which will vest to different parties in the ecosystem over 65 months.

Circulating supply is currently 55 million.

28% of the supply will be allocated to the Sky Mavis team developing Axie Infinity, and their advisors.

$AXS demand drivers

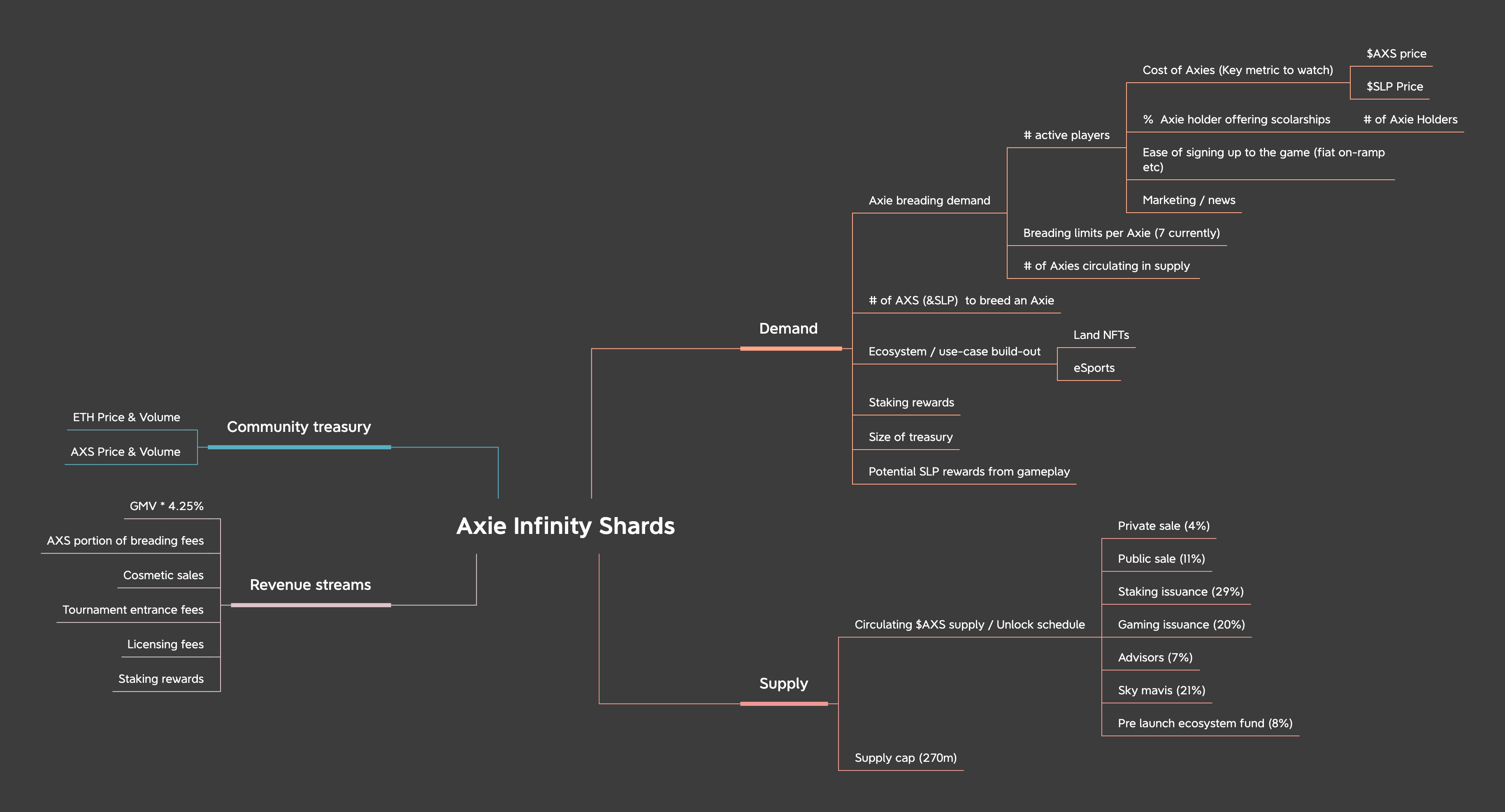

The graphic sets out my view of key $AXS value drivers.

Fundamentally, more player activity is required to drive marketplace GMV.

Many players are playing to earn either SLP or income from breeding and selling Axies.

Demand for breeding/Axies, will drive demand for SLP, which will drive the price of $SLP up attracting new players and ‘sponsors’. Demand for breeding also drives up the price of $AXS.

Demand will also be driven by improving and expanding gameplay.

Users

DAUs passed 800k in July 2021, with tripple digit growth in May, June and July.

The game has gone viral.

Axie is the fastest growing game in the world right now.

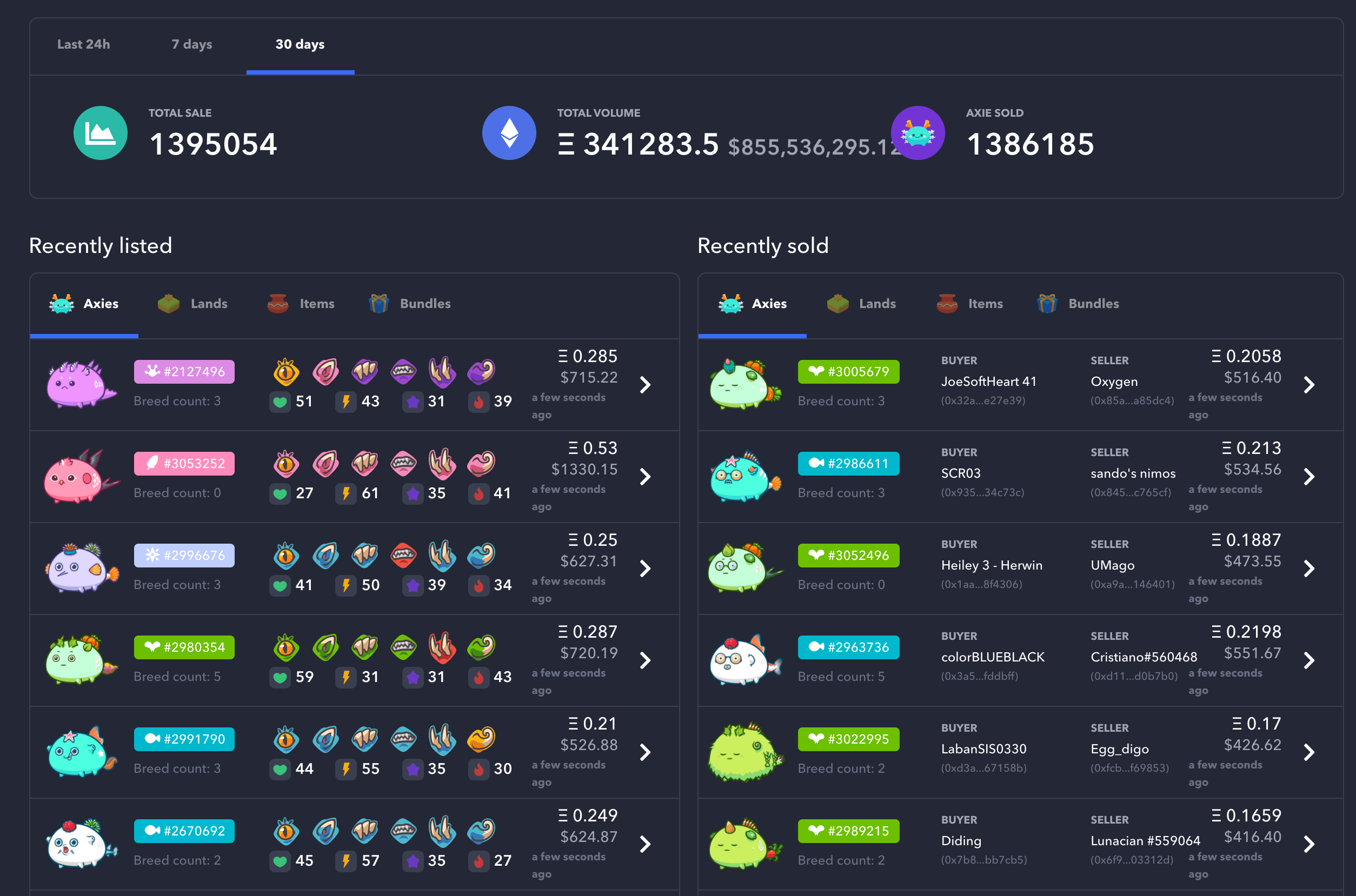

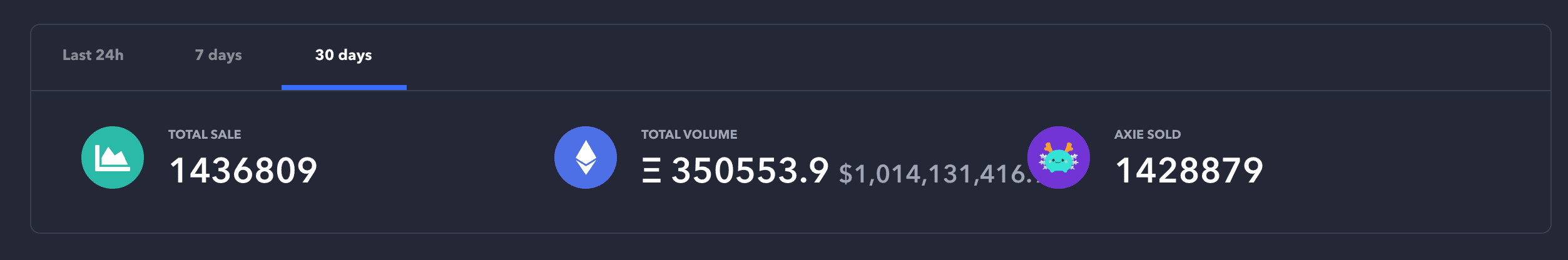

GMV

As of 4 August 2021, GMV was c. USD 883m in the last 30 days.

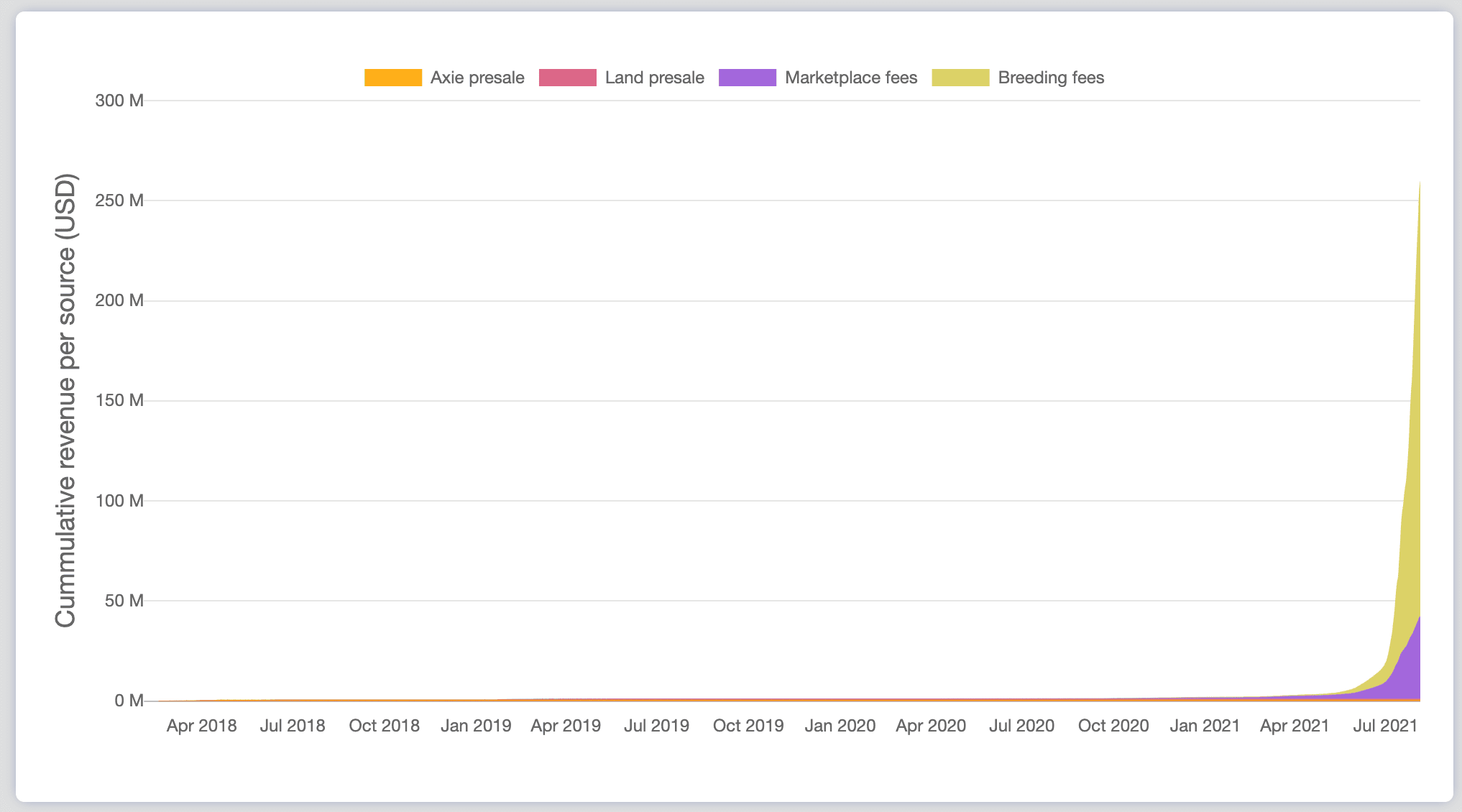

$AXS Protocol Revenue

Protocol revenue is similarly showing exponential growth.

83% of cumulative revenue to date has been generated by breeding fees (i.e. the 4 $AXS needed to breed a new Axie).

Marketplace revenue contributes most of the remaining 17%.

New revenue streams are expected in the future from land sales etc.

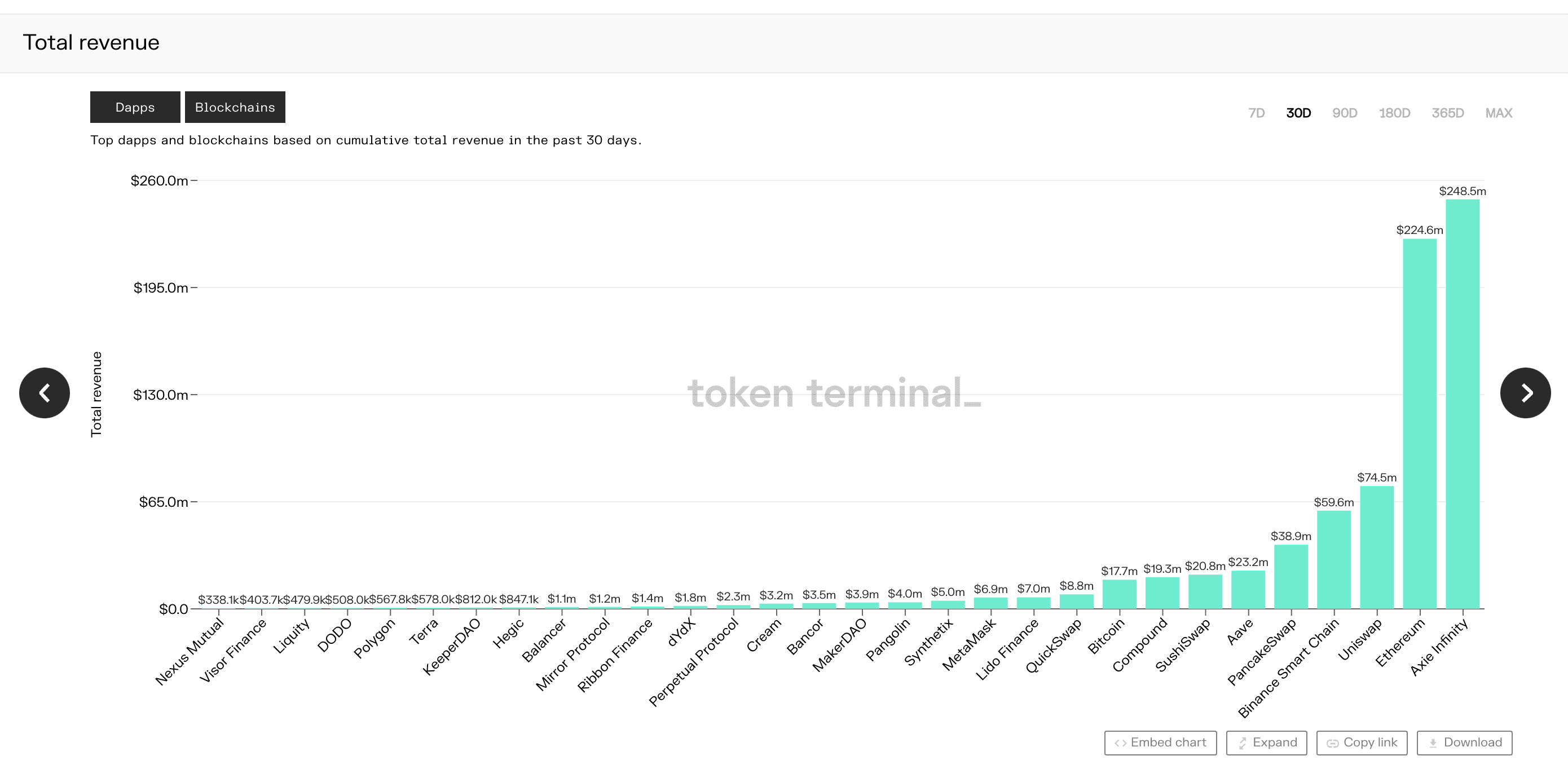

$AXS is generating more 30 day protocol revenue than every other decentralised app combined.

Protocol revenue has even surpassed Ethereum in the last week.

At current growth rates, monthly protocol revenue could surpass Activision Blizzard run rate revenues (c. USD 650m), by the end of 2021.

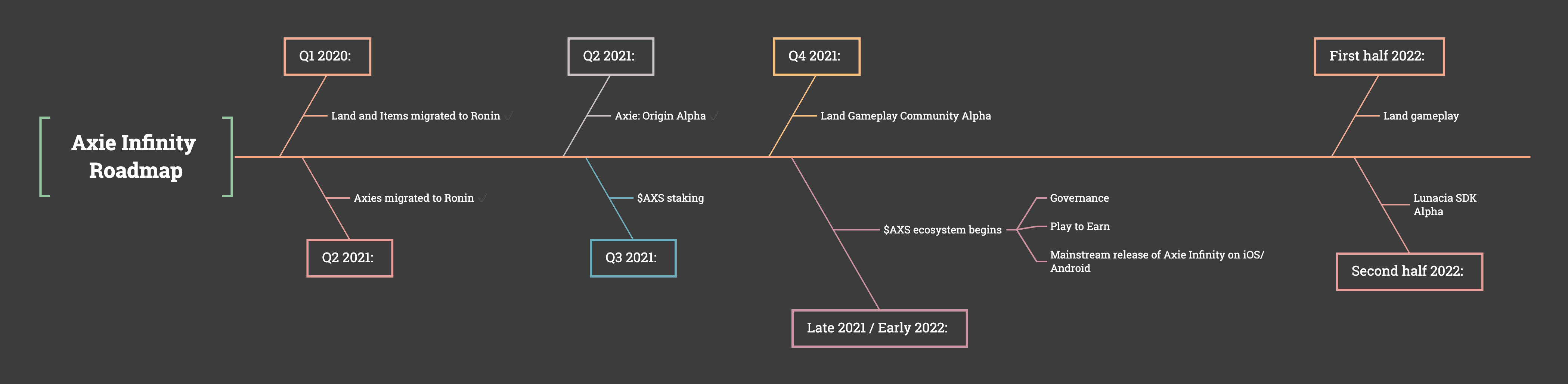

Bull thesis for $AXS

The dev team continue to hit their roadmap, driving up users and demand for tokens and NFTs. This includes:

- incorporating $AXS staking (driving down circulating supply of $AXS)

- Land Gameplay for land NFTs

- eSports

Bear thesis for $AXS

- A Ponzi scheme.

Rebuttal: the ecosystem includes NFTs (unique digital goods) with are traded on an open market. Supply of $AXS tokens is limited. Supply is auditable via the blockchain

2. In the long run everyone will have their own Axie teams and therefore demand for $AXS will decline.

Rebuttal: Breeding limits, and the death of Axies from gameplay reduce this risk. In addition, provided gameplay evolves, demand should grow.

3. Viral game, but people will quickly move on to the next fad:

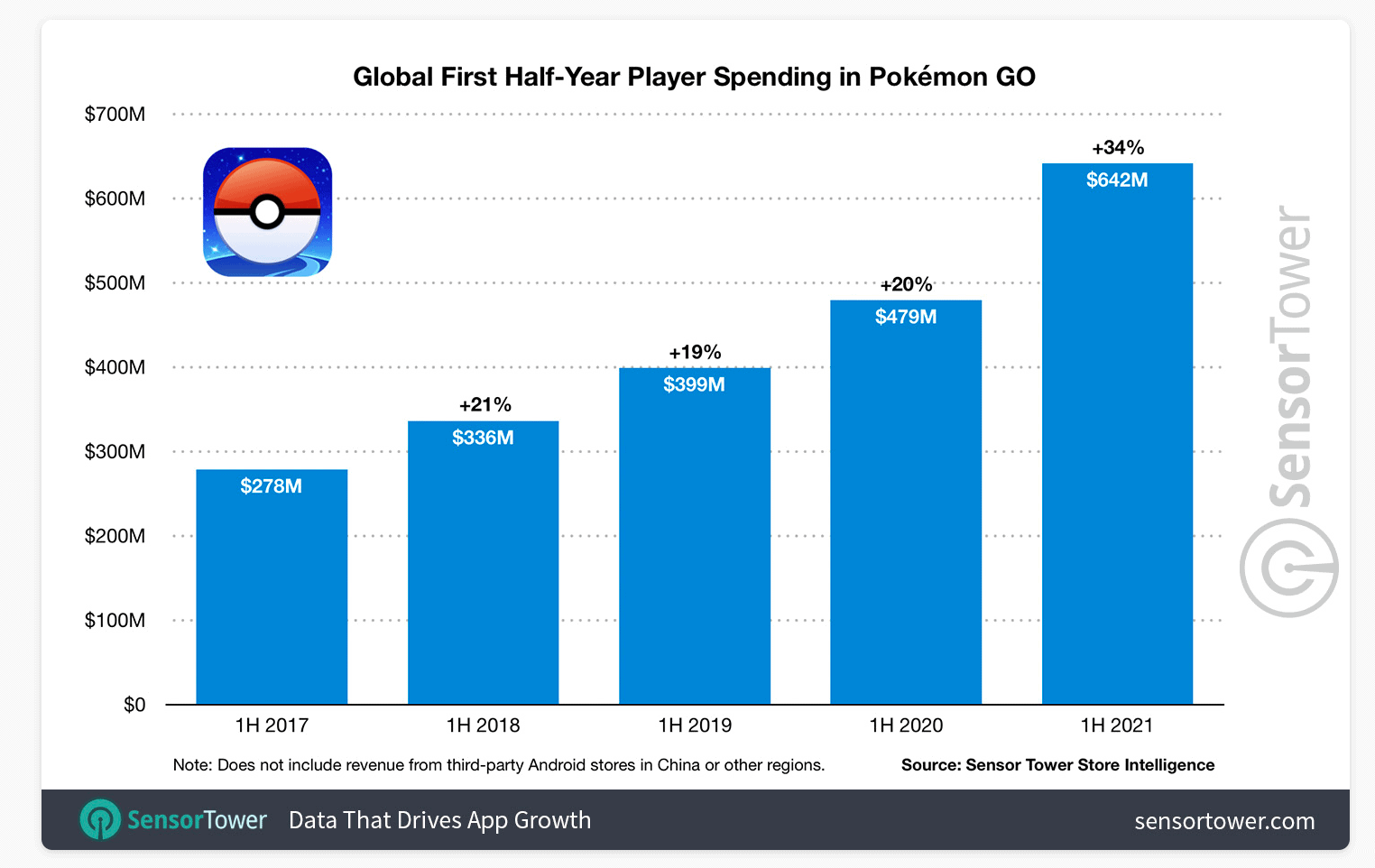

Rebuttal: Pokemon Go continues to generate strong revenues six years after first going viral.

4. The developers could arbitrarily change rules adversely impacting the value of $AXS.

No rebuttal. This happened in the past, where breading costs were changed from 2 $AXS to 4 $AXS, resulting in a spike in $AXS demand.

5. The cost to play becomes too high, resulting in reduced users.

This is the risk I am most concerned about. Growth requires investors to step in and continue to offer scholarships to users.

Valuation

$AXS currently trades at a P/s and P/e ratio of 4x per Token Terminal. This is lower than any other DApp of similar size.

$AXS market cap is currently c. USD 2.3bn based on the latest price of c. $42 an $AXS.

Run rate monthly protocol revenue is c. USD 225m, so P/e may be significantly < 1x NTM earnings if you assume the current levels continue.

Activision Blizzard trades at c. 20x LTM earnings. Given $AXS’ trajectory I would have thought its market cap could easily 4x.

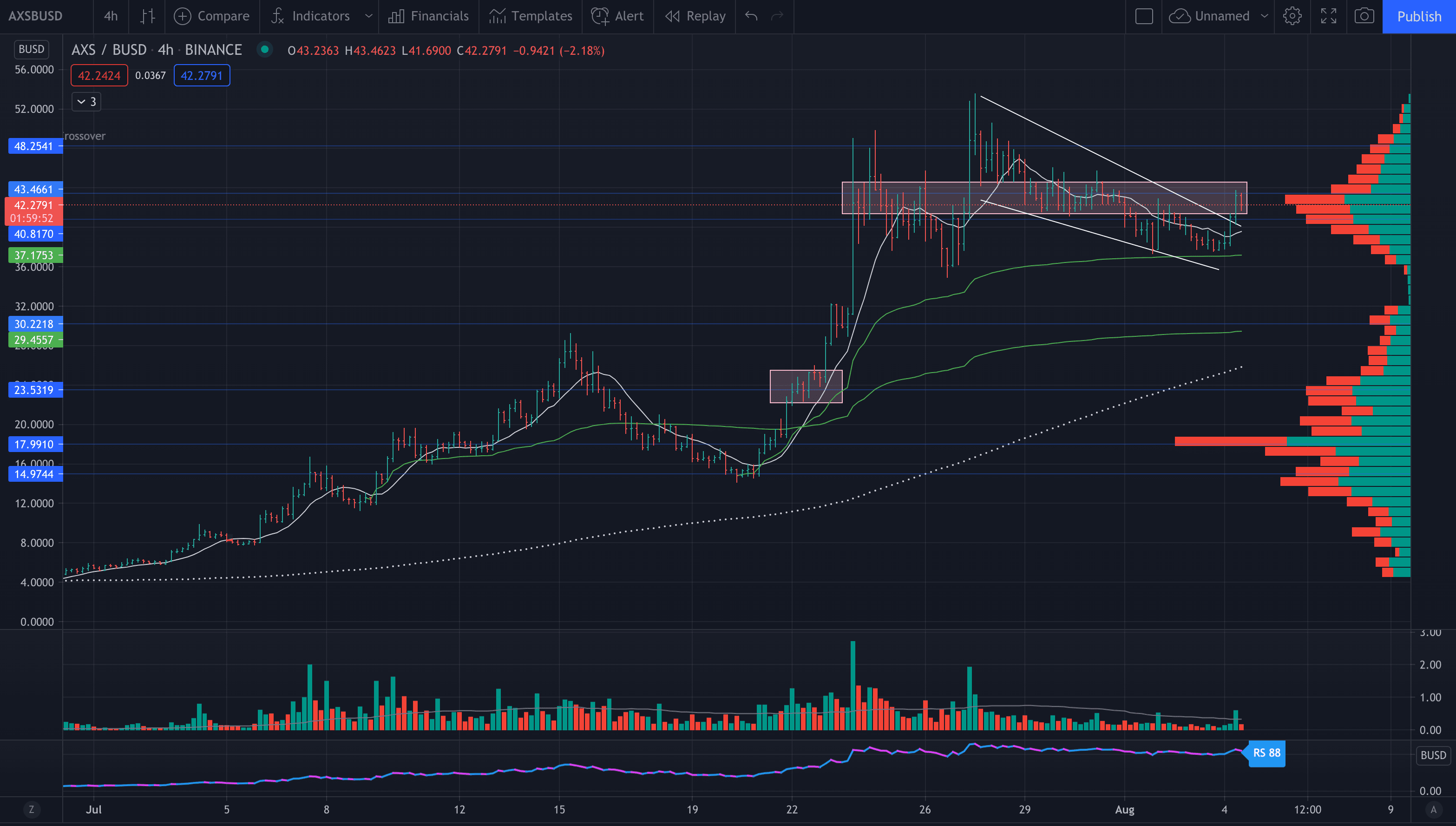

Technicals & conclusion

There are a number of risks to an investment in $AXS, but i’ve never seen such a compelling risk-reward profile in 17 years of investing (professionally and personally).

After a big move up, price consolidated in the $37 – 48 range and i would surprised if we didn’t see another move higher soon.

I took positions at $17, $28, $37. I plan to sell gradually as price targets are met.

Data sources

Further reading